Indexed products headline strong 3Q annuity sales, Wink reports

Third-quarter sales of deferred annuities soared nearly 21% over the year-ago quarter, according to Wink’s Sales & Market Report.

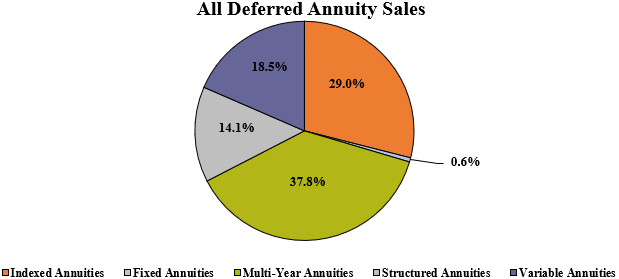

All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines. Indexed products led the way, said Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence.

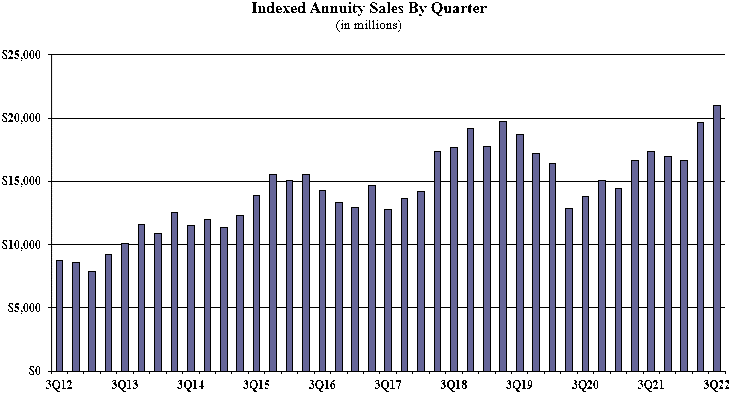

"It was a record-setting quarter for indexed annuity sales," she said. "In fact, 2022 will be a record year for indexed annuities as well."

Noteworthy highlights for all deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.5%. New York Life moved into second place, while Corebridge Financial, Equitable Financial, and Massachusetts Mutual Life Companies rounded out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity was the No. 1 selling deferred annuity, for all channels combined in overall sales.

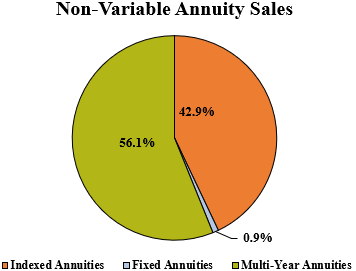

Total third-quarter non-variable deferred annuity sales were $48.8 billion, an increase of 5.5% when compared to the previous quarter and an increase of over 67.1% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 12.3%. Massachusetts Mutual Life Companies held onto second place while Corebridge Financial, New York Life, and Sammons Financial Companies completed the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYGA, was the No. 1 selling non-variable deferred annuity, for all channels combined for the quarter.

Total third-quarter variable deferred annuity sales were $23.5 billion, down 10.8% when compared to the previous quarter and down more than 23% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the third quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 16.2%. Jackson National Life moved into the second-place position, as Lincoln National Life, Brighthouse Financial, and Allianz Life concluded as the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined in overall sales for the fifteenth consecutive quarter.

Indexed annuity sales for the third quarter were $20.9 billion; up more than 6.9% when compared to the previous quarter, and up more than 20.9% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the third quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 12%. Allianz Life moved into the second-ranked position while Corebridge Financial, Sammons Financial Companies, and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively. Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined.

Traditional fixed annuity sales in the third quarter were $451.6 million; sales were down 6.8% when compared to the previous quarter, and up more than 25.1 % when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 16.4%. EquiTrust ranked second, while Modern Woodmen of America, Western-Southern Life Assurance Company, and American National, rounded out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined for the ninth consecutive quarter.

Multi-year guaranteed annuity (MYGA) sales in the third quarter were $27.4 billion; sales were up more than 4.7% when compared to the previous quarter, and up over 138% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include Athene USA ranking as the No. 1 carrier, with a market share of 12.7%. New York Life moved into the second-ranked position, while Massachusetts Mutual Life Companies, Brighthouse Financial, and Corebridge Financial rounded out the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for all channels combined.

“Multi-Year Guaranteed Annuity sales killed it this quarter,” Moore said. “This isn’t surprising considering that I have three-year MYGAs today, that are crediting nearly three times the interest that they were in the first quarter.”

Structured annuity sales in the third quarter were $10.1 billion; sales were down 3.1% as compared to the previous quarter, and up 11.8% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the third quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 21.9%. Allianz Life ranked second, while Brighthouse Financial, Lincoln National Life, and Prudential completed the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity for all channels combined for the second consecutive quarter.

Variable annuity sales in the third quarter were $13.3 billion, down more than 15.9% as compared to the previous quarter and down more than 37.8% as compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the third quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 21.1%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished out as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the fifteenth consecutive quarter, for all channels combined.

Sixty-three indexed annuity providers, 42 fixed annuity providers, 71 multi-year guaranteed annuity (MYGA) providers, 18 structured annuity providers, and 43 variable annuity providers participated in the report.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Consumers initiating life insurance purchases at record rate, study finds

What does the Great Unwinding mean for employer-based health plans?

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News