Mass Affluent Investors Demanding More Complex Financial Products

Mass affluent investors traditionally opted for general or mutual funds for their investments, but there are clear signs that this trend is in on the wane.

In fact, the demand for complex financial products is increasing significantly, especially among mass affluent investors. This historically overlooked group no longer relies exclusively on exchange-traded funds and mutual funds. Instead, mass affluent investors are starting to branch out and opt for alternatives, structured products, even art and other non-bankable assets, all of which were traditionally the domain of high net worth and very high net worth investors.

These are some of the trends highlighted by recent ThoughtLab research, Wealth and Asset Management 4.0: How Digital, Social, and Regulatory Shifts Will Transform the Industry, that looked at trends in investing. The research compared investor preferences across all wealth levels.

The study revealed that there is little difference between very high net worth investors and the mass affluent in their desire for increasing complex investments. Demand for alternatives (69%), tax-exempt investments (59%), structured products (26%), and art (16%) among the mass affluent is, in fact, quite similar to that shown by VHNW investors.

Currently, around 75% of all investors use actively managed funds, with a slight drop expected to occur over the next two years. Interest in passive funds and individual securities, on the other hand, will continue to grow as investors seek out better returns and look at diversifying with alternative investments such as hedge funds and private equity.

All wealth levels are looking to boost alpha through specialized products such as initial public offerings, tax-exempt investment, commodities and derivatives, real estate investment trusts, and structured products.

Cryptocurrencies are still not dominating a significant share of the market since many investors are still concerned about regulatory, market and cyber security risks. However, interest in longer-term tax-sheltered investment products and pensions is growing in popularity. This is clearly a sign of an ageing population.

This more complex environment poses significant challenges to wealth managers, starting with the regulatory one. To offer elaborate products to the risk-protected, mass affluent market, wealth management firms must ensure that documentation and processes are well managed, accurate and auditable.

All relevant regulatory Know Your Customer profiles and risk-appropriateness documents and client confirmations must be filled and filed correctly right from the start during the onboarding stage, and then periodically reviewed.

This presents a considerable burden to the wealth manager, who must take trouble to avoid not-in-good-order documents that require applications to be resubmitted to the investor due to errors and omissions. These are key causes of client dissatisfaction and of possible compliance issues further down the line.

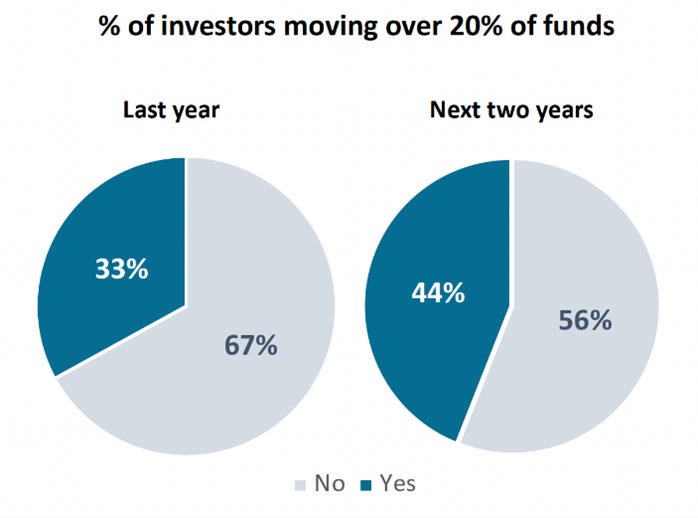

In addition to this tendency to diversify investment products and services, investors are starting to diversify wealth management providers as well. One out of three investors changed wealth managers in the last year, while almost half of investors globally are planning to add additional wealth management relationships in the next two years.

This significant new flow of capital will fire up the competition between wealth management firms. They will need to consider the key role that a seamless digital experience can have in acquiring – and keeping new clients.

A stronger digital experience is also one of the key reasons cited by billionaires for switching providers in the last year. In addition to looking to improve investment performance, better wealth advice, access to greater personal service, clearer pricing structures and fees are just some of the other reasons that investors cited for transferring assets. Wealth management businesses are getting a clear message from investors: Focus on their requirements or suffer churn.

The wealth management arena thus is becoming more competitive and complicated. If you add disaggregated systems and service processes, a remote work environment and evolving investor expectations to this mix, it is evident that systems and processes need to be optimized and automated at the earliest stages of investor contact to help lay solid foundations for later customer relationship development and growth. In particular, the first-impressions, onboarding stage is far too important and complex to be managed manually or with paper-based-tools.

Advisors must have the right tools to orchestrate increasingly complex processes and to make sure the tone set is a positive one. According to the ThoughtLab industry outlook, wealth managers must be able to connect disconnected people, data and systems to provide a smooth experience for the client while maximizing efficiencies for the front and back offices without sacrificing compliance. Even the smallest inconvenience during this process can result in loss of business or lengthy and costly compliance issues.

Switching to a seamless, digital onboarding system can prove crucial for wealth management firms that want to provide diverse investments products and to grasp the opportunity coming their way in the next two years with the mass affluent market. Digital onboarding experience plays a vital role in streamlining processes to make them faster and more compliant.

Not only is collecting data right-first-time key to delivering a simple, intuitive, and positive first impression to avoid churn, it can also help improve efficiency and reduce compliance risk for wealth management firms that are poised to rapidly scale in an increasingly complex and diverse mass-affluent market.

Mark Shields is director of solution marketing at Appway. He may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Nationwide Adds BNP Paribas Global H-Factor Index To FIA

Wisconsin Insurance Commissioner Releases April Enforcement Actions

Advisor News

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- A new era of advisor support for caregiving

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

More Life Insurance News