Income tops annuity buyers’ reasons for purchase, study says

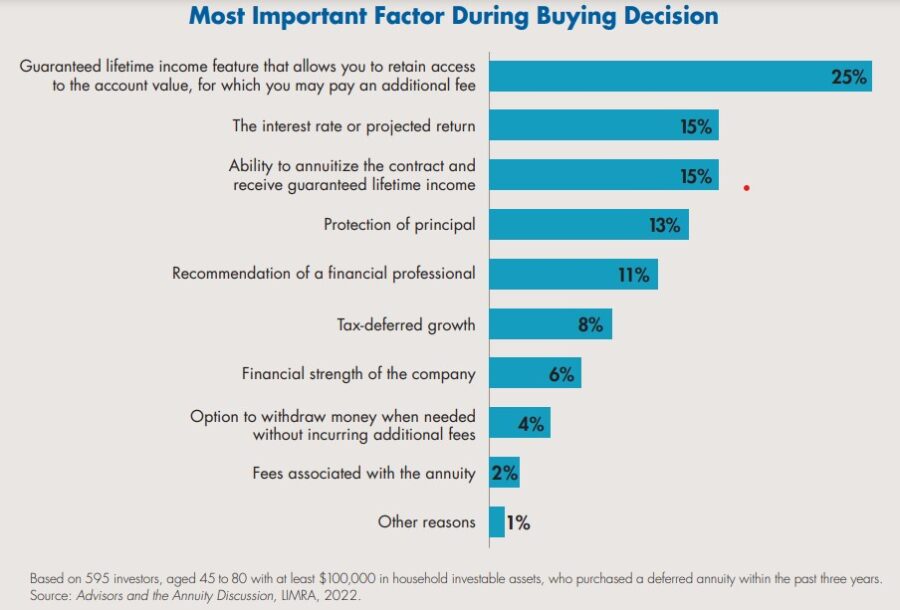

Access to their money and ability to annuitize were the biggest reasons annuity buyers cited for buying their annuities – even more than interest rates and far more than fees, according to a LIMRA buyer study.

The top reason, cited by 25% of 900 buyers, was having a guaranteed lifetime income feature that allowed access to the account value, according to the poll taken mid-2022. One of the next reasons was the ability to annuitize the contract and receive a guaranteed lifetime income, cited by 15%.

Matthew Drinkwater, LIMRA Corporate Vice President, Annuity and Retirement Income Research, noted the top reasons in a report.

“It seems that the income-generation features are understood to be a fundamental, unique aspect of deferred annuities — simply hearing about these features may have led to the purchase,” Drinkwater wrote. “Combined with the other income-related reasons, as many as 44 percent of all buyers prioritize the annuity’s ability to provide various forms of income, via annuitization, lifetime guaranteed withdrawals or other withdrawals.”

He also noted that although 15% of the respondents overall cited the ability to annuitize, that reason was most important to people in the mid-range of assets, with 21% of buyers with $500,000 to $999,999 in household investable assets citing it and 13% above and below that range picking that reason.

Although the COVID pandemic changed attitudes about mortality and security, annuitization has held steady as a leading reason to buy annuities.

“This finding, showing a stronger perceived annuitization value for mass affluent and affluent investors among investors and advisors, has been consistent across LIMRA research studies over the years,” according to the report.

This despite the fact that a “vast majority” of annuity owners don’t annuitize their annuity and instead use the guaranteed lifetime withdrawals or systematic withdrawals, Drinkwater noted.

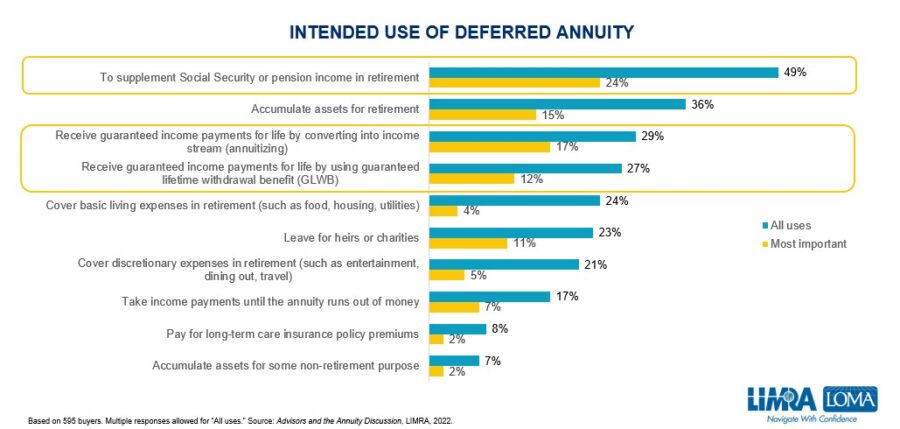

Supplementing retirement income was the clear No.1 intended use for the annuity, by a healthy margin over the next cited use, to accumulate retirement assets. In fact, three of the top four intended uses involved income.

