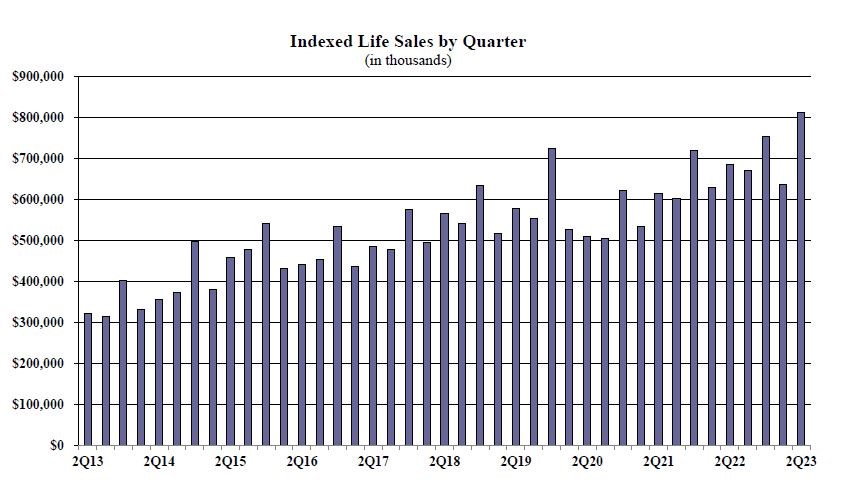

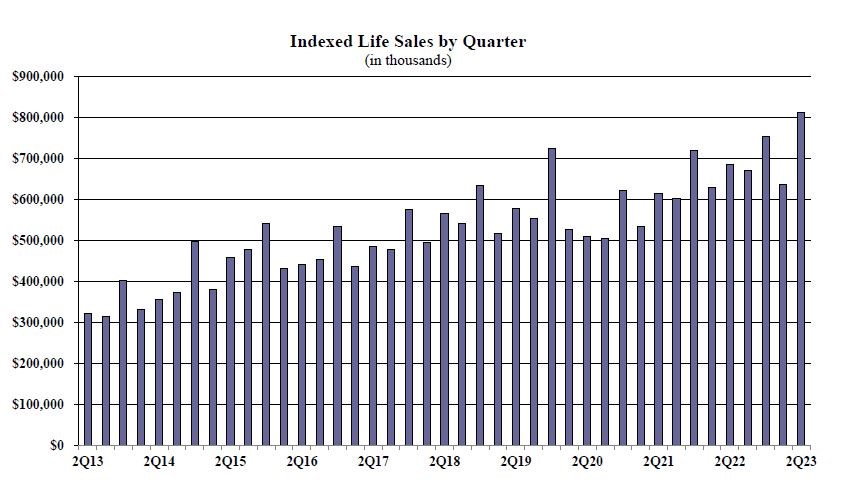

Indexed life sales up 28%, drives strong Q2 for life insurance, Wink says

Indexed life insurance sales soared nearly 28% in the second quarter, helping the industry post a very strong bottom line, Wink, Inc. reported.

Life insurance sales numbers were much improved from a lukewarm first quarter.

Q2 indexed life sales hit $812.6 million, up 27.8% from Q1 and up 18.5% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“Like indexed annuities, indexed life is setting sales records," said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “If sales keep setting records like this, the par whole life carriers will have no choice but to develop their own indexed solution.”

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life sales, with a 23.9% market share, Transamerica, Pacific Life Companies, Nationwide and Sammons Financial Companies rounded-out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined for the ninth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 73.6% of sales. The average indexed life target premium for the quarter was $11,194, a decline of more than 9% from the prior quarter.

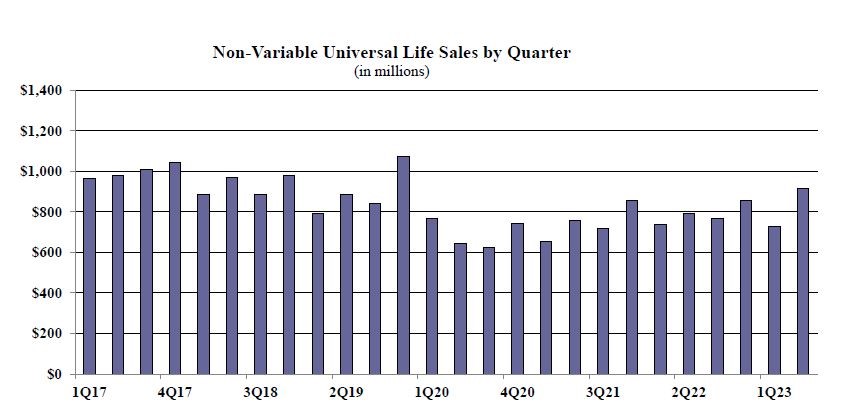

Non-variable universal life sales for the second quarter were $914.3 million, up 25.2% compared to the previous quarter and up 15.6% compared to the same period last year. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 21.3%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the ninth consecutive quarter.

