Life insurance does more than just replace income

When mentioning life insurance to the average investor, the response is usually the same: “I pay a premium and in return, when I die, beneficiaries receive a large sum of money to help replace income that is lost.”

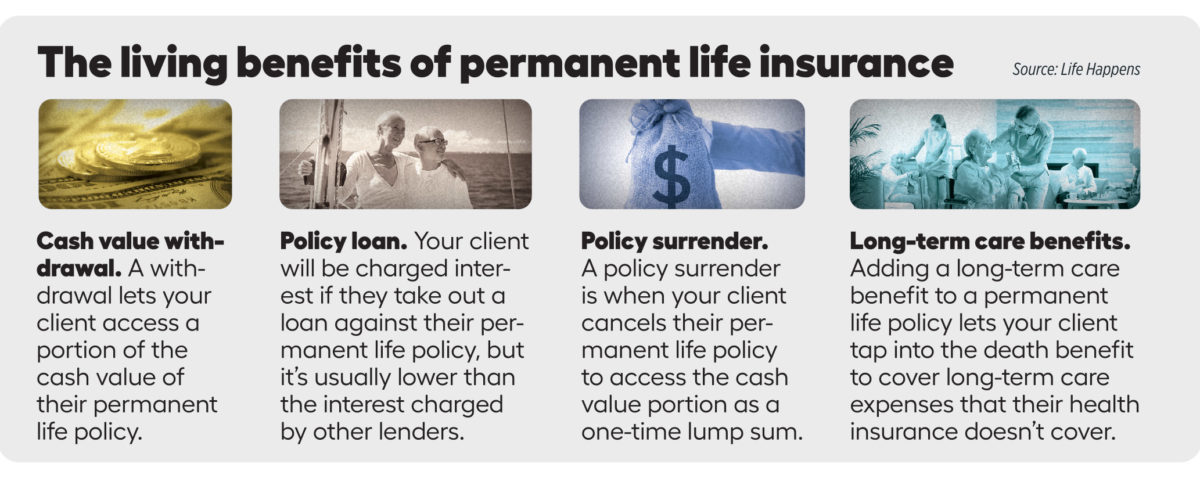

Although this is accurate when referring to term life insurance, universal and whole life policies offer investors additional advanced strategies, including cash value, taxation benefits, and the ability to use the death benefit if needed for long-term care. All these features make the life insurance conversation much more interesting.

Overfunding leads to cash value

These advanced strategies can’t be done using term insurance but are available on policies that have cash value. A cash value life insurance strategy can be achieved with universal or whole life policies. In general, these types of policies are “overfunded,” meaning the policyowner is depositing money into the policy in excess of what is needed to provide the death benefit. Then this money is invested and grows tax deferred.

In universal policies, the money can be invested in the market using various indices or funds, depending on the type of policy. Meanwhile, a whole life policy usually provides a guaranteed fixed rate of return not tied to the market. These two types of insurance have pros and cons, and it’s widely debated which is the best type to own. As you can imagine, the answer depends on the purpose of the policy and the age of the person seeking it.

If your client is sensitive to market fluctuations, you might advise them toward an indexed universal life or whole life policy. Whole life offers a fixed rate of return while IUL can provide guarantees of principal protection and locked-in gains. This often will come at the cost of not receiving all the upsides of the market.

Policies can offer tax benefits

Tax benefits are a major draw for many individuals. As previously mentioned, the cash value (or the amount the policyowner overfunded) grows tax deferred. Those funds can be withdrawn from the policy in a tax-favored manner. Your client can withdraw funds and choose whether they want to withdraw the gains or some of their original deposit. This is the flexibility policyowners typically find appealing.

The gains, in this case, would most likely be a taxable event, but the gains could be part of a strategy when your client’s income is lower during their first years of retirement. This flexibility is something you can’t find in traditional retirement accounts, such as individual retirement accounts, where the order of withdrawals is not in your client’s control and the requirement to withdraw certain amounts at age 72 can cause a tax nightmare, including the Social Security torpedo tax and potentially higher Medicare part B and D costs.

