Life insurance sales take a dive in the third quarter, Wink reports

Life insurance sales were down across major product categories in the third quarter, Wink, Inc. reported in its quarterly Sales and Market Report.

The sales news continues a recent trend of depressed life sales. Some analysts say peak growth opportunities fueled by the COVID-19 pandemic have passed.

Non-variable universal life sales for the third quarter were $774 million, down 6.4% compared to the second quarter and up 0.6% compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the third quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 13.1%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the tenth consecutive quarter.

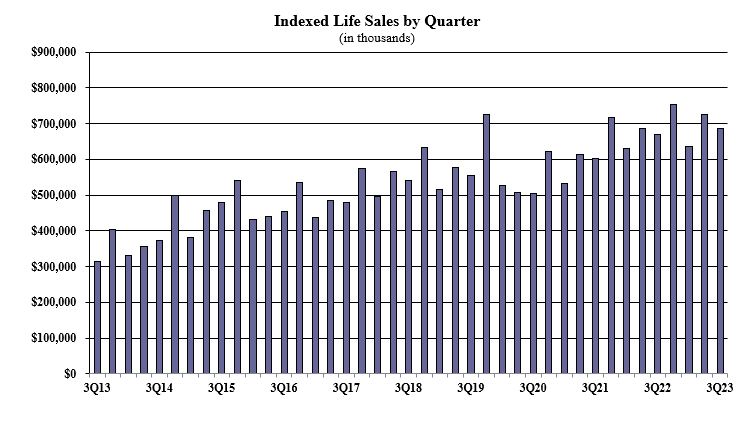

Indexed life sales for the third quarter were $687.2 million, down 5.3% compared with the previous quarter, and up 2.4% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

"Indexed life sales were surprisingly down since last quarter," said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. "However, we are still anticipating record sales this year."

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life sales, with a 14.7% market share, Transamerica, Nationwide, Pacific Life Companies, and Sammons Financial Companies rounded-out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined for the tenth consecutive quarter. The top primary pricing objective for sales this quarter was cash accumulation, capturing 79.1% of sales. The average indexed life target premium for the quarter was $11,631, an increase of nearly 4% from the prior quarter.

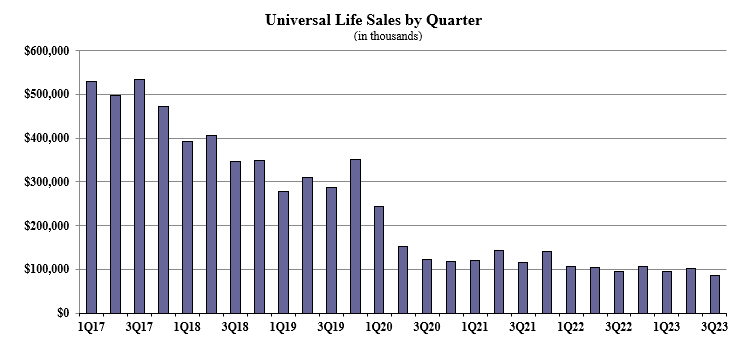

Fixed UL sales for the third quarter were $86.8 million, down 14.5% compared to the previous quarter and down 9.6% compared to the same period last year. Noteworthy highlights for fixed universal life included the top primary pricing objective of no-lapse guarantee capturing 54% of sales. The average UL target premium for the quarter was $5,493, an increase of nearly 2% from the prior quarter.

“It is hard to watch the decline of UL," Moore said. "It used to be such a thriving market.”

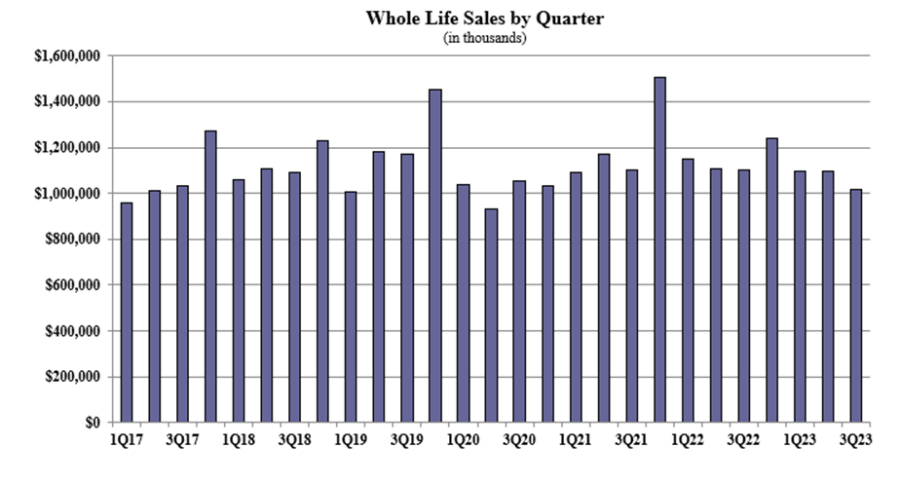

Whole life third-quarter sales were $1 billion, down 7.1% compared with the previous quarter, and down 7.6% compared to the same period last year. Items of interest in the whole life market included the top primary pricing objective of final expense capturing 49.6% of sales.

The average premium per whole life policy for the quarter was $4,283, an increase of more than 3% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future.

Iowa commissioner: DOL regulators ‘misunderstand’ state annuity rules

DPL hits $2B in commission-free annuity sales driven by fiduciary advisors

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

More Life Insurance News