How To Harness Bias For Retirement Investing

Financial advisors, particularly those working with employer plans, might often be struck by the question of why can’t people think of their future?

The answer is they can’t. Humans are not wired that way, said Jonathan Young, senior national accounts manager at Capital Group. Young discussed the mystery of self-defeating practices as understood by behavioral economics during the firm’s webinar, Misbehavin’ in Retirement Plans, on Tuesday.

“We adapt timing biases, which are essentially survival tactics or strategies that use the lessons of the present -- right or wrong by the way -- to make decisions,” Young said. “So we're going to focus on three of these timing biases.”

Present Bias: The tendency to overvalue the now versus the later. This manifests itself as a preference for smaller short term gains and immediate rewards over longer term rewards.

Procrastination Bias: The human desire to put off until tomorrow the things that they think are too difficult today or the decision they find too challenging to make today.

Compounding Blindness Bias: The inability to grasp that ancient adage that time is money.

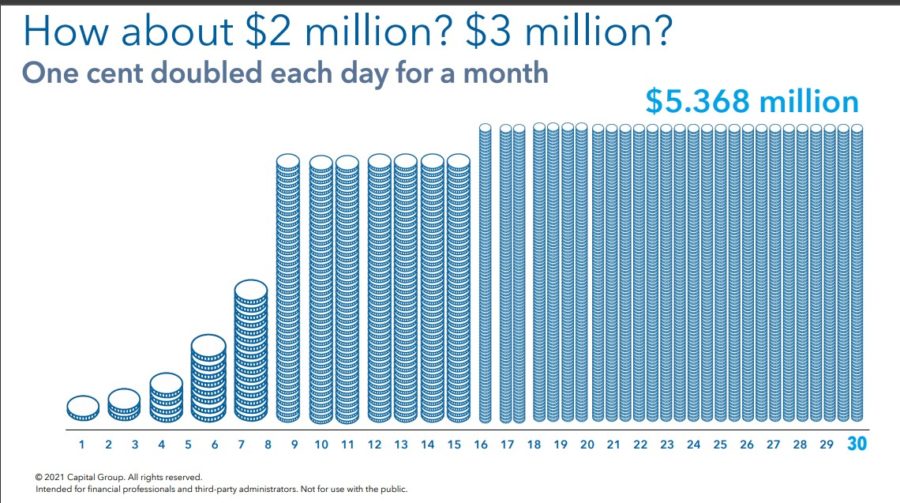

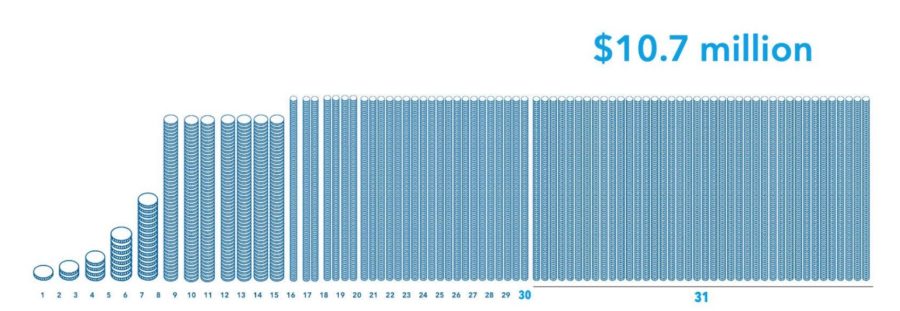

Young used a riddle to demonstrate compounding blindness. Would you choose to take $1 million today or one penny doubled each day for a month?

Many people might choose the million now. After all, how much could a penny double in 30 days?

How about $5.4 million? And how about if you left the money in the compounding machine for just one more day?

This might be an effective, yet familiar, example to many advisors. But something to keep in mind is that if the person chose to start the penny on the second day, that person would have half the money at the end.

“Taken together these behaviors -- ordinary, normal, perfectly natural behaviors -- can be devastating to long-term retirement planning,” Young said. “But there are some ways that we can help manage the situation to control the fallout or better yet prevent bad timing decisions from ever taking place.”

When working with clients and employer plans, the key is automation. True, automating retirement saving is already available and accepted, so what’s the point?

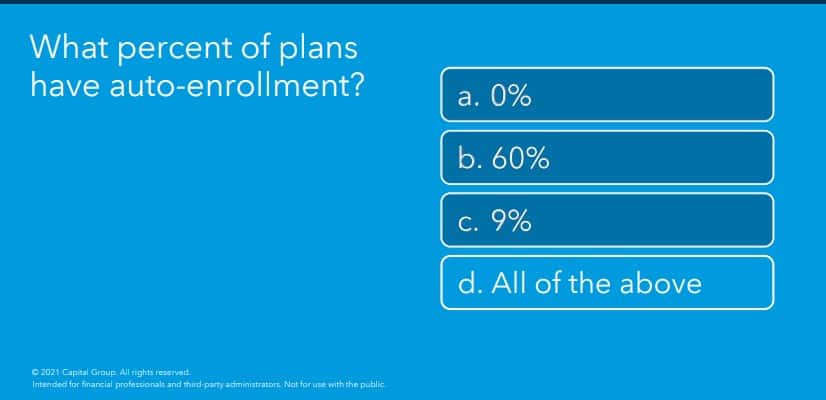

“That may be true in your practice, but statistically speaking, it may not be the norm you think it is,” Young said before adding another question based on data from the Plan Sponsor Council of America's 63rd annual survey: What percent of plans actually use auto enrollment?

