Long-term care: Don’t be afraid of too many choices

Advisors who want to offer long-term care solutions sometimes can be overwhelmed by the options available. But it’s possible to narrow down those options to come up with the best solution possible for a client.

Tom Riekse, managing director of LTCI Partners, discussed the many LTC options available during a recent event, “Don’t Be Scared of Long-Term Care” by the National Association of Insurance and Financial Advisors’ Limited and Extended Care Planning Center.

Riekse ran down a list of the various choices advisors can offer. They include:

- Traditional long-term care insurance.

- Short-term care plans.

- Hybrid life insurance with LTCi.

- Hybrid annuities with LTCi.

- Medically underwritten immediate annuities.

- An LTC rider on permanent life insurance products.

- Life insurance with a chronic illness rider (upfront charge).

- Life insurance with a chronic illness rider (charge or benefit determined at time of claim).

“It’s overwhelming,” he said. “Advisors and financial professionals are faced with difficult decisions. Do they offer all of these? Specialize in some of them? Partner with someone?”

Riekse recommended narrowing down the options for a particular client to come up with the best one for their needs. He described a framework for a client who wants LTCi or other products to pay for extended care.

The three considerations in choosing options, he said, are health considerations, product benefit considerations and funding considerations.

“Health considerations come first,” he said. “Pricing is built around health considerations. Before we can make a recommendation, we must get a baseline of client’s health condition. Then we can narrow down some production options.”

Riekse presented a list of client health considerations along with the best product options to meet those considerations.

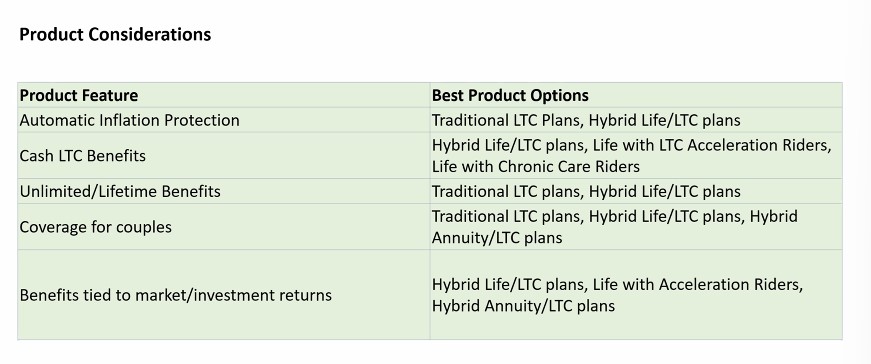

In choosing the best LTC product for a client, Riekse said, several product features must be considered. He presented a list of features that a client might want, and the best product options that include those features.

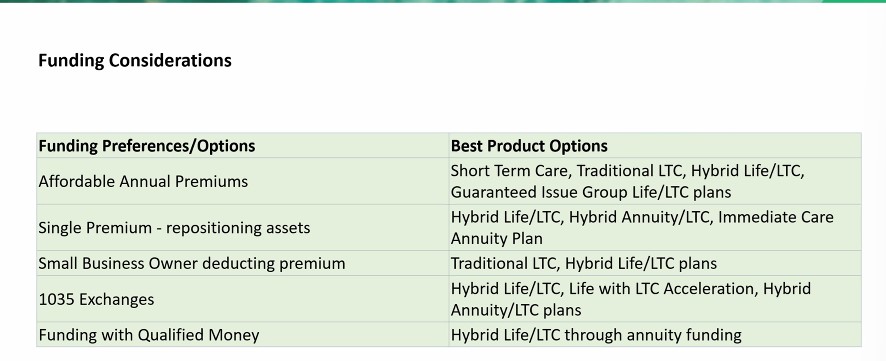

After the client’s health condition and product considerations are finalized, it’s time to determine how care will be funded. Riekse presented a list of funding considerations.

Now it’s time to select a carrier. In choosing a carrier, Riekse recommended focusing on the carrier’s claims-paying reputation. “This is where the rubber meets the road,” he said.

Riekse also recommended looking at a carrier’s financial stability, customer service, policyholder in-force servicing and application processing time.

“All of this is a lot of work, but help is on the way. There are a lot of tools available,” he said.

Tools that can help the process, he said, include:

- Online health screens and underwriting filters.

- Third-party comparison organizations such as Living Benefit Review, comparative quote engines such as WinFlex or Ensight.

- Financial planning software and client surveys.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

National Flood Insurance Program nears Nov. 17 expiration

MassMutual to ‘wind down’ Haven Life amid poor results, high costs

Advisor News

- Study: key gaps advisors miss in retirement planning conversations

- T. Rowe Price: Trends that will shape retirement in 2025

- Trump revives plan for tax deduction on car loan interest payments, pushes sweeping tax cuts

- U.S.: A significant negative wealth effect looms if the trade war persists

- Does your investor client know how much they pay in fees?

More Advisor NewsAnnuity News

Life Insurance News

Property and Casualty News

- The web of factors behind rising P/C premiums

- Q4 2024 Results – Press Release

- Dobson son, mother among trio charged with illegal bondsman activity

- Florida governor, legislative leaders offer different visions for spring session

- AM Best Assigns Credit Ratings to Chubb Seguros de Vida Chile S.A.

More Property and Casualty News