Jackson brushes off reinsurance loss, volatility with Q1 annuity sales bump

Jackson Financial continues its evolution from primarily a variable annuity seller to a one-stop annuity operation that performs like an asset manager.

Jackson’s retail annuity suite reported first-quarter growth across all lines, executives said Thursday:

- Sales of variable annuities, which reached $2.7 billion, were up 9% from the first quarter of 2024, with a more than 40% increase in sales of annuities without lifetime benefits.

- Jackson’s registered index-linked annuity posted sales of $1.2 billion, up 3% from the first quarter of 2024.

- Fixed and fixed index annuity sales of $174 million were up 74% in Q1.

“Jackson's multi-product portfolio positions us well to serve a range of market environments and client needs, which was evident again this quarter,” said CEO Laura Prieskorn.

“We saw increasing demand for Elite Access, our investment-only variable annuity. Elite Access growth benefited from the success of our recently introduced Principal Guard feature, a guaranteed minimum accumulation benefit.”

Overall, retail annuity sales hit $4 billion for the quarter, up 9% year over year, continuing Jackson’s rise up the sales charts. The insurer moved to eighth place in LIMRA’s annual sales after $16.8 billion in 2024 sales, up more than 35% from 2023.

In Other News:

Reinsurance loss. Jackson reported a net loss of $35 million in the quarter, driven by a $161 million loss on business reinsured to third parties, executives said. “The results of reinsured business can differ significantly from quarter to quarter,” Jackson said in a news release.

Jackson has reinsurance deals with others, notably, a $27 billion deal inked with Athene Holding in 2020. That deal covers traditional fixed annuity and indexed annuity liabilities.

In addition, Jackson established its own reinsurer, Brooke Re, in December 2023. While analysts have expressed concerns about its capitalization, Chief Financial Officer Don Cummings said Brooke Re performed as intended during severe April volatility.

“Brooke Re was initially structured and capitalized to withstand stressful market environments, and we are pleased with the performance of our hedging program during April,” Cummings said. “Brooke Re did not require any capital contributions during April, and the hard assets at Brooke Re have increased since its formation.”

Wanted: asset manager partner? Jackson’s business mix and having Brooke Re means the company is less sensitive to equity market movement and “results in the economics at Jackson National Life being more like an asset management business,” Cummings explained.

That led one analyst to note that competitors attempting this strategy have opted for asset management partners to invest the life insurance and annuity proceeds.

“We're continuing to see growth in sales, in spread products, and we'll maintain the discipline that we've had in the past,” Prieskorn said. “If opportunities present themselves for us to do something different to compete, we’ll be open to what those opportunities are.”

Cummings added that Jackson is succeeding with its RILA product without partnering with an asset manager.

“We do think we can be very competitive and remain competitive in the RILA space,” he said. “We've grown that business from essentially zero over the last few years to about $12 billion in AUM.”

Quarterly Snapshot:

- Jackson National Life Insurance Co. held a risk-based capital (RBC) ratio of 585% at the end of the first quarter.

- Advisory annuity sales up 28% when compared to Q1 of 2024.

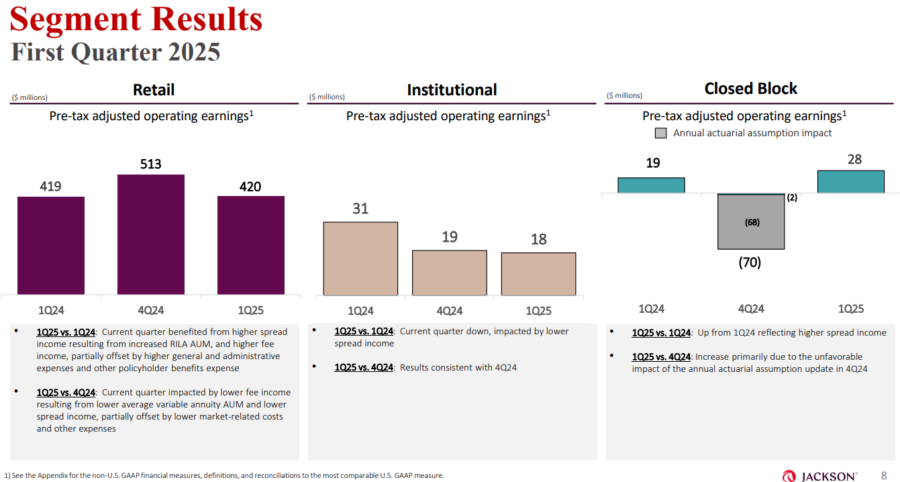

- Closed life and annuity blocks reported pretax adjusted operating income of $28 million, up from $19 million in Q1 2024, reflecting higher spread income.

- Cash and highly liquid securities at the holding company of over $600 million at the end of Q1, above Jackson’s targeted $250 million minimum liquidity buffer.

Management Perspective:

“The current environment reinforces the importance of providing security to Americans planning for their retirement. Advisors are increasingly seeing annuities as a valuable tool in delivering the security for their clients, a powerful illustration of this dynamic. Jackson’s focus on the annuity industry and delivering flexible protection income-oriented solutions is highly valued during times of market uncertainty.”

– CEO Laura Prieskorn

By The Numbers:

- Adjusted Operating Earnings: $376 million ($334 million in Q1 2024)

- Net Income: -$35 million ($784 million in Q1 2024)

- Earnings Per Share: Adjusted operating earnings of $5.10 per diluted share ($4.23 in Q1 2024)

- Share Repurchases: $172 million

- Dividend Declared: $59 million

- Stock Price Movement: Shares up 2.5% at midday Thursday to $85.09.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Lincoln Financial: ‘Solid’ Q1 despite loss, moves toward Bain partnership

Life insurance application activity again flat in April, MIB reports

Advisor News

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Long-term care insurance can be blessing

- Solano County Supervisors hear get an earful from strikers

- How Will New York Pay for Hochul's State of the State Promises?

- As the January health insurance deadline looms

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

More Health/Employee Benefits NewsLife Insurance News