Jackson reports 42% bump in Q4 annuity sales, up $39% for the year

Jackson Financial sticks to what it does best and that’s annuities. Amid a red-hot annuity market, executives were in a celebratory mood while discussing fourth-quarter and full-year 2024 results Thursday.

The insurer, which not long ago posted a few weak quarterly reports, shared eye-popping numbers with Wall Street analysts:

- Annuity sales up 42% in Q4 over the prior-year quarter, and 39% for the full year.

- An estimated risk-based capital ratio of 572%, well above industry standards of 400% to 450%.

- Full-year profit of $946 million off revenues of $6.97 billion.

Laura Prieskorn, president and CEO, called 2024 “a tremendous year of momentum for Jackson.”

However, some analysts are concerned enough about the state of Brooke Re, a reinsurer Jackson established in December 2023, to eye Jackson stock warily. Jackson's share prices rose about 90% in one year before tumbling in recent days.

Of concerning note, Jackson reported a $419 million actuarial charge at Brooke Re due to refined assumptions about customer behavior, particularly regarding guaranteed minimum withdrawal benefit utilization rates on a legacy variable annuity block.

“It was more related to making sure that we've got captured in our projections more precise information around the frequency of withdrawals, as opposed to being able to utilize those benefits,” explained Don Cummings, chief financial officer. “Even though the overall book is largely out of the money, we still have people who are using these products as they were designed. So, they're taking withdrawals on a regular basis.”

With high lapse rates at 13% during Q4, at least one analyst expressed concerns of further stress on Brooke Re going forward.

Cummings sought to reassure analysts that the reinsurer is on solid long-term footing.

“While we did see an impact on Brooke Re capital in the fourth quarter from the actuarial assumption update, capital for the full year increased by about $200 million,” he noted. “Other than the initial formation, there were no capital contributions to or distributions from Brook Re in 2024. Going forward, we will continue to manage Brook Re on a self-sustaining basis.”

In Other News

Annuity sales. Jackson celebrated big sales gains in every product line. Variable annuity sales of $2.8 billion in the fourth quarter were up 27% from the year-ago quarter.

Registered index-linked annuity sales hit $1.5 billion in Q4, up 47% from the fourth quarter of 2023. And fixed and fixed index annuity sales of $397 million were about five times the sales made in the year-ago period.

“Our consumer-oriented product offerings and service capabilities led to new and diverse distribution relationships,” Prieskorn said. “Growth in distribution created increases in new producers, multi-product producers and the total number of producers and new sales.”

Jackson reached $1 billion in advisory sales in 2024 as more advisors turn to annuity solutions, she added.

“We see increasing interest in solutions that offer investment protection and guaranteed lifetime income, allowing for greater certainty for the future,” Prieskorn added.

Quarterly Snapshot

- Earnings driven in part by a 7% increase in total annuity assets under management, from $235 billion on Dec. 31, 2023, to $252 billion on Dec. 31, 2024, largely due to higher equity markets

- Net income reflected a $347 million gain from business reinsured to third parties, while the prior year’s fourth quarter included a loss on that business of $841 million

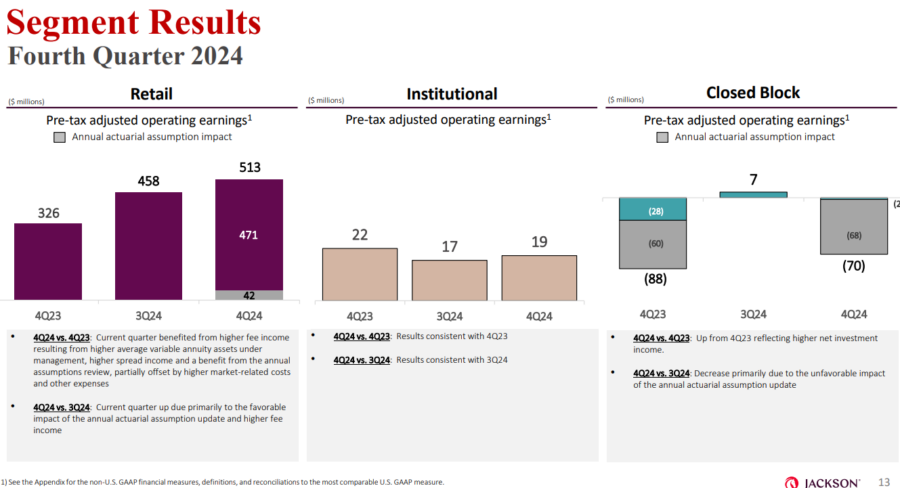

- Closed life and annuity blocks reported pretax adjusted operating income (loss) of $(70) million in Q4, up from $(88) million in the year-ago quarter, reflecting higher net investment income

By The Numbers

- Total Revenues: $225 million ($882 million in Q4 2023)

- Net Income: Net income per diluted share was $334 million (-$1.6 billion in Q4 2023)

- Earnings Per Share: Adjusted operating earnings per diluted share of $4.65 ($2.53 in Q4 2023)

- Share Repurchases: $96 million in Q4 2024

- Dividend Declared: $52 million in Q4 2024

- Stock Price Movement: Stock is down 9% to $85.08 at midday Thursday

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Despite LTC loss, Genworth sees net income growth, CareScout expansion

Health agents ‘optimistic’ as a new administration takes charge

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

More Annuity NewsHealth/Employee Benefits News

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- Iowa insurance firms warn bill would make health costs rise

- Farmers among many facing higher insurance premiums

- Mark Farrah Associates Analyzed the 2024 Medical Loss Ratio and Rebates Results

- PID finds violations by Aetna Insurance

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

More Life Insurance News