Jackson Financial rides out Q4 loss with solid sales and capital, new reinsurer

Jackson Financial executives touted the potential for Brooke Re, a wholly owned reinsurer established in January, while explaining a fourth-quarter loss of $1.56 billion.

CEO Laura Prieskorn insisted that Jackson is right on target with its growth plan. The company "met or exceeded all financial targets" for the third consecutive year, she added. For the year, Jackson reported profit of $934 million, or $10.76 per share. Revenue was reported as $3.16 billion.

"2023 was a fantastic year of execution for Jackson," Prieskorn told Wall Street analysts on a Thursday morning call, "with our financial performance highlighting and strong fundamentals of our business."

Jackson's annual actuarial assumptions update and lower-than-expected returns on private equity resulted in the depressed Q4 earnings, explained Marcia Wadsten, chief financial officer. The Michigan-based insurer posted $892 million in Q4 total revenue compared to $2.61 billion in the prior quarter and -$2.01 billion a year ago.

Net investment income of $754 million fell short of the $782 million in Q3 and increased from $739 million in Q4 2022.

The annual actuarial assumptions review in the fourth quarter led to a pre-tax adjusted operating earnings impact of $60 million in the quarter, compared to a benefit of $38 million in the fourth quarter of 2022, Wadsten explained.

"The impact in 2023 was focused in the closed-block segment, where we recorded a reserve increase for life insurance and annuitization benefits, driven by a decrease in lapses partially offset by an increase in the long-term earned rate," she added.

In January, Jackson established Brooke Life Reinsurance Co., a Michigan-based captive reinsurer. Executives said the new reinsurer, known as Brooke Re, will allow Jackson to optimize its hedging, stabilize capital generation and produce more predictable financial results going forward.

Brooke Life Insurance Co., Brooke Re and Jackson National Life Insurance Co. are all domiciled in Michigan, giving Jackson "consistent regulatory oversight," Wadsten noted.

"Through the coinsurance agreement executed in January, the in-force and future [variable annuity] guaranteed benefits are transferred to Brooke Re while the VA base contract remains at JNL," she added. "The base contract is expected to continue generating substantial earnings and capital for JNL."

Strong RILA sales

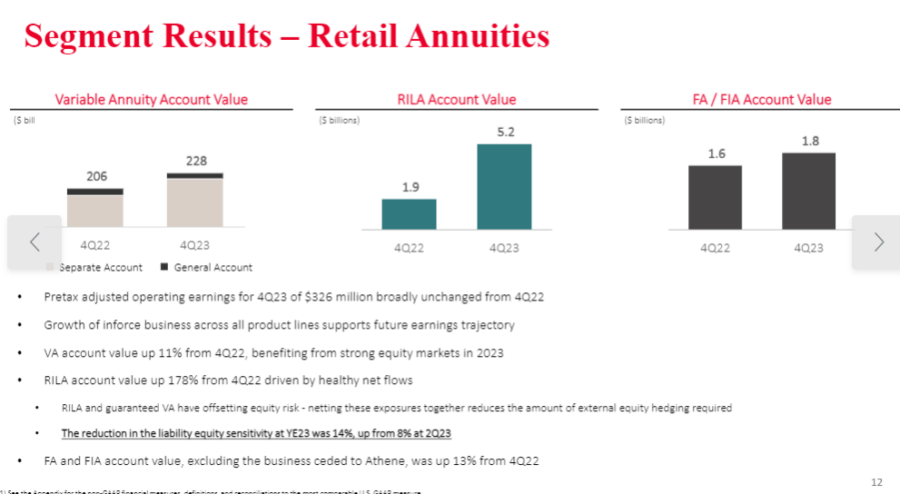

Jackson annuities segment reported pretax adjusted operating earnings of $326 million in Q4,

essentially flat compared to the fourth quarter of 2022. The quarter "benefited from higher fee income resulting from higher average variable annuity AUM, and improved spread income as higher net investment income was only partially offset by the impact of resetting minimum interest crediting rates on variable annuity fixed rate options in 2023," Jackson said in a news release.

Full-year 2023 pretax adjusted operating earnings for the segment were $1.4 billion, compared to $1.5 billion in full year 2022. The current year benefited from higher spread income and improved mortality, the release said.

Total annuity sales of $3.3 billion in the fourth quarter of 2023 were up 1% from the fourth quarter of 2022. Traditional variable annuity sales in the current quarter were down 14% compared to the fourth quarter of 2022, primarily due to consumer preferences for asset protection, the release said.

For the full year 2023, annuity sales of $12.8 billion were down 18% from the full year 2022, reflecting lower sales of variable annuities. Prieskorn highlighted the success of Jackson Market Link Pro, its registered indexed-linked annuity entry introduced in October 2021.

"In our second full year selling RILA, sales were nearly $3 billion, up 60% from 2022," she said. "Notably, RILA sales in the fourth quarter alone reached $1 billion, accounting for nearly one-third of our total annuity sales, and reaching a $4 billion annual run rate."

Wadsten lauded

Prieskorn wrapped up scripted comments with a tribute to Wadsten, who is retiring after 32 years with Jackson. Wadsten will stay on until June 3, when it is expected that Don Cummings, Jackson’s current senior vice president, chief accounting officer and controller will be appointed CFO. Wadsten is also expected to continue as an advisor to the company, Prieskorn said.

"She has led finance and actuarial teams across the organization and has had an incredible impact on the company overall," Prieskorn said. "Her deep subject matter expertise has allowed for positive rating agency analyst and shareholder engagement."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Women assuming more financial power, responsibility, study finds

In AI ‘Wild West,’ firms urged to adopt in-house policies

Advisor News

- Health insurance premium tax bill moving in House

- Iowa Senate committee approves one-time tax increase on certain health insurance plans

- SEC manual shake-up: What every insurance advisor needs to know now

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

More Advisor NewsAnnuity News

- Variable annuity sales surge as market confidence remains high, Wink finds

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- New Findings on Managed Care from Harvard University T.H. Chan School of Public Health Summarized (Shared labor-Public Private Partnerships for Maternal Health Equity): Managed Care

- New Managed Care Study Findings Have Been Reported by Researchers at Brigham and Women’s Hospital (Disparities in Prescription of Long-Acting GLP-1s): Managed Care

- ‘Critical failure’ at UCare blocks dialysis care, creates systemic risk

- Hearing Tests: What to Expect, Costs, and Insurance Coverage

- New Findings from National Health Insurance Service Ilsan Hospital in the Area of Rectal Cancer Reported (Endoscopic resection versus surgery for T1 rectal cancer: A systematic review and meta-analysis of oncologic and safety outcomes): Oncology – Rectal Cancer

More Health/Employee Benefits NewsLife Insurance News

- Hearing Tests: What to Expect, Costs, and Insurance Coverage

- Securian Financial Reports Very Strong 2025 Results

- The New Way Life Insurers Are Fact-Checking Your Application

- Best’s Special Report: US Life/Health Insurance Industry Sees Impairments Halved in 2024

- Jackson Study Exposes Stark Disconnect Between Anticipation of Policy Change and Retirement Planning Conversations

More Life Insurance News