Life insurance sales down ‘across the board,’ Wink reports

Life insurance sales suffered greatly from several disruptions in the first quarter, posting sales losses across the board, Wink, Inc. reported today.

Traditionally, life insurance sales struggle in the first quarter because of the ramped-up sales efforts to close out the previous year, noted Sheryl Moore, CEO of both Moore Market Intelligence and Wink. Still, it was a terrible quarter, she added.

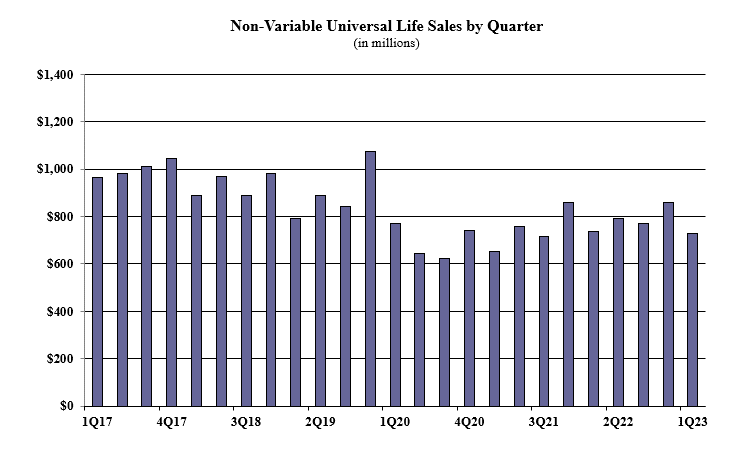

Non-variable universal life sales for the first quarter were $727.2 million, down 15.3% compared to the previous quarter and down 1.3% compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Unlike other investment products, rising interest rates is not helping life insurance.

"My take is that the life insurance products haven't been able to take advantage of increased rates as much, just because they primarily use portfolio crediting, rather than new money," Moore explained. "Second quarter will also be a challenge because of the adoption of AG49-B."

As of May 1, the National Association of Insurance Commissioners’ Actuarial Guideline 49-B requires that index accounts cannot be illustrated above the benchmark index account and the maximum illustrated rate must include bonuses, according to Gregory Rohtstein, a Symetra assistant vice president who outlined the guideline during an NAIC webinar. The guideline also limits illustrated rates to a maximum of 145% of whatever an IUL portfolio is earning.

AG 49-B amends AG 49-A and in the latest NAIC attempt to rein in IUL illustrations, particularly around uncapped volatility-controlled indexes with a fixed bonus. AG 49-B is seen as a patch until the NAIC reopens illustration regulation.

Company highlights

Noteworthy highlights for total non-variable universal life sales in the first quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 12.7%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the eighth consecutive quarter.

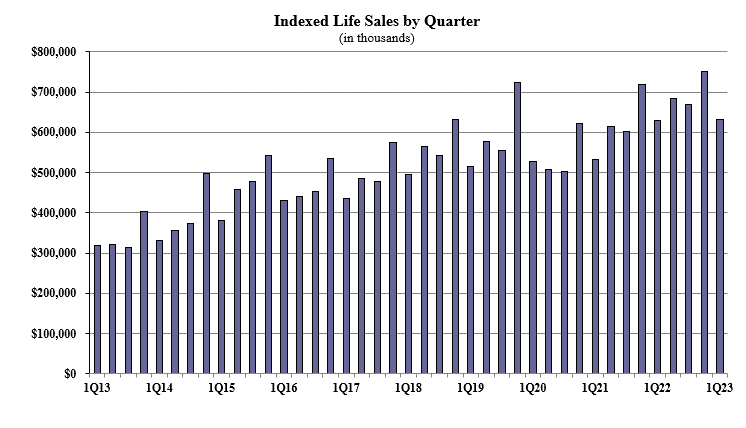

Indexed life insurance sales for the first quarter were $632.6 million, down 15.9% compared with the previous quarter, and up 0.4% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“Indexed life was the only product line not to experience a decline in sales, over this time last year” Moore said. “Sales for the next quarter will likely prove challenging, thanks to the implementation of AG49-B.”

