How Brokers Can Support Overtaxed HR Teams

Americans continue to switch jobs at near-record rates, subjecting employers to a level of turnover that few have ever experienced. As a result, human resource teams that were already spread thin are juggling increased recruiting, onboarding and offboarding efforts and return-to-work planning. All of these leave little time for them to focus on more routine demands such as their benefits program.

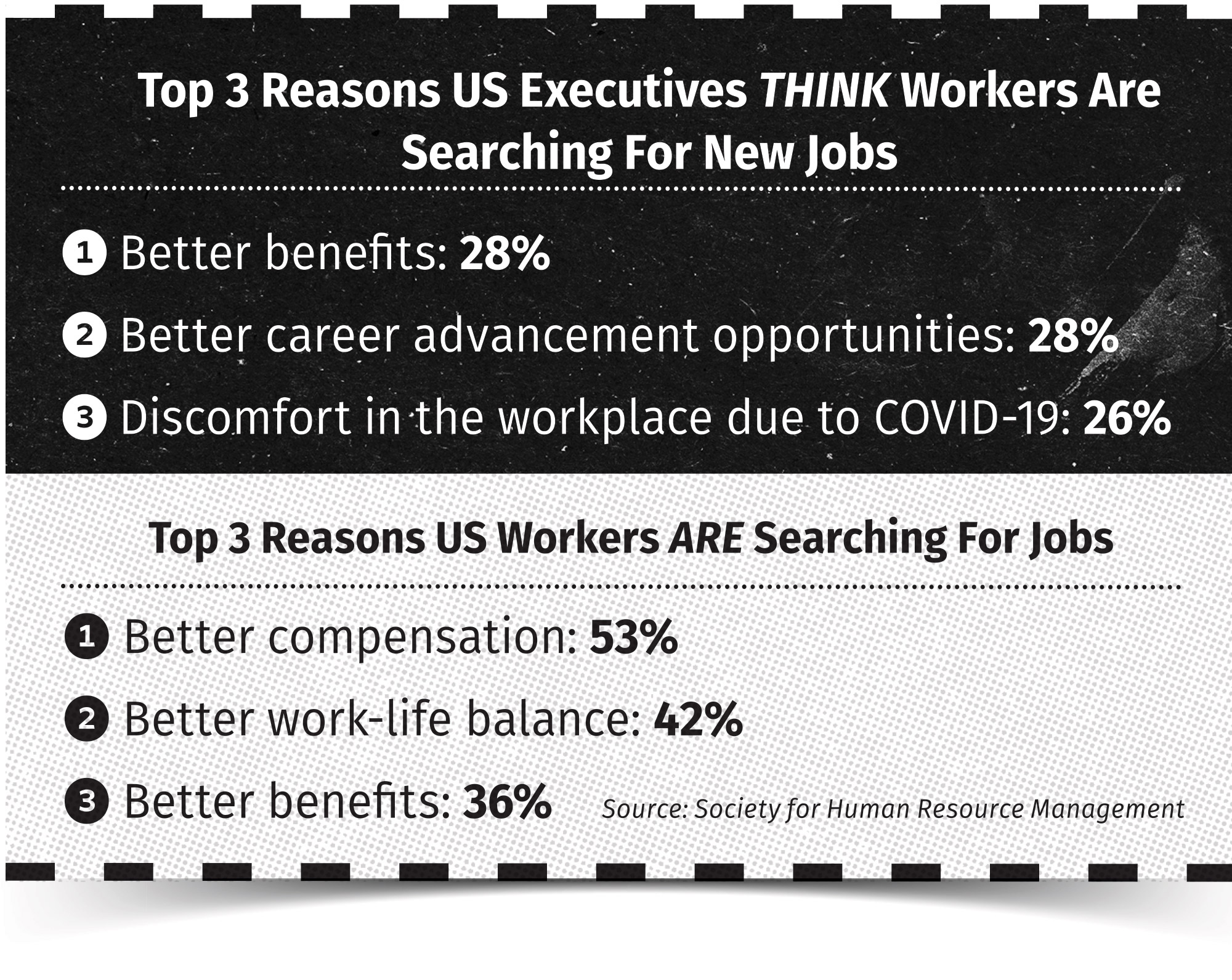

Yet benefits are among an employer’s strongest tools in offsetting the challenges of recruiting and retention: the Society for Human Resource Management reports 36% of employees admit they are looking to switch jobs for better benefits options. It’s critical for employers to make sure employees and prospects are aware of the plans and programs available to them and what role each can play in protecting the individual’s health and financial well-being.