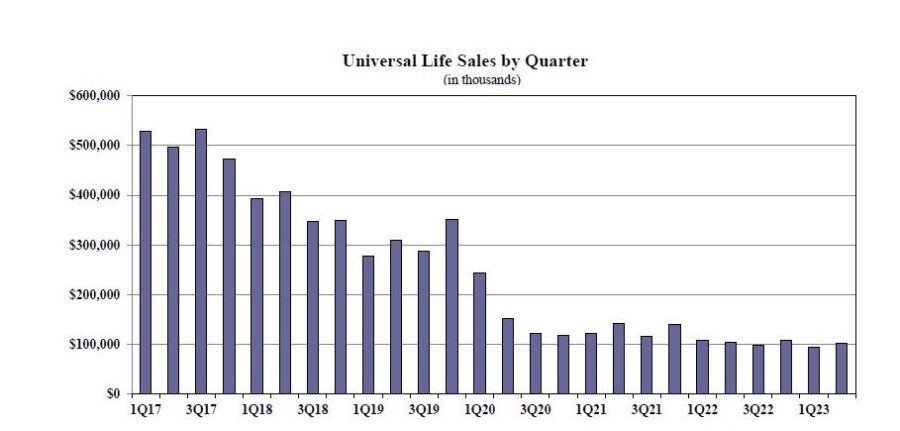

Fixed universal life insurance 'withering'

Fixed UL sales for the second quarter were $101.7 million, up 7.1% compared to the previous quarter and down 2.8% compared to the same period last year. Noteworthy highlights for fixed universal life included the top primary pricing objective of no-lapse guarantee capturing 54.3% of sales. The average UL target premium for the quarter was $5,396, an increase of more than 15% from the prior quarter.

“We’ll be lucky if fixed UL sales break $400 million for the year," Moore said. "This once-superstar product is now withering on the vine.”

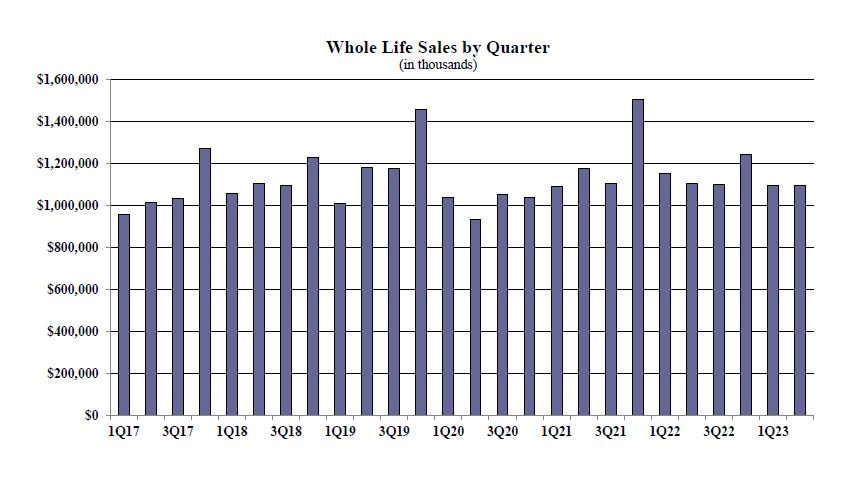

Whole life second-quarter sales were $1 billion, up 0.07% compared with the previous quarter, and down 0.8% compared to the same period last year. Items of interest in the whole life market included the top primary pricing objective of final expense capturing 56.3% of sales. The average premium per whole life policy for the quarter was $4,149, an increase of less than 1% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

The steadfast role of agents and advisors: A Labor Day story

‘Annuity King’ sentencing delayed a month to permit character witnesses

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- Insurer ends coverage of Medicare Advantage Plan

- NM House approves fund to pay for expired federal health care tax credits

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

- Students at HPHS celebrate 'No One Eats Alone Day'

- Bloomfield-based health care giant Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News