Indexed universal life drives strong 2022 sales, Wink reports

Consumers love indexed universal life, a love affair that remained strong in the fourth quarter 2022, according to Wink’s Sales & Market Report.

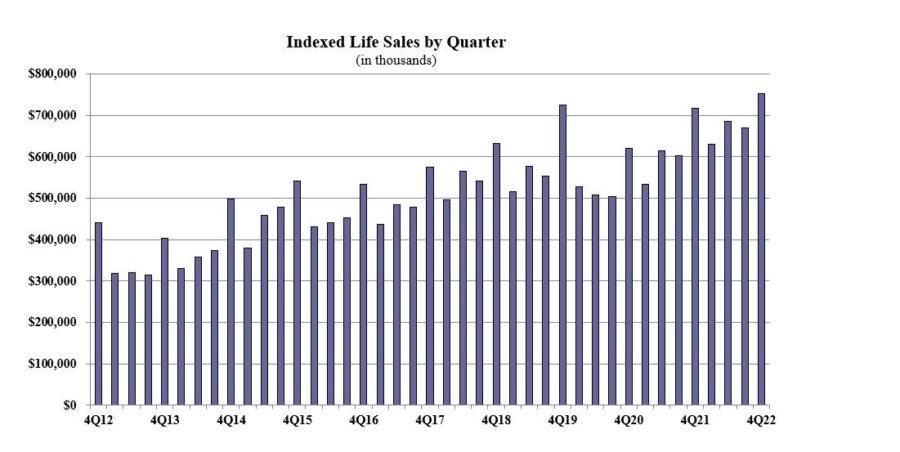

Indexed life sales for the fourth quarter were $752.2 million, up 12.1% compared with the previous quarter, and up 4.7% compared to the same period last year. Indexed life sales include both indexed universal life and indexed whole life.

Total 2022 indexed life sales hit $2.7 billion, an increase of 10.9%. This was both a record-setting quarter and a record-setting year for indexed life sales, Wink reported.

“The number two seller of indexed life increased their sales by nearly a third this year,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “This put indexed life sales over the top.”

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life sales, with a 14.7% market share, Transamerica, Pacific Life Companies, Nationwide, and John Hancock rounded out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product for all channels combined. The top pricing objective for sales this quarter was cash accumulation, capturing 79.2% of sales. The average indexed life target premium for the quarter was $13,447, an increase of more than 2% from the prior quarter.

Total non-variable universal life sales for the fourth quarter were $861.5 million, up 12% compared to the previous quarter and down 0.4% compared to the same period last year. Non-variable UL sales include both indexed UL and fixed UL product sales. Total 2022 non-variable universal life sales were $3.1 billion, an increase of 5.9% over the prior year.

Noteworthy highlights for total non-variable universal life sales in the fourth quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 12.9%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

Fixed UL sales for the fourth quarter were $109.6 million, up 11.4% compared to the previous quarter and down 21.7% compared to the same period last year. Total 2022 Fixed UL sales were $425.3 million, a decline of 17.9%.

“Universal life sales are likely the lowest they have been since the product was developed nearly 45 years ago," Moore said. "There definitely needs to be some new innovation in the market, if carriers want to revive the product line.”

Noteworthy highlights for fixed universal life included the top pricing objective of no lapse guarantee capturing 54.6% of sales. The average UL target premium for the quarter was $5,440, a decline of more than 1% from the prior quarter.

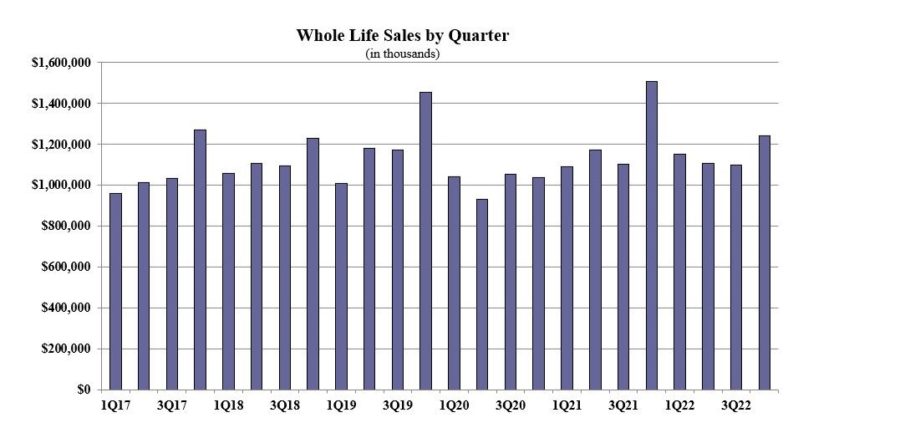

Whole life fourth quarter sales were $1.2 billion, up 12.7% compared with the previous quarter, and down 17.6% compared to the same period last year. Total 2022 whole life sales were $4.5 billion, a decline of 5.7%.

Items of interest in the whole life market included the top pricing objective of final expense capturing 52.4% of sales. The average premium per whole life policy for the quarter was $3,894, a decline of more than 4% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Female advisors see ‘helping people’ as main career draw, training as hurdle

New York Life rockets to the top of the 2022 annuity sales charts

Advisor News

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News