All the above, Young said. That’s because 0% of the plans are required to use auto enrollment by ERISA rules.

“And I'm going to suggest that in large part, the vast majority of plans, if not all, would never use auto enrollment we it not for advisors in the retirement planning space helping them see around the corners and think about on the auto enrollment a little bit differently,” Young said.

The study showed that 60% use auto-enrollment but they use it only for new employees. Only 9% of the plans use an annual auto-enrollment.

“I think that's really important because that sweeps all non-participating employees into the plan that are eligible,” Young said of the annual auto-enrollment. “Why is that important? Because this year, I might have a lot going on. I may not be able to financially afford to participate in my plan, but next year things change. And unless I'm prompted to do it, the odds of me doing out going out and doing it on my own are still de minimis when you look at the data. What we're trying to do is allow participants to reaffirm their decision annually to opt out. Let's not let opt-out be a one-and-done decision.”

Why do investors make bad decisions and disrupt their retirement plans? It has to do with attention biases, particularly anchoring, Young said.

Anchoring is attachment to the first piece of information offered, which then informs future decisions.

“Information that aligns with the anchor is accepted and accepted quickly,” Young said. “Information that doesn't align with it is quickly dismissed.”

One example is the 3% auto-enrollment minimum default, which Young said many advisors would agree is too low.

Home bias is the tendency to focus on markets, geographic or otherwise, that are closest or most familiar. Confirmation bias is filtering out all new inputs that don’t align with what the person already believes.

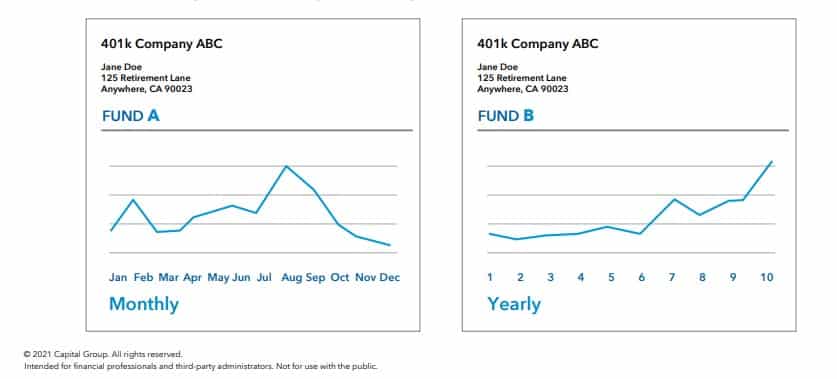

A key way to overcome these biases is through framing. For example, which of these plans looks like the better one?

Plan B looks better at a glance, but they are both the same fund but shown for a different time period, monthly and annually. That is reframing.

After auto-enrollment, the best device to rachet up a person’s retirement contribution is through auto-escalation. But Young said that even though financial professionals know strategies like auto-escalation can be incredibly powerful and can make the difference between a dignified or a substandard retirement, advisors also know that many plan sponsors believe that participants might resist because they might not be able to afford to allocate such a large chunk of their paycheck to retirement savings.

This is where reframing comes in. The chart below shows the impact of auto-escalation over the long term.

The chart shows that not only does the participant end up with $1.3 million more at retirement, but it also reveals the participant can look forward to getting $3,650 per month to make those years a little more golden.

“More each month in retirement income, ladies and gentlemen, is life-saving,” Young said, adding a connection to the anchor bias. “Participants don't seem to care whether we start them at 6% or 3%. The opt out rates aren't that much higher for 6% versus 3%. Auto escalation doesn't quite have the opt out rates that many people think they will. So, we have got to change the anchors to change the frame.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Adaptability Is Key: 5 Tips For Insurance Advisors

Principal Financial In A ‘Good Place To Fight From’ As Competitors Scale Up

Advisor News

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

More Advisor NewsAnnuity News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

More Annuity NewsHealth/Employee Benefits News

- Midland National and North American Announce New Indexed Universal Life Products

- MHS’ Health Equity Program, MHS Serves, Launches Youth Mental Health Partnership

- Tips for filing small business taxes for the first time

- Hundreds rally for expanded health coverage

- All 50 states appear to have lost access to Medicaid portals

More Health/Employee Benefits NewsLife Insurance News

- AM Best Removes From Under Review With Developing Implications and Upgrades Credit Ratings of Mountain Life Insurance Company

- Midland National and North American Announce New Indexed Universal Life Products

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Amalgamated Life Insurance Company Announces Amanda Turcotte as New Senior Vice President, Chief Actuary

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

More Life Insurance News