Medicare Advantage set to grab half the market, even as scrutiny tightens

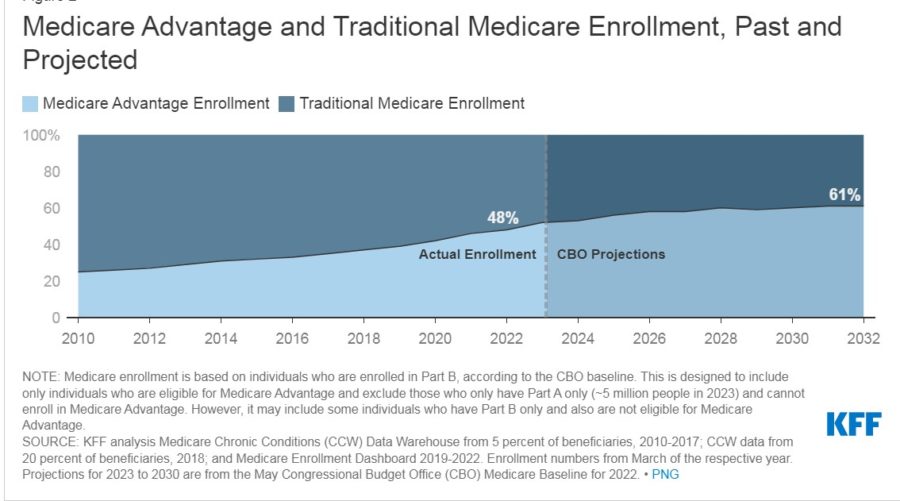

Medicare Advantage is expected to account for more than half of Medicare enrollees in this open enrollment season, despite greater scrutiny over fraud allegations and criticism of MA’s benefits.

Not only are MA plans expected to take a majority of enrollees, two companies will be responsible for nearly half of those enrollments: UnitedHealth Group and Humana.

Medicare covers Part A for inpatient hospital care and skilled nursing services and Part B for doctor visits, outpatient services and preventive care, all considered “Original Medicare.” Enrollees can add Part D for prescription benefits. They can also add Medicare supplement, or Medigap, to cover out-of-pocket costs, such as the 20% coinsurance in Medicare.

Medicare Advantage, or Part C, covers Parts A and B and usually Part D through private insurers. MA can also include dental, vision, hearing and fitness benefits. They can offer special needs plans, for example, geared for patients who suffer from diabetes.

Not only are the extra benefits attractive but MA plans often offer lower premiums, although the out-of-pocket expenses may be greater. MA plans require patients to use in-network services, which can be severely limiting in some areas. They have also been criticized for denying services that should have been approved under Medicare guidelines.

MA plans have been growing in popularity over the past two decades since it and Part D were created during the George W. Bush administration, with MA expected to account for more than half of Medicare enrollees this year.

MA plans and providers have been accused of fraud for overbilling the system, usually through upcoding, or the practice of finding a more lucrative designation for a patient’s conditions. That is because the system pays per patient, rather than for services – and the sicker the enrollee, the higher the reimbursement.

The New York Times reviewed fraud lawsuits and found almost all the top 10 carriers have been accused of fraud or of having been defrauded by providers.

UnitedHealth, which has 27.1% of the market has been accused of fraud by a whistleblower and the U.S. government, and has also been accused by the inspector general of being overbilled. Humana, with 17.4% of the market, was accused of fraud by a whistleblower and of being overbilled. Of the top 10 carriers, only Centene, with 5% of the market, was not accused of any fraud. Carriers have denied the allegations, saying their efforts were to code patients accurately.

In fact, the plans’ rich benefits are funded by overbilling, according to the reporting: “The more the plans are overpaid by Medicare, the more generous to customers they can afford to be.”

MA was devised under the Bush administration to allow private companies to lower expenses, but it has actually increased costs over traditional Medicare, according to The New York Times, adding that the additional diagnoses have led to $12 billion to $25 billion in overbilling in 2020.

Scrutiny tightens

While MA plans are becoming more popular, some House Democrats want to distinguish Medicare from Medicare Advantage – specifically, they want MA to drop Medicare from the name and be called Alternative Private Health Plans.

The Save Medicare Act was introduced this month by Reps. Mark Pocan, D-Wisc., and Ro Khanna, D-Calif., who say Medicare should be expanded to include the extra benefits, rather than paying private companies to handle them.

“They often leave patients without the benefits they need while overcharging the federal government for corporate profit,” Pocan said in a release. “This bill eliminates any confusion about what is – and what is not – Medicare and ensures this essential program will continue to serve seniors and other Americans for years to come.”

In June, several representatives from both parties on the House Energy and Commerce Committee said they were dissatisfied with the Centers for Medicare & Medicaid Services’ oversight of MA plans. Rep. Morgan Griffith, R-Va., said he was disappointed that CMS officials did not appear to discuss their practices before a subcommittee hearing.

“As Medicare Advantage takes on an even larger presence in the Medicare program and as the Medicare hospital insurance trust fund is projected to be insolvent by 2028, it will continue to be important to assess how well Medicare’s current payment methodology for MA is working,” Griffith said, according to the news site Fierce Healthcare, noting that the panel heard from the Department of Health and Human Services, Office of Inspector General, Government Accountability Office and Medicare Payment Advisory Commission.

Some issues that the subcommittee heard included:

- Unclear guidance on when service denial was appropriate, leading to delay or denial of services that met Medicare’s coverage requirements. An Inspector General report found in a random sample of denials that 13% of prior authorization denials and 18% of denied payment requests would have been approved under Medicare coverage requirements.

- Reliance on third party chart reviews and health risk assessments that can lead to upcoding patients for higher payments. Chart reviews are supposed to identify diagnoses that were submitted in error. According to an Inspector General report, 20 of the 162 MA insurers included in the study drove the bulk of the $9.2 billion in overpayments. “Each generated a share of payments using chart reviews and HRAs that were 25% higher than their share of MA beneficiaries,” according to Fierce Healthcare. The office also found that third party health risk assessments at patients’ homes can result in higher diagnoses that were not subsequently tested for or treated, but did result in $2.6 billion in higher billing in 2017.

The CMS had agreed to increase oversight of MA plans’ health risk assessments, but did not implement the plan, according to Fierce Healthcare. The agency also did not implement other audit plans.

Legislators did not lay all the blame at CMS’s feet, however, instead turning to Congress itself.

“The only conclusion I can come to is the agency is understaffed, that Congress has not been paying its attention to saving the taxpayers money and reforming the process,” said Rep. Tom O’Halleran, D-Arizona. “I am very disheartened from what I have seen today.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

7 steps advisors can take for a strong finish to the 2022

What a breast cancer diagnosis means for obtaining life insurance

Advisor News

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

More Life Insurance News