Life insurance sales down ‘across the board,’ Wink reports

Life insurance sales suffered greatly from several disruptions in the first quarter, posting sales losses across the board, Wink, Inc. reported today.

Traditionally, life insurance sales struggle in the first quarter because of the ramped-up sales efforts to close out the previous year, noted Sheryl Moore, CEO of both Moore Market Intelligence and Wink. Still, it was a terrible quarter, she added.

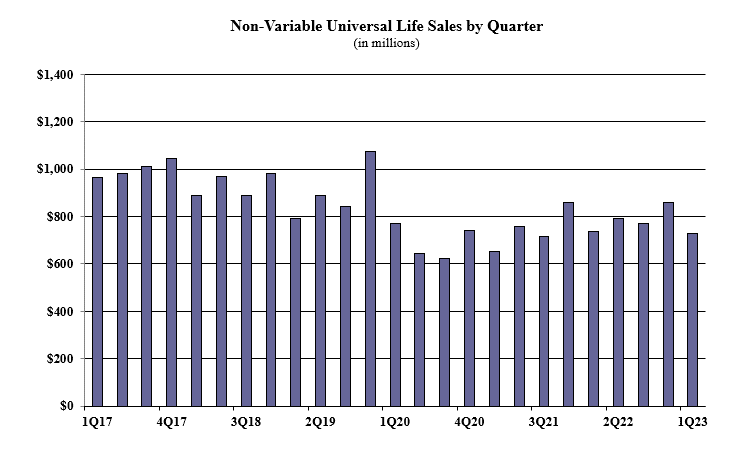

Non-variable universal life sales for the first quarter were $727.2 million, down 15.3% compared to the previous quarter and down 1.3% compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Unlike other investment products, rising interest rates is not helping life insurance.

"My take is that the life insurance products haven't been able to take advantage of increased rates as much, just because they primarily use portfolio crediting, rather than new money," Moore explained. "Second quarter will also be a challenge because of the adoption of AG49-B."

As of May 1, the National Association of Insurance Commissioners’ Actuarial Guideline 49-B requires that index accounts cannot be illustrated above the benchmark index account and the maximum illustrated rate must include bonuses, according to Gregory Rohtstein, a Symetra assistant vice president who outlined the guideline during an NAIC webinar. The guideline also limits illustrated rates to a maximum of 145% of whatever an IUL portfolio is earning.

AG 49-B amends AG 49-A and in the latest NAIC attempt to rein in IUL illustrations, particularly around uncapped volatility-controlled indexes with a fixed bonus. AG 49-B is seen as a patch until the NAIC reopens illustration regulation.

Company highlights

Noteworthy highlights for total non-variable universal life sales in the first quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 12.7%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the eighth consecutive quarter.

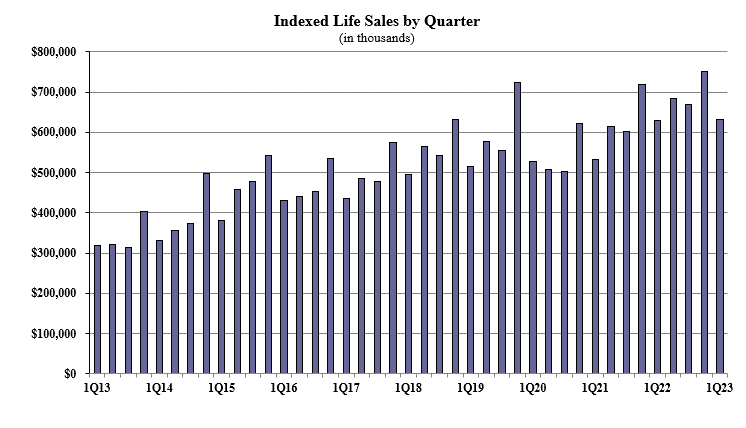

Indexed life insurance sales for the first quarter were $632.6 million, down 15.9% compared with the previous quarter, and up 0.4% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“Indexed life was the only product line not to experience a decline in sales, over this time last year” Moore said. “Sales for the next quarter will likely prove challenging, thanks to the implementation of AG49-B.”

