Low- And Middle-Class Families Dropping Life Insurance: Study

Even before the COVID-19 pandemic hit, ownership of life insurance fell among households earning less than $100,000, declining by 25% over the past 10 years.

This year’s Insurance Barometer Study by LIMRA and Life Happens reviewed 10 years of consumer data on life insurance and related financial issues based on a survey taken in January 2020.

In January, 46% of adult consumers did not own life insurance. Although 36% of respondents said they intended to purchase life insurance in the next 12 months, many were without it during the height of COVID-19.

Of those surveyed, 44% said they would feel a financial impact within six months if the primary wage earner were to pass away. More than a quarter (28%) would feel it within one month.

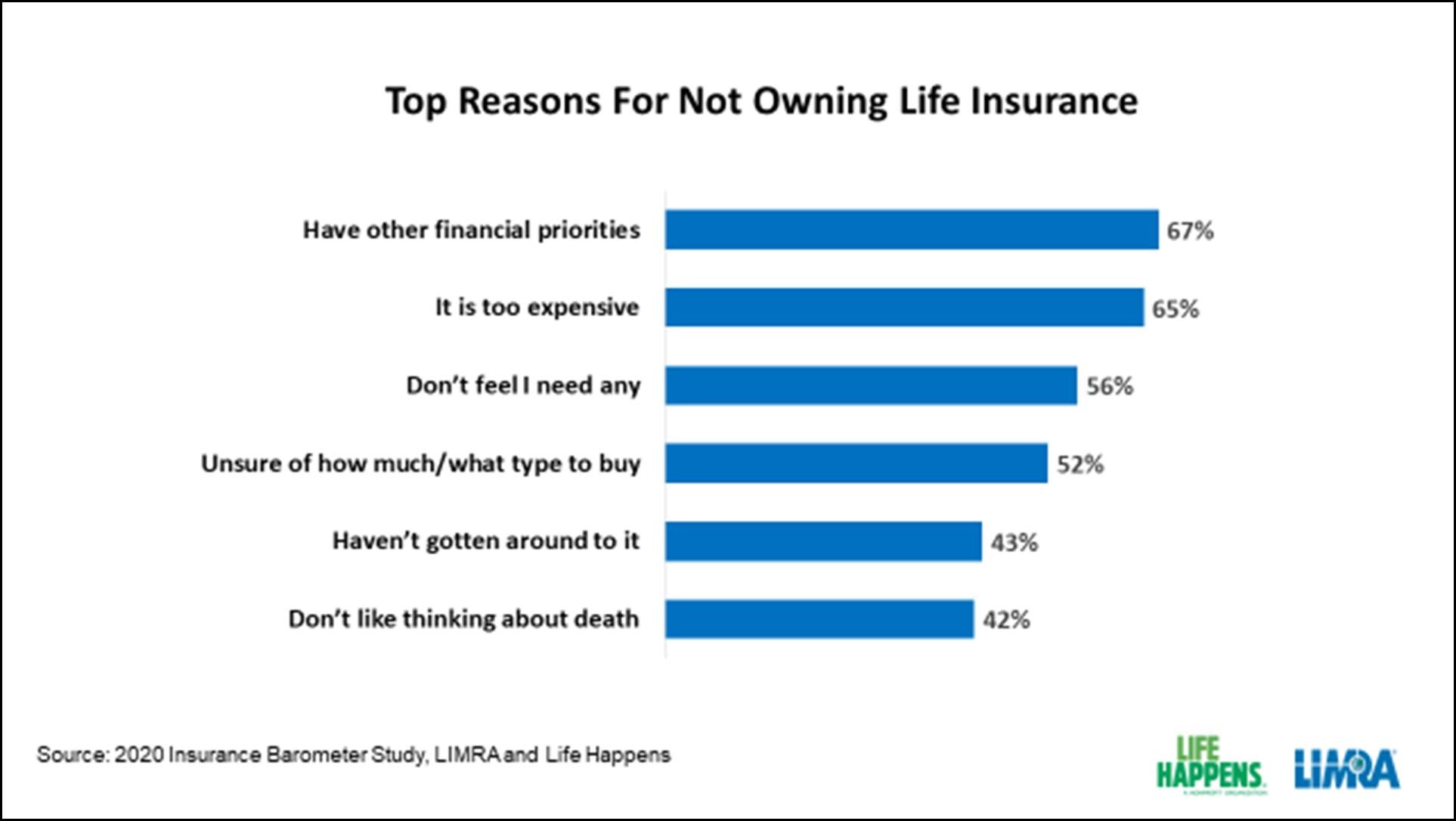

Perception of cost may be the most significant barrier. Half of millennials believe the estimated yearly cost for a $250,000 level-term life insurance policy for a healthy 30-year-old is $1,000 or more when in actuality, it’s closer to $160 per year, LIMRA reported.

“Over the last 10 years, a drop in ownership of life insurance and disability insurance could correlate to a broad decline in employer-paid group benefits, showing that consumers are relying on their employers for important financial protection,” according to a release from LIMRA.

Although only 16% of Americans have disability coverage in January, that percent might be even lower now because of the significant number of layoffs since then.

“As many consumers look to take control of their finances and plan for the future, both disability and life insurance should be important parts of their financial plan and safety nets,” according to the release.

The life insurance organizations warned that consumers would regret not getting their coverage while they were young. Studies show that 40% of people who own life insurance wish they had purchased policies at a younger age, according to LIMRA. Although it’s best for consumers to get life insurance policy when they are young and healthy, research shows that many do not take action when they can typically secure a more affordable rate.

Methodology for 2020 Insurance Barometer Study

The Insurance Barometer is an annual study that tracks the perceptions, attitudes, and behaviors of adult consumers in the United States. In January 2020, LIMRA and Life Happens engaged an online panel to survey adult consumers who are financial decision-makers in their households. This survey generated over 2,000 responses.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Technology Touching ‘Every Aspect’ Of Insurance In Pandemic

Annuity Sales Expected To Decline Up To 15% In 2020: Report

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News