Life insurance can shield your estate

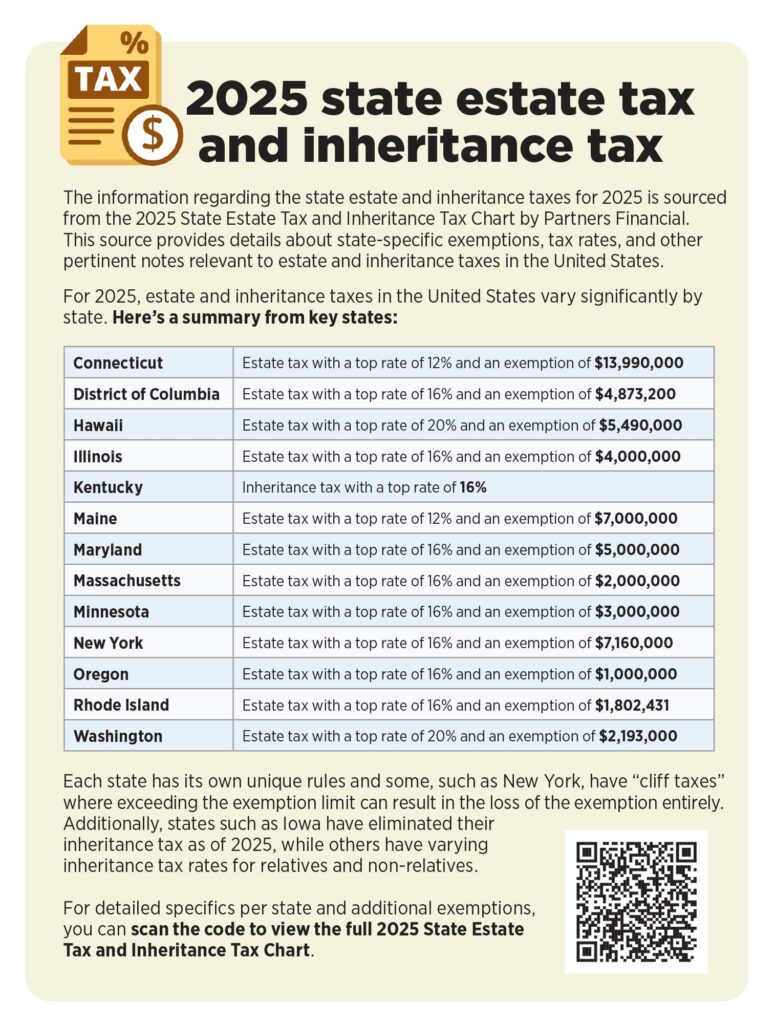

Although the “Big Beautiful Bill” raised the federal estate tax exemption to $15 million per person, state estate taxes have much lower exemptions in many states. Oregon is the lowest, with a $1 million exemption, and Connecticut is the highest, with a $13.99 million exemption.

The top state estate tax rates range from a low of 12% in states such as Maine and Connecticut to a high of 20% in Washington state and Hawaii. In states such as Massachusetts, it is a bit of a double whammy with a low exemption of $2 million and a top tax rate of 16%.

Therefore, the state estate tax should not be overlooked. For many families, a low threshold can lead to unexpected tax bills that threaten the inheritance of a home, a family business or other valuable assets. Although there are estate planning strategies to minimize the burden of this tax, one of the most effective tools used to pay this tax is often overlooked: life insurance.

Let’s explore how estate taxes work and why life insurance can play a crucial role in helping families manage the financial challenges of settling an estate.

As mentioned previously, Massachusetts imposes an estate tax on estates that exceed a certain threshold. As of a 2025 update, the threshold is $2 million for individuals.

This means that if a deceased person’s estate is under these thresholds, no state estate tax is due. The low threshold disproportionately affects middle-to-high-income families who may not have “traditional” wealth but own a home or small business valued at more than $2 million.

In order to explain how state estate taxes are applied, we took the Massachusetts estate tax as an example. The estate tax rates in Massachusetts, like many other states, are progressive, based on the value of the estate. Estates valued at more than $2 million are subject to marginal estate tax rates between 7.2% and 16%.

Massachusetts estate tax rates in 2025

To calculate the estate tax:

1. Determine the gross estate worth (real estate, investments, retirement accounts, business interests, etc.).

2. Apply allowable deductions (debts, funeral expenses, administrative costs).

3. If the net estate exceeds the $2 million individual threshold, consult the estate tax table.

Most people should have an accountant or estate planning lawyer prepare the estate tax returns and calculate the tax due.

Some issues to consider regarding assets include:

» Families must get appraisals for real estate, collectibles and business interests to accurately value the estate.

