Leveraging Medicaid-compliant annuities in crisis LTC planning

Clients frequently find themselves in a long-term care crisis and need an advisor’s help. Thomas Krause, vice president of sales and marketing with The Krause Agency, described how to help a client’s crisis LTC planning during a recent event, “Don’t Be Scared of Long-Term Care” by the National Association of Insurance and Financial Advisors’ Limited and Extended Care Planning Center.

Crisis planning, he said, is the financial planning surrounding a long-term care event when someone already has entered a facility. The goals of crisis planning include avoiding or mitigating the financial stress associated with long-term care, as well as preserving assets for a healthy spouse or for the next generation.

Getting the care recipient to qualify for Medicaid is the foundation of crisis planning, Krause said, but specific criteria must be met. In addition, to accelerate Medicaid eligibility, the care recipient’s assets must be “spent down” properly. This may include purchasing or improving exempt assets, paying off existing liabilities or purchasing a Medicaid-compliant annuity.

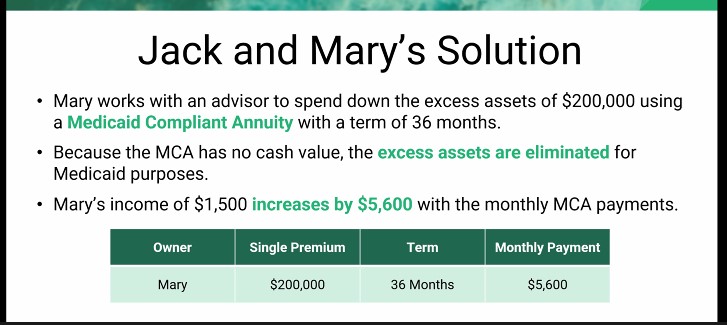

Krause explained a Medicaid-compliant annuity is a single-premium immediate annuity that meets Medicaid requirements. It converts assets into an income stream for the owner, allowing the institutionalized person to qualify for Medicaid benefits. A Medicaid-compliant annuity has no cash value to the owner, can have terms as short as two months and can be funded with nonqualified or tax-qualified funds.

A Medicaid-compliant annuity has several requirements, Krause said. They are:

- The terms of the contract cannot be changed.

- Non-assignable. The contract cannot be assigned or sold to another party.

- Equal payments. The contract must not have any deferral or balloon payments.

- Actuarially sound. It must be a fixed term equal to or shorter than the owner’s Medicaid life expectancy, determined by the Social Security Administration actuarial life table in most states.

- State as beneficiary. The state Medicaid agency must be the primary beneficiary in most cases.

A client might be a good candidate for a Medicaid compliant annuity, Krause said, if they:

- Are about to enter a facility or are already in one.

- Have assets in excess of the resource allowance.

- Have exhausted their long-term care insurance or Medicare benefits.

- Are expected to stay at the facility indefinitely.

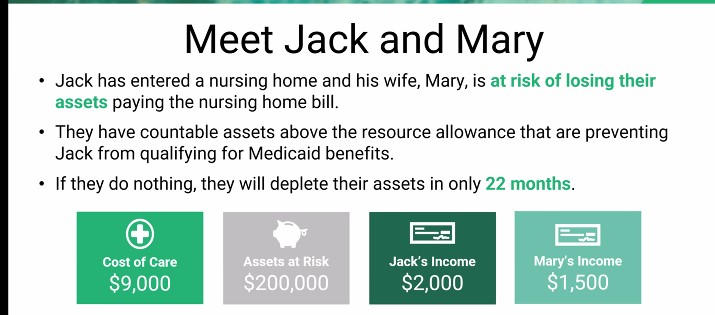

A Medicaid-compliant annuity can help in the case of a married couple in which one partner is about to enter a care facility or is already in one. Krause explained that the most common Medicare-compliant annuity planning strategy for a married couple consists of converting the spend-down amount into a Medicare-compliant annuity for the spouse at home.

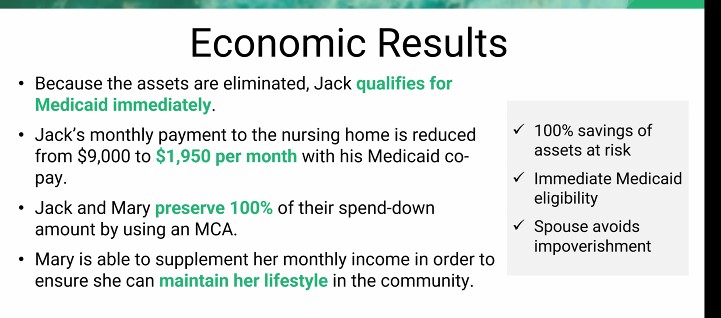

The primary goals of this strategy are to:

- Gain immediate Medicaid eligibility for the institutionalized spouse.

- Provide reliability monthly income to the spouse at home, avoiding spousal impoverishment.

Krause provided the following case study illustrating how a Medicaid-compliant annuity can help a married couple avoid running out of assets when one partner needs care.

“There is still a solution available even if someone didn’t do their planning previously,” Krause said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

MassMutual to ‘wind down’ Haven Life amid poor results, high costs

Level funding: an onramp to health plan innovation for fully insured employers

Advisor News

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsLife Insurance News

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

More Life Insurance NewsProperty and Casualty News

- AM Best Affirms Credit Ratings of Bahamas First Holdings Limited’s Operating Subsidiaries

- Triple-I: Homeowners Insurance Market Shows Early Signs of Stabilization as Post-COVID Inflation Pressures Level-Set Into ‘New Normal’ For Risk Pricing

- AM Best Revises Outlooks to Positive for Hagerty Reinsurance Limited and Drivers Edge Insurance Company

- MetLife Pet Insurance Collaborates with Petstablished to Make Pet Coverage Easy at Adoption

- State Farm Cutting Auto Rates, Hiking Home Premiums in Louisiana | Insurify

More Property and Casualty News