Principal Financial In A ‘Good Place To Fight From’ As Competitors Scale Up

While in agreement that bigger is better in the retirement plan management world, Principal Financial executives say they feel no pressure to respond to the blockbuster Empower Retirement acquisition.

Empower will acquire Prudential’s defined contribution, defined benefit, non-qualified and rollover IRA business in addition to its stable value and separate account investment products and platforms in a $3.55 billion deal.

Principal executives held a conference call today to discuss its second-quarter financial performance. The first question from analysts referenced how the company would respond to the Empower deal.

Renee Schaaf, president of Retirement Income Solutions, said Principal will continue to "watch the market very closely" for acquisitions that make sense.

"We have good capabilities," added Dan Houston, president and CEO. "We're constantly supplementing those and building on it from a digital perspective. But we think that we've got a really good place to fight from at this point in time."

Principal is remaking its business and in a dealmaking mode. In July 2019, the company acquired Wells Fargo’s Institutional Retirement & Trust business.

Last month, Principal announced that it will stop selling U.S. retail fixed annuities and consumer life insurance products and pursue sales of blocks of those assets already in force. The company will continue selling variable annuities.

Houston conceded the likelihood that its block of fixed annuities stands a better chance of being sold first.

"I think the best way to think about it is we view these as potentially one transaction," he added. "And there's no shortage of interest in these blocks, whether it's the annuity or the life. As you can expect, we are pulling a lot of data together and initiating the process."

Principal said in February it planned a strategic review and appointed two new independent directors as part of a settlement agreement with activist investor Elliott Investment Management. The hedge fund had been pushing the company to explore selling or spinning off its more capital-intensive life-insurance business to focus on its more profitable wealth-management operations.

As part of the new strategy, Principal will also invest in growth areas such as global asset management and retirement businesses in the U.S. and select emerging markets, according to the statement.

Mixed Earnings Bag

Principal operating revenues increased 13.6% year over year to nearly $3.6 billion, primarily due to lower premiums and other considerations, fees and other revenues and net investment income. Total expenses increased 18.8% year over year to $3.1 billion due to higher benefits, claims and settlement expenses as well as increased operating expenses.

Principal reported assets under management of $990.4 billion, up 41.1% year over year.

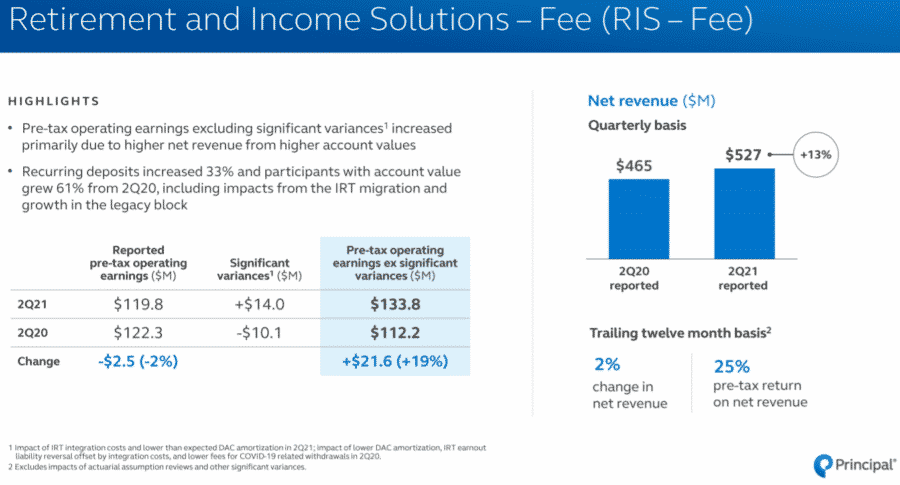

Principal's retirement business (RIS) reported a pre-tax operating earnings decline of $2.5 million as higher net revenue was more than offset by higher operating expenses, including integration costs associated with the IRT business.

Net revenue increased $62.1 million due to higher equity markets and growth in the business.

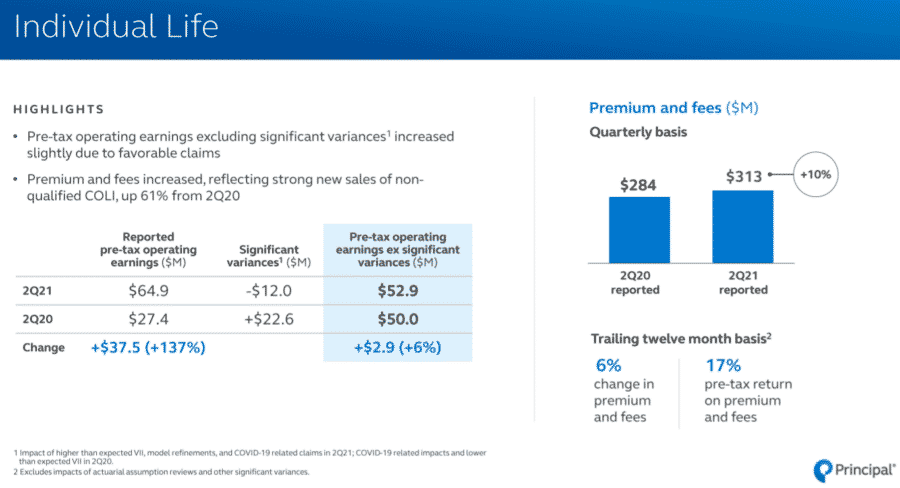

In the remaining life insurance business, pre-tax operating earnings increased $37.5 million primarily due to higher variable investment income and favorable claims. Premium and fees increased $28.1 million primarily due to growth in the business.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

How To Harness Bias For Retirement Investing

Clients Are Relieved To Have Guaranteed Retirement Income, Survey Says

Advisor News

- Tax refund won’t do what fed says it will

- Amazon Go validates a warning to advisors

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

- Tax filing season is a good time to open a Trump Account

More Advisor NewsAnnuity News

- Corebridge Financial powers through executive shakeup with big sales

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

More Annuity NewsHealth/Employee Benefits News

- Arizona faces lawsuit over Medicaid cuts to therapy for autistic kids

- Shenandoah County clinic braces for surge as insurance losses mount

- Medicare and covering clinical trial prescriptions

- EXAMINING THE POTENTIAL IMPACT OF MEDICARE'S NEW WISER MODEL

- Lawmakers hear testimony on Truth in Mental Health Coverage Act

More Health/Employee Benefits NewsLife Insurance News