» Real estate often makes up a significant portion of a decedent’s estate. The tax burden can force heirs to sell property quickly at an inopportune time just to pay taxes.

» Massachusetts property values can fluctuate, and estates with substantial real estate holdings could face varying estate tax bills. Clients should plan for higher values.

» The estate is taxed based on fair market value, which may cause disputes or confusion if assets are not properly appraised and some family members want to retain them.

» If the estate includes a family business, heirs may face the difficult decision of selling the business to cover the tax bill.

» Estate taxes can create roadblocks to smooth business succession, potentially affecting job security and the legacy of a family business when not planned for in advance.

Without sufficient cash, when a loved one dies, heirs may face the responsibility of paying estate taxes out of pocket. This can have a severe impact. For many families, liquidating assets — such as selling a home or business — may be necessary to cover these taxes.

This is where life insurance can be used to help with these issues. The resulting stress can cause emotional strain on grieving families, in addition to the financial burden. Homes and family-run businesses are often the largest assets in an estate. If they are worth a decent amount, the estate tax bill can be large.

Heirs may have no choice but to sell these assets to meet tax obligations. This can possibly disrupt family legacy or livelihood. In addition, estate taxes are due nine months after the date of death, which could force the sale of some of these assets in a hurry in order to pay the tax. Interest and penalties accrue for late payments, adding to the financial stress.

Example: Married couple with $10 million estate

Let’s assume a married couple has a $10 million estate and uses basic estate planning to split their exemptions (i.e., each spouse can use their $2 million state exclusion, for a total of $4 million). Here’s how their state estate tax might look:

Step 1: Net taxable estate

» Gross estate: $10,000,000

» Less couple’s exemption: $4,000,000

» Taxable estate: $6,000,000

Step 2: Estimate tax using the Massachusetts estate tax table

For a $10 million estate, the Massachusetts estate tax liability is roughly $1,000,000 (exact amount depends on the table and deductions).

This tax is due within nine months of death and must be paid in cash. A six-month extension is available, but this only extends the filing deadline, not the payment deadline. Late payments or late filings incur interest and penalties, which can further increase the financial burden on the family.

Where might life insurance fit in?

» Life insurance as a tax-offset strategy: One of the most effective tools for covering estate taxes is life insurance. A life insurance policy can provide heirs with the liquid cash necessary to pay the estate tax without having to sell valuable assets.

» Individual or survivorship life insurance policies: Whole life, universal life, indexed universal life and other permanent life insurance policies can be especially useful in estate planning. The death benefit from these policies is typically paid income-tax-free to the beneficiaries, making it a reliable source of funds when estate taxes are due.

» Policy ownership structure: Life insurance is includable in the taxable estate. By owning the life insurance policy in an irrevocable life insurance trust, the death benefit can be excluded from the decedent’s estate, ensuring it won’t be subject to additional estate taxes.

Benefits of using life insurance for estate tax planning

» Avoiding a fire sale of assets: With life insurance, heirs can avoid selling family homes or businesses to pay estate taxes, thus preserving family wealth and legacy.

» Guaranteed funds: Life insurance provides a guaranteed death benefit, meaning the beneficiaries know exactly how much will be available to cover estate taxes. This eliminates the uncertainty of whether there will be enough liquid assets.

» Cost-effective in the long run: Life insurance premiums are generally affordable and can be structured to fit an individual’s financial situation. By setting up a policy early in life, individuals can lock in lower premiums and ensure their family is financially protected when they pass away.

» Immediate liquidity: Death benefits are paid quickly, allowing heirs to pay taxes when due without selling assets.

» Cash when needed: Avoids the forced sale of legacy properties or businesses.

» Wealth preservation: Keeps the estate intact for heirs.

» Tax-advantaged status: Death benefits are income-tax-free, and if structured properly, outside of the estate, using an ILIT.

We used Massachusetts as an example because with the relatively low estate tax thresholds, even modestly wealthy couples are at risk of a large tax bill. States such as Rhode Island, Minnesota, Illinois, Oregon and Washington all have fairly low exemptions and have similar effects. Planning with tools such as life insurance and trusts can preserve wealth and ease the burden on heirs.

David E. Appel, CLU, ChFC, AEP, is managing partner at Appel Insurance Advisors, Newton, Mass. Contact him at [email protected]. Aviva Sapers, CLU, ChFC, is the CEO of Sapers & Wallack, a third-generation insurance, benefits and investment management firm in Newton, Mass. Contact her at [email protected].

Feelings, prayers and vibes: How many Americans buy

Strong succession planning starts early: A case study

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News