Insurance Coalition Targets Life Coverage Gap

Too few American families have been adequately covered by life insurance for too long, and a coalition of trade associations plans to do something about it this year.

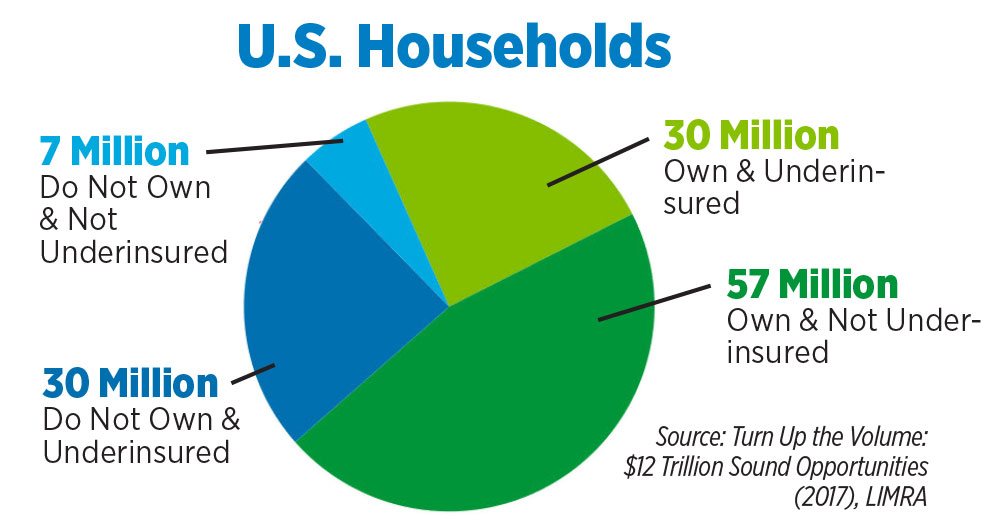

The group launched Help Protect Our Families on Feb. 1 with an outreach campaign to close the gap in under- and uninsured households. About 60 million households fall into that group, with an average coverage gap of $200,000, amounting to a $12 trillion opportunity for the industry.

LL Global, the parent organization of LIMRA and LOMA, the American Council of Life Insurers, Finseca, Life Happens, Million Dollar Round Table, National Association of Insurance and Financial Advisors, and National Association of Independent Life Brokerage Agencies are pulling together for the yearlong effort.

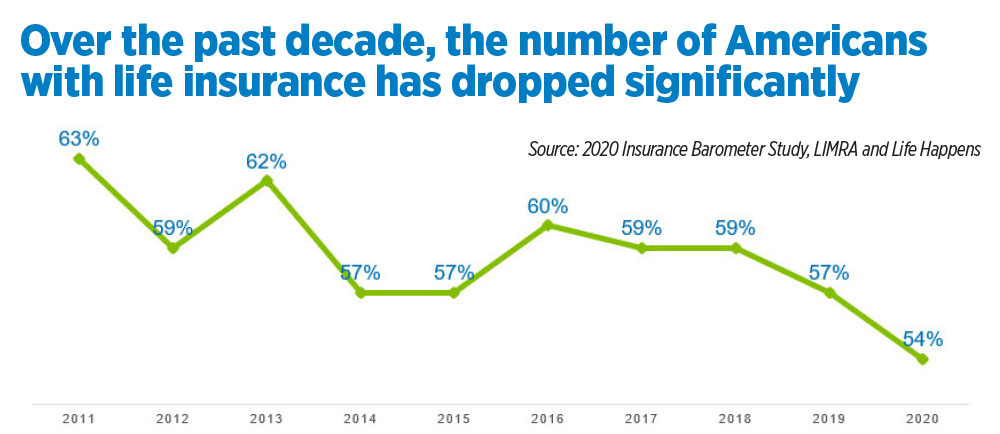

Although the coverage gap has been an issue for several decades, it has accelerated over the past few years. In 2020, just 54% of Americans had life insurance coverage, a significant decline from 63% just a decade ago, according to research by LIMRA and Life Happens. Even those who have life insurance may not have enough coverage to adequately support their families.

The seven trade associations plan to leverage their expertise and resources to develop and share consumer insights and industry best practices that will help carriers and financial security professionals reach those families that are at risk of not having proper coverage.

One of the reasons to act now is the increase in consumer awareness during the COVID-19 pandemic. In 2020, one-third of Americans (32%) said COVID-19 was the primary reason they began shopping for life insurance.

Also, according to LIMRA and Life Happens research:

» Seven in 10 Americans agree that the pandemic has been a wake-up call to reevaluate their long-term financial goals.

» Three in 10 Americans say they are more likely to buy life insurance due to COVID-19, with seven in 10 saying they want to increase what they already have.

» Three in 10 Americans have discussed life insurance coverage with their family during the pandemic.

Consumers are ready to talk to an agent, with 41% saying they want to work with an agent to buy coverage.

The coverage gap might actually be a knowledge gap. More than half of consumers said they haven’t bought because they don’t know what they need. In fact, 34% of Americans said they don’t understand the basic concepts about life insurance.

Millennials have said they are interested in insurance, but 52% said they haven’t bought because no one has approached them. More than a third (35 percent) of married couples with dependent children want to speak with a financial professional about their life insurance needs.

Coalition members have not specified the full plan as of the rollout, but they said that agents and advisors will be able to get informational resources from their associations’ websites. LIMRA’s section for information is www.limra.com/helpprotectourfamilies.

Americans Are Split On Return To Normal Life

When Closing Down Means Opening Up

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

- IF FINALIZED, PROPOSED CHANGES TO MEDICARE ADVANTAGE AND MEDICARE PART D WOULD IMPACT SENIORS' COVERAGE AND CARE IN 2027

- ASSEMBLYMEMBER WILSON INTRODUCES LEGISLATION TO PROTECT CALIFORNIANS FROM GENETIC AND BIOMARKER DISCRIMINATION IN INSURANCE

More Health/Employee Benefits NewsLife Insurance News

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

More Life Insurance News