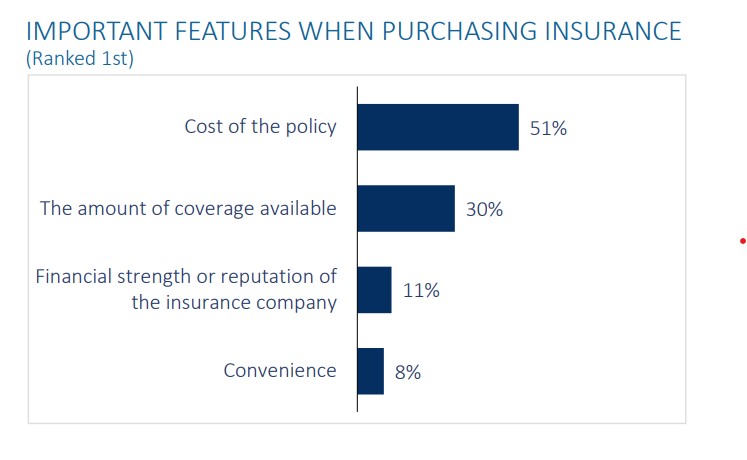

The top reasons for buying an annuity were in stark contrast to why consumers buy life insurance. In a recent Society of Actuaries study conducted by Greenwald Research, the most important feature for life insurance buyers was the cost of the policy for 51% of the respondents.

And although certificates of deposit are usually seen as the nearest competitor to annuities, 23% bought a CD rather than an annuity, but 42% bought a mutual fund and 34% purchased individual stocks instead of an annuity.

Rates, return rule for annuity buyers

One of the other top reasons is good news for the industry – “the interest rate or projected return” was cited by 15% of the respondents. Improved rates have been touted by insurance executives as a key draw for consumers in this unsettled financial environment. Marc Rowan, CEO of Apollo, said in the company’s recent quarterly earnings call that rates were key to generating inflows for Athene, even in challenging times.

“I see this a little bit as the golden age of annuities,” Rowan said during the call. “Consumers simply prefer 5% to 2%.”

“Projected return” was also part of the reason, which shows why illustrations are such an important (and contested) part of the sales process for products such as indexed annuities.

Interest rates, projected return and protection of principal were important to certain buyers, according to the LIMRA report.

“The interest rate or return, and protection of principal, were of major importance for many [annuity] buyers, especially older buyers who likely have more conservative investment allocations and who may be thinking of legacy goals,” Drinkwater wrote. “These factors are likely of increasing importance during a time of extreme market volatility and rapidly increasing interest rates.”

Even with exciting new rates, the products don’t sell themselves. Advisor recommendations were an important role for 11% of the buyers, but the sellers had to work for it.

“Those with established relationships and regular contact with their advisors were more likely than other buyers to have placed advisor recommendations at the top of the list of reasons for buying: 14 percent versus 8 percent, respectively,” Drinkwater wrote. “Older and retired buyers were also more inclined than younger or non-retired buyers to rely on the recommendation of their advisors, possibly reflecting their greater tendency to have established relationships and regular contact with their advisors.”

It is also worth noting that fees were far down the list, with only 2% citing fees as a top buying factor, leading Drinkwater to add that “low-fee products are not necessarily at that much of an advantage and higher-fee products are not at as much of a disadvantage in the purchase process.”

Recrafting marketing, processes

Drinkwater said sellers can use the results to recraft product marketing, along with advisor training and sales processes.

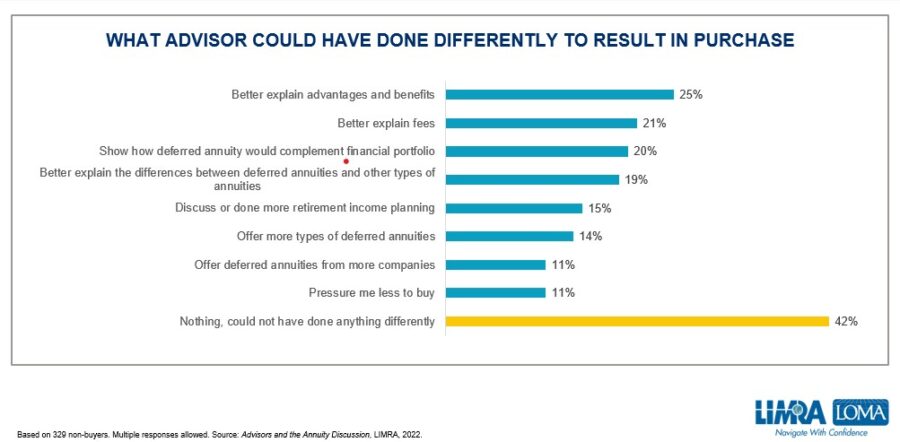

In fact, the top reasons people cited for not buying an annuity tended to be common objections, such as it was not the right time, indicating that potential buyers did not see the value of the product.

Respondents said their advisor should have done a better job explaining the product for them to buy it.

Because income was the overriding factor in purchasing the products, not only can income features be highlighted in marketing material, but they can also be important parts of the sales process.

Drinkwater also suggested that sellers might do well to segment their marketing along the product features – “In particular, intended use will vary depending on the customer’s life stage.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

How insurers can profit amid inflation

Florida man fighting to get back $850K invested with Madoff-style advisor

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News