A popular chosen strategy is not to withdraw money but instead allow the insurance company to lend it. The amount lent is not required to be paid back until death, when the death benefit proceeds are reimbursed by the life insurance company. This is a strategy the wealthy have been using for decades, and because it’s a loan, it’s completely tax-free.

Funds can be withdrawn in a lump sum or as a stream of income. The latter is what many gravitate toward as this stream of income is tax-free, helping to keep Social Security taxation and Medicare premiums low.

The loan will have interest, however. The interest rate often is fixed and determined at the beginning and guaranteed for the life of the contract. If the funds invested are performing better than the loan amount accruing, there shouldn’t be any issues. However, this is when you’ll want to work with your client to help create the best plan for their needs. Because of the many moving parts with this strategy, it is best to have the plan of action before the policy is sold and then tailor the policy to the plan. Even though these types of policies are flexible, it’s best to not veer too far from the illustration in order for the policy to perform at its best.

Death benefit withdrawals can help cover LTC

Strategies to withdraw money tax-free aren’t only for the cash value but can also be done with the death benefit. As mentioned previously, the death benefit often can be “accelerated” during the policyowner’s life.

This accelerated death benefit is a lump sum that can be used tax-free if needed for a long-term care event. Usually, the life insurance company will require documentation that the policyowner is unable to perform two or three of the six activities of daily living, or ADLs. ADLs are activities related to personal care. They include bathing or showering, dressing, getting in and out of bed or a chair, walking, using the toilet and eating.

Some clients assume Medicare will pay for a long-term stay in a hospital or nursing home. In most cases, Medicare will pay for only 100 days of this type of care. Anything that extends past this point will need to be paid out of pocket.

With costs ranging from $5,000 to $10,000 a month for this type of care, a retirement nest egg can take a huge hit. If such an event takes place at the beginning of retirement, a spouse can quickly drain investments meant to maintain income for the rest of their life. A long-term care policy can be purchased and designed for this sole purpose. However, premiums typically will increase as the policyowner ages. Designing a life insurance policy with the acceleration of a death benefit for long-term care is usually much less costly than a long-term care policy. Making the decision to go this route is frequently a no-brainer. Of course, if the policyowner never experiences a long-term care event, the death benefit gets paid to the policy’s beneficiaries, providing a tax-free legacy that’s hard to beat.

Life insurance has become even more useful with recent legislation, such as the SECURE Act, which eliminated the stretch IRA and added the requirement of certain beneficiaries to withdraw retirement accounts over a 10-year window after the IRA’s owners and spouses die. These changes require much larger withdrawals for most beneficiaries. These withdrawals often must be made at a time when the beneficiaries are in their peak earning years. If you believe income tax rates will increase, doesn’t it make sense to pass tax-free money instead of taxable retirement accounts to heirs?

Between tax reduction strategies, policy flexibility, and the ability to use the death benefit while you’re alive, life insurance does more than replace income and should be considered by those of any age.

Dan Casey is an investment advisor representative and owner of Bridgeriver Advisors in Bloomfield Hills, Mich. He may be contacted at [email protected].

Finding success with centers-of-influence marketing

Play to the end: Finish Q4 committed to 2023

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- New Mexico's insurance exchange sees record enrollment ahead of Jan. 15 deadline

- Studies from University of Southern California Yield New Information about Managed Care (Why do few Medicare beneficiaries switch their Part D prescription drug plans? Insights from behavioral sciences): Managed Care

- Wyoming's catastrophic 'BearCare' health insurance plan could become reality

- Duckworth pushes military IVF coverage as critics warn taxpayers could pay

- House to consider extension for expired ACA subsidies

More Health/Employee Benefits NewsLife Insurance News