LIMRA: Consumers’ Brand Awareness Of Life Insurers Remains Low

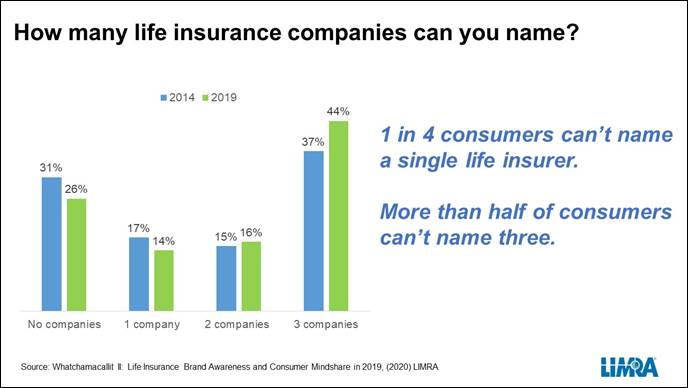

A new LIMRA study finds 1 in 4 adult Americans cannot name a single company that sells life insurance and a majority (56%) are unable to name three life insurance companies.

As discouraging as this may sound, it does reflect an uptick in unaided awareness of life insurance brands among U.S. consumers (chart), compared to 2014 results.

Over the past 5 years, life insurers have been increasing their advertising and marketing budgets to increase consumer awareness and garner greater mindshare. According to a 2017 Aite Group report, the life insurance industry was projected to spend $5.6 billion in advertising and marketing in 2020, up 49% from $3.7 billion in 2016.1 According to the study, insurers were investing more dollars in social media, internet marketing, and radio and television.

One of the biggest challenges for life insurers is that consumers generally buy life insurance only once or twice during their lifetime, and according to LIMRA sales data, more than a quarter of policies sold are by independent agents and advisors, unaffiliated with a specific company.

In these cases, it may be consumers are more aware of who sold them a policy than the company that underwrites it.

In LIMRA’s survey, 1,500 consumers named 200 unique companies (including some insurance agencies and nonspecific companies like “Mutual”) out of the close to 800 life insurers in the U.S. However, there were 10 companies mentioned the most, representing 61% of the consumer mentions2 (see sidebar).

The top two factors driving consumers’ awareness of life insurers are advertising (46%) and whether the consumer owns a product from that company (34%). A company’s reputation is also a key driver of brand awareness (chart). For those who cited reputation, 81% said the company they mentioned had an above average or excellent reputation.

Over the past five years, as life insurers have increased their digital advertising, more consumers report seeing advertisements for life insurance. In 2019, 57% of consumers said they recalled seeing an ad for life insurance in the prior three months, up from 35% in 2014.

But advertising doesn’t always ensure brand awareness. In 2019, nearly half of those who remember seeing an ad don’t recall the name of the company sponsoring the ad.

The study suggests increased advertising has helped to improve brand awareness among consumers, However, researchers believe some companies may find more success with their advertising by targeting individuals or market segments that have been identified as more receptive to the messages, based on available data, Big Data and analytics.

1Life Insurance: Trends in U.S. Marketing and Advertising Spend, Aite Group, 2016.

2 While consumers cited Geico and Progressive when asked to name life insurers, these companies do not manufacture life insurance in the U.S.

Sheryl Moore: From Single Mom To Insurance Rock Star

Massachusetts Dealing With Flood Of Comments On Fiduciary Proposal

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- EDITORIAL: Eliminate CON Laws, lower healthcare costs

- Thousands in CT face higher health insurance costs after federal subsidies expired at start of 2026

- Medicaid agencies stepping up outreach

- With Obamacare’s higher premiums come difficult decisions

- U.S. Federal Minimum Wage Remains Flat for 16th Straight Year as Billionaires’ Wealth Skyrockets

More Health/Employee Benefits NewsLife Insurance News