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life insurance sales, with a 14.5% market share, Transamerica, Nationwide, Pacific Life Companies, and Sammons Financial Companies rounded out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined for the eighth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 80.3% of sales. The average indexed life target premium for the quarter was $12,266, a decline of more than 9% from the prior quarter.

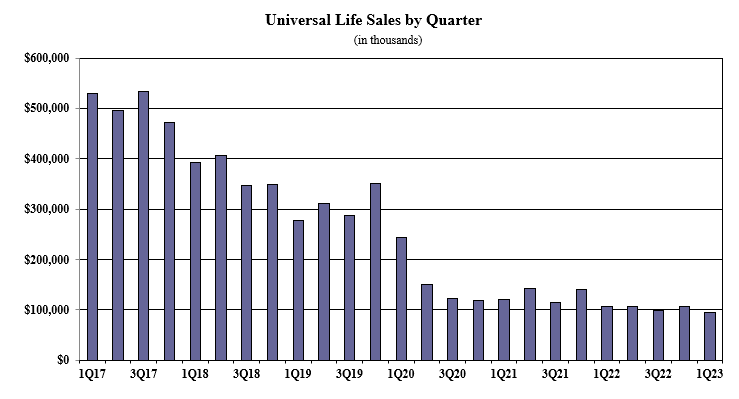

Fixed UL sales for the first quarter were $94.9 million, down 11.3% compared to the previous quarter and down 11.6% compared to the same period last year. Noteworthy highlights for fixed universal life included the top primary pricing objective of No-Lapse Guarantee capturing 50.4% of sales. The average UL target premium for the quarter was $4,690, a decline of nearly 14% from the prior quarter.

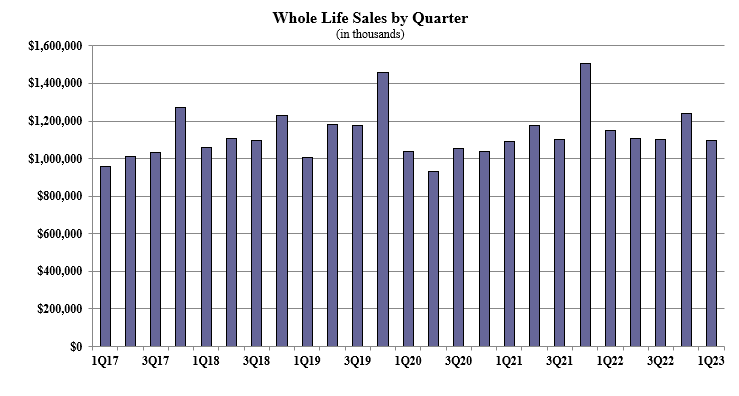

Whole life first quarter sales were $1 billion, down 11.8% compared with the previous quarter, and down 4.7% compared to the same period last year. Items of interest in the whole life market included the top primary pricing objective of Final Expense capturing 58.7% of sales. The average premium per whole life policy for the quarter was $4,127, an increase of nearly 6% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

3 steps to mitigate financial risks in retirement

‘Annuity King’ faces a second trial on tax evasion charges

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Reports from University of Michigan Provide New Insights into Coronavirus (Continuous Medicaid Eligibility, Child Insurance, and Health Care Use): RNA Viruses – Coronavirus

- Data on COVID-19 Published by Researchers at Peking University (Socioeconomic Disparities in Childhood Vaccination Coverage in the United States: Evidence from a Post-COVID-19 Birth Cohort): Coronavirus – COVID-19

- DIFS URGES CONSUMERS WHO NEED HEALTH INSURANCE FOR 2026 TO ENROLL IN A PLAN BEFORE JANUARY 15 DEADLINE

- Rising costs outpacing gains in workforce well-being

- Slew of new Florida laws now in effect

More Health/Employee Benefits NewsLife Insurance News