Life insurance application activity in sharp decline among 50+ ages

The latest life insurance application data shows a sharp decline among a demographic that should be a reliable source of sales: Americans ages 50+.

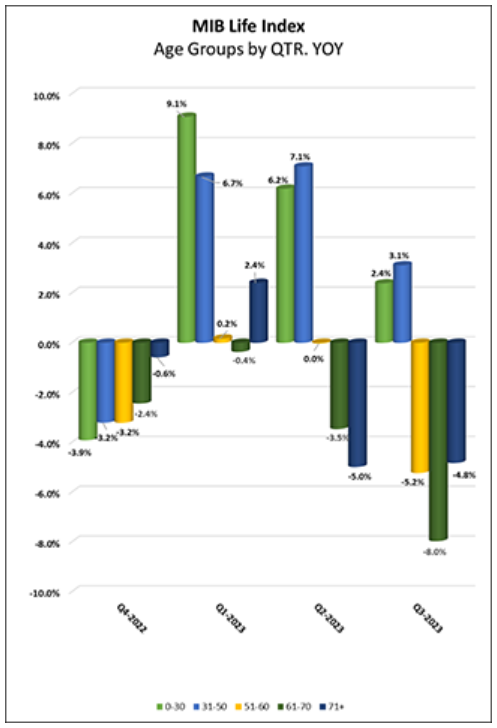

Overall, life insurance application activity finished the third quarter up 2.8% compared to the year-ago period, reported MIB Group, a membership-supported nonprofit organization. MIB data shows life insurance sales are full of good news and bad news.

Application activity is up 5.1% compared to pre-COVID numbers from Q3 2019. However, September 2023 activity was down 2.6% compared to September 2022 and activity during Q3 2022 finished flat at -0.4% compared to activity during Q3 2022, MIB reported.

A peek inside the numbers shows more distressing news, as ages 0-50 saw flat year-over-year activity, while ages 51+ saw declines in September, in the double digits for ages 61-70. On a quarterly basis, Q3 2023 saw year-over-year and year-to-date growth compared to Q3 2022 for ages 0-50 and declines for ages 51+, representing the third consecutive quarter that ages 0-50 lead in year-year-year growth.

Stephen W. Chang is managing director at Acts Financial Advisors in McLean, Va. It's likely a combination of factors causing life insurance sales declines among the age 50+ demographic, he said.

"Life insurance has been somewhat demonized in different personal finance [forums] lately," he said. "Agents are criticized for caring only about commissions, lapse rates are called out for being too high, term insurance is critiqued for having such low payout rates, and various flavors of permanent insurance were probably sold inappropriately in the past."

Focus on accumulation?

Examining activity by face amount, September 2023 saw double-digit, year-over-year declines for amounts up to and including $250,000 and growth across all other face amounts, in the double digits for face amounts over $1 million, MIB reported.

Comparing Q3 to the prior-year quarter revealed similar patterns with amounts up to and including $250,000 declining and all other face amounts at growth, in the double digits for face amounts over $500,000. Year-to-date data revealed declines for face amounts up to and including $250,000 and growth for all other face amounts, in the double digits for amounts over $1 million.

The financial focus on investing and growing retirement plan dollars might be coming at the expense of basic life insurance protection, Chang said. Basic life insurance sales often take more patience and persistence.

"Many people don't want to think about their own mortality," he added. "'Don't be more valuable to your family at death than while still alive' is a common mantra I come across. If you've chosen a poor life partner, then that's probably a reasonable thought, but I hope most of us want to provide for our families if we should pass earlier than expected."

Further breaking down the age bands shows ages 0-30 with flat activity year over year in Q3 for amounts up to and including $250,000 and growth for all other face amounts, in the double digits for amounts over $1 million. Ages 31-50 saw declines for amounts up to and including $250,000 and growth for all other face amounts, in the double digits for amounts over $500,000.

Ages 51-70 saw double-digit declines for amounts up to and including $250,000 and double-digit growth for all other face amounts. Ages 71+ saw declines for amounts up to and including $250,000 and growth for all other face amounts, in the double digits for amounts over $250,000 up to and including $2.5 million as well as amounts over $5 million, MIB reported.

Life insurance product breakdown

Continuing a pattern seen throughout 2023, universal life led in year-over-year growth in September with flat activity of -0.7%. Additionally, term life and whole life saw declines of 2.8% and 6.3%, respectively. When comparing Q3 2023 to Q3 2022, universal life saw growth of 3%, however term life was down 1.6% and whole life down 2.7%.

When breaking down the Q3 2023 year-over-year comparison by age bands, universal life saw growth for ages 0-30, double-digit growth for ages 31-50, declines for ages 51-70, and double-digit declines for ages 71+.

Term life saw growth for ages 0-30, flat activity for ages 31-50, and declines for all other age bands, with double-digit declines for ages 61+. Whole life saw flat activity for ages 0-30, growth for ages 31-50, double-digit decline for ages 51-60, declines for ages 61-70, and growth for ages 71+.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Helping high net worth clients create their retirement purpose plan

Why employer-sponsored health insurance could disappear in the next 20 years

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

More Health/Employee Benefits NewsLife Insurance News