International stocks are having their moment. Will it last?

By Kyle Jahnke

Over the past decade, U.S. equities have dominated global markets leading investors to wonder whether international stocks still have a place in a diversified portfolio. After all, ten years is a decent trend. From the perspective of Generation Z investors (and even some Millennials!), U.S. outperformance has been a reality for the entirety of their investing lives.

But markets always have a way of humbling our conviction. Cue 2025. While U.S. equities have been whipsawed due to uncertainty surrounding tariffs and their impact on the economy, international stocks have taken center stage with double-digit returns. Naturally, this resurgence has led many investors to ask the question, “Is this a short-term rally or a durable trend?” Let’s explore four reasons why international markets may be poised to excel.

1. Valuations of International Equities

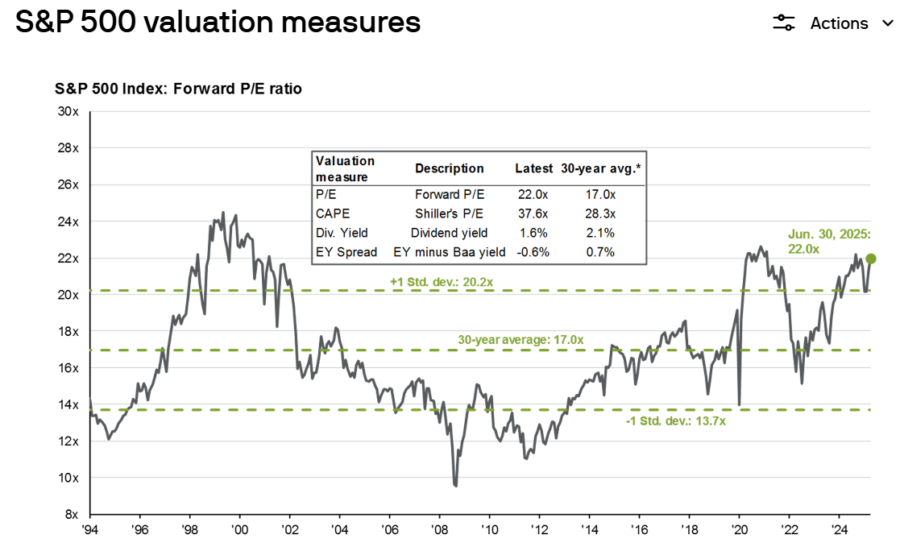

The discussion starts with value. As this is written in Mid-2025, U.S. stocks continue to trade at historically high price-to-earnings (P/E) ratios. In comparison, international developed and emerging markets trade at substantial discounts, both to their own historical values and to their U.S. counterparts.

For example, the MSCI EAFE Index (developed international markets) trades at a P/E multiple in the mid-teens, compared to the S&P 500, which still represents a premium closer to 20–22x earnings.

Critics of foreign markets will argue that U.S. valuations deserve to be higher due to structural advantages enjoyed by American companies. It is also worth pointing out that lower valuations in isolation do not necessarily correlate to higher returns in the short term.

However, history does indicate that over longer periods, starting valuation is one of the most reliable predictors of long-term returns. Put simply, while higher valuations for U.S. companies may be justified today, international equities may arguably have more room to run in a bull market.

2. Diversification Still Matters

In recent years, the benefits of diversification have felt more like a drag. U.S. markets, led by mega-cap tech stocks affectionately known as “The Magnificent 7”, outpaced nearly everything else over the period.

These outsized returns have driven the S&P 500 to new highs, but this level of concentration doesn’t come without risk. There is no telling if these handful of high-flyers will continue to dominate, but history does show that it pays to be ready when trends shift.

International markets offer exposure to different economic cycles, currencies, demographic trends, and sectors underrepresented in the U.S. For example, European indexes are dominated by sectors such as industrials and financials, while emerging markets offer access to the growing middle class in countries like India, Indonesia, and Mexico.

When U.S. growth inevitably slows or faces policy headwinds, international equities may offer counterweight and opportunity as we’ve experienced this year. Global diversification is less about predicting the next winner and more about avoiding the next big loser.

3. The Dollar & Currency Exchange

Let’s dive into Econ 101 for a moment. Following the 2008 Financial Crisis, the relative value of the U.S. dollar has marched steadily upward. This has worked against international investors, who were required to convert earnings from local currencies around the globe into dollars that are continuously worth more. These unfavorable exchange rates have a direct impact on returns.

But that trend may be reversing. After peaking in late 2022, the dollar has shown signs of weakening relative to other major currencies. If this continues, it could provide a tailwind for U.S.-based investors holding foreign equities, as foreign earnings become more valuable when translated back to dollars.

Like any other market, trends in exchange rates are almost impossible to predict. What we do know is that there will be another environment where the dollar weakens leaving international equities poised to benefit.

4. Global Growth is Expanding

Although there is little doubt that innovations continue to be concentrated in the U.S., many of the most exciting trends in technology, supply chains, and consumer growth are happening overseas.

• Semiconductor production in Asia gives exposure to the AI theme.

• Fintech and mobile payments adoption in Southeast Asia.

• Manufacturing shifts from China to more affordable emerging markets like Vietnam and India.

• Mining of key metals in China and South America.

Given these trends, international markets that were traditionally known as “value plays” now offer investors access to growth opportunities outside of the narrow U.S. exposure.

Conclusion: Committing to international investing

International stocks are having their moment, but there is evidence to believe this moment could become a multi-year trend. With attractive valuations, broadening global growth, currency tailwinds, and diversification benefits, the case for international exposure is both time-tested and relevant today.

If you are a diversified investor, times like these provide a chance to take a breath and refocus on the role of international exposure from a position of strength instead of weakness. And for those not investing globally, now may be a perfect time to consider how added diversification may support you in creating a portfolio that endures.

Kyle Jahnke, CFP® is a financial advisor at Retirement & Wealth Strategies in Saginaw, Michigan, where he helps clients navigate retirement, tax, and investment planning. With experience in both corporate finance and independent wealth management, he specializes in serving individuals and families seeking personalized, comprehensive financial advice. Kyle is an active member of the Financial Planning Association and a contributor to the FPA NexGen community.

How ICHRAs put downward pressure on health plan costs

Health community reacts to Senate bill impacts on health care

Annuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance NewsProperty and Casualty News

- Alexander County issues Request for Proposals for insurance broker/agent

- Despite rate hikes, study finds California home insurance costs are middle of the pack nationwide

- Using AI to predict and prevent weather catastrophe home insurance claims

- Pennsylvania State University (Penn State) Researchers Have Provided New Study Findings on Environment (Flood risk perceptions, insurance, and policy: a review of the Pennsylvania flood task force initiative): Environment

- SENATOR SCHMITT LEADS COLLEAGUES IN CALLING FOR REPEAL OF HARMFUL BIDEN-ERA HOUSING REGULATION

More Property and Casualty News