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life insurance sales, with a 14.5% market share, Transamerica, Nationwide, Pacific Life Companies, and Sammons Financial Companies rounded out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined for the eighth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 80.3% of sales. The average indexed life target premium for the quarter was $12,266, a decline of more than 9% from the prior quarter.

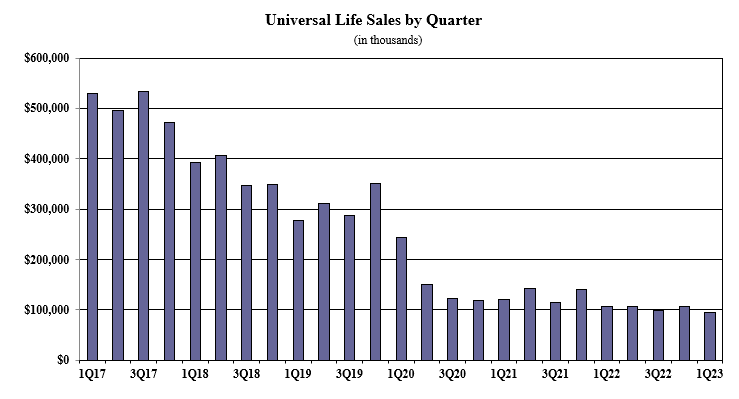

Fixed UL sales for the first quarter were $94.9 million, down 11.3% compared to the previous quarter and down 11.6% compared to the same period last year. Noteworthy highlights for fixed universal life included the top primary pricing objective of No-Lapse Guarantee capturing 50.4% of sales. The average UL target premium for the quarter was $4,690, a decline of nearly 14% from the prior quarter.

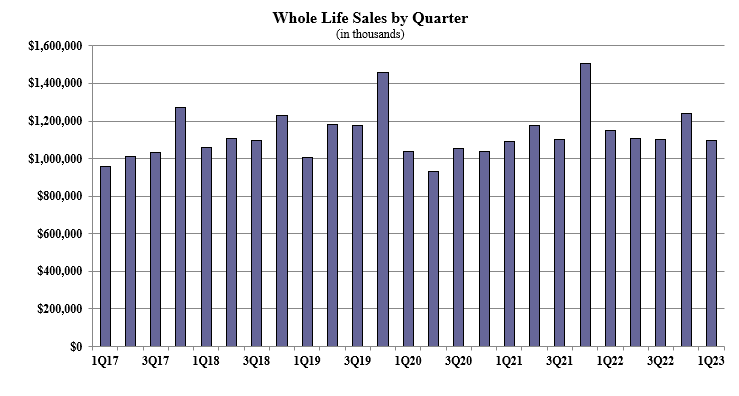

Whole life first quarter sales were $1 billion, down 11.8% compared with the previous quarter, and down 4.7% compared to the same period last year. Items of interest in the whole life market included the top primary pricing objective of Final Expense capturing 58.7% of sales. The average premium per whole life policy for the quarter was $4,127, an increase of nearly 6% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

3 steps to mitigate financial risks in retirement

‘Annuity King’ faces a second trial on tax evasion charges

Advisor News

- SEC manual shake-up: What every insurance advisor needs to know now

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

More Advisor NewsAnnuity News

- Variable annuity sales surge as market confidence remains high, Wink finds

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- New York receives partial approval for Essential Plan changes

- New York receives partial approvel for Essential Plan changes

- Parents of children with disabilities urge lawmakers not to ‘lock in’ Iowa Medicaid privatization

- Delaware approves $200 copay for weight-loss drugs, new premiums for state employees

- Ex-congressman Tom Perriello criticizes Ben Cline on healthcare

More Health/Employee Benefits NewsLife Insurance News

- Jackson Study Exposes Stark Disconnect Between Anticipation of Policy Change and Retirement Planning Conversations

- Thrivent plans to add 600 advisors this year

- Third Federal Named a top Financial Services Company by USA TODAY

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- Investors Heritage Promotes Andrew Moore to Executive Vice President; Names Him CEO of Via Management Solutions

More Life Insurance News