Annuity Sales Expected To Decline Up To 15% In 2020: Report

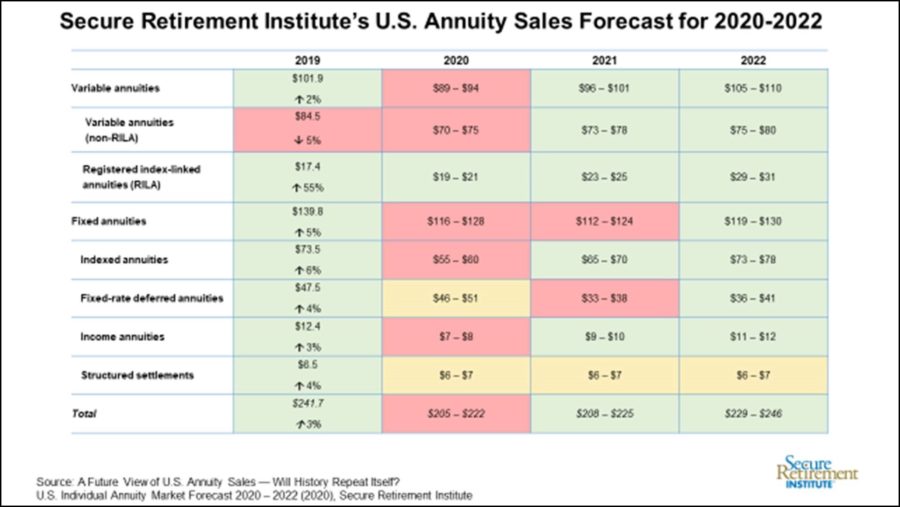

The Secure Retirement Institute is forecasting that overall annuity sales will decline 8% to 15% in 2020.

The COVID-19 pandemic triggered ultra-low interest rates, extreme market volatility and record-high unemployment — conditions that generally are unfavorable for annuity sales.

The good news is the outlook for 2021 and 2022 is brighter. As equity markets and interest rates slowly rise over the next two years1 and the number of people age 65 and over expands to comprise 18% of the U.S. population, SRI is forecasting the annuity market to rebound and make up the losses incurred in 2020.

“Most annuity products will face headwinds under the current economic conditions,” noted Todd Giesing, senior research director, SRI Annuity Research. “However, registered index-linked annuities (RILAs), which offer investment growth opportunity with limited downside risk, are uniquely positioned to thrive in this environment and successfully compete for clients who may have looked to indexed annuities in the past. We expect RILAs to expand their VA market share over the next few years.”

A Look At Individual Products

Variable Annuities (VA): SRI is forecasting VA sales to drop as much as 15% in 2020, similar to the decline experienced in 2009. As market volatility subsides and consumer confidence improves in 2021, SRI expects VA sales to recover the losses experienced in 2020 and continue to grow in 2022.

Registered Index-Linked Annuities (RILA): A subset of the VA market, this is the one product that is predicted to grow in 2020, reaching nearly $20 billion as consumers look for the balance of protection, safety, and growth potential. By 2021, RILA sales will represent nearly a quarter of all VA sales and will continue to expand in 2022.

Fixed Indexed Annuities (FIA): SRI predicts FIA sales to fall 25% in 2020, due to the low interest rate environment and continued market volatility. As economic conditions improve — allowing carriers to raise cap levels — FIA sales will rebound in 2021, and by 2022 SRI is forecasting sales to exceed the record-level sales set in 2019.

Fixed-Rate Deferred Annuities (FRD): Despite falling interest rates in 2020, fixed-rate deferred annuity products will attract those seeking protection from market volatility, so SRI expects 2020 sales will remain level with 2019 sales results.

As equity markets stabilize but interest rates remain low in 2021, consumers are expected to seek products that will provide greater investment growth causing fixed-rate deferred sales to drop by as much as a third. In 2022, fixed-rate deferred sales will grow slightly as economic conditions improve and short duration fixed-rate deferred contracts sold in 2018 and 2019 lose their surcharges.

Income Annuities: With interest rates well below 1%, income annuities will struggle to find a market. SRI is forecasting sales of income annuities — both immediate annuities and deferred income annuities — to tumble 40% or more in 2020. Rising interest rates will help improve sales of income annuities in 2021 and 2022 but sales will not approach the record sales levels reached in 2019.

1Oxford Economics, April 2020

Low- And Middle-Class Families Dropping Life Insurance: Study

Georgia Judge Calls Viatical A Case Of Illegal ‘Wagering’

Advisor News

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

More Annuity NewsHealth/Employee Benefits News

- Former South Salisbury firefighter charged for insurance fraud

- Studies from University of Washington Medical Center Provide New Data on Managed Care (The Impact of Payment Reform on Medicaid Access and Quality: A National Survey of Physicians): Managed Care

- Franklin County Seeks Administrator for Human Services Division

- Cigna hails pharmacy deal with the FTC, battles elevated cost trends

- Health care inflation continues to eat away at retirement budgets

More Health/Employee Benefits NewsLife Insurance News