If this sounds like a tall order for HR teams, the good news is that they don’t have to juggle these demands by themselves. Brokers can help either directly or by connecting employers with the right resources to identify meaningful benefits options, communicate those options to the workforce, support employees as they use their benefits, and keep their employer client compliant with current regulations.

To pinpoint how employers can leverage brokers in their benefits programs, DirectPath surveyed health insurance brokers on what services they currently offer and which services they believe deliver the most business value. The findings illustrate how integral brokers are and will continue to be in helping employers develop financially effective benefits programs that support employees’ evolving needs.

Finding Benefits Reflective Of Employees’ Evolving Lifestyles

Employees’ new normal requires new coverage options. The pandemic has given employees a chance to reassess their needs, and they are looking for the same flexibility in their benefits that they want in choosing where they work. This means it’s time for employers to evaluate their benefits package to ensure they offer employees the benefits they need and want. Brokers can help employers determine which voluntary benefits to add to support employees’ evolving lifestyles.

Notably, brokers have witnessed an almost 60% increase in clients adding voluntary benefits in the past year. In the shadow of COVID-19, it makes sense that accident (78%), critical illness (73%) and hospital indemnity (60%) insurance were the most requested additions.

Workers also are looking for benefits beyond medical insurance. In 2021, brokers reported higher demand for pet insurance (28%) than for ID theft and legal protection (20% each), likely due to more employees adopting pets after their roles went remote. Making recommendations for carriers to supply this coverage is also a large part of brokers’ roles, with 55% sharing that they spend more than half their time recommending supplemental carriers to clients.

Of course, these benefits provide little value if employees don’t know how to use them or even that they exist. Considering more than three-quarters of consumers either learn about health insurance terms and concepts from friends and family or are self-taught, employers should plan to educate — or reeducate —workers on how to best choose and use their benefits.

To this end, employers also must provide timely communication materials as they add and update coverage options. Brokers are filling this gap for employers: 95% of brokers report moderate to high demand for help with benefits communications. In addition, most brokers (72%) offer a full range of communications services, including virtual presentations, in-person support and vendor recommendations.

Offering Clarity Amid Confusion And Expense

The current health care landscape can be confusing even for those in the industry, not to mention the average consumer. Employees can quickly rack up unexpected medical expenses if they don’t select the right coverage or use their plans correctly. When employees overspend on care, employers overpay on coverage. And, with pay increases not keeping pace with the rise in health care costs, it’s crucial that employers provide appropriate programs, tools and support for employees’ financial well-being. Considering that the Federal Reserve reports nearly 40% of American adults would not be able to cover a $400 emergency expense, these resources are more important than ever.

Employers rely heavily on their brokers for cost containment (89% of brokers report clients depend on them for this already). While brokers can help employers better understand where their money is going and suggest areas for cost savings, brokers can also help workers be financially smarter with their care selections.

DirectPath’s survey found that 86% of brokers currently provide some sort of health care transparency and clinical advocacy services to help clients keep their health care costs down.

With access to advocates who can help employees shop for care, resolve claims and billing questions, and find providers, employees can feel more confident they are getting the care they need at a reasonable price.

The pandemic is pushing HR teams to their limits, leaving them with reduced bandwidth to create, maintain and promote the benefits programs employees expect from their employers.

Fortunately for brokers, this situation gives them a significant opportunity to support employers in creating plans that attract and retain top talent and in identifying partners to support that talent year-round.

Brokers are and will continue to be an invaluable resource to employees — and employers — in navigating the current health care landscape.

Kim Buckey is vice president of client services with Optavise. Kim may be contacted at [email protected].

You Helped Your Clients Build A Budget — But What About Their Kids?

DI Coverage: Insuring The ‘Golden Goose’

Advisor News

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Long-term care insurance can be blessing

- Solano County Supervisors hear get an earful from strikers

- How Will New York Pay for Hochul's State of the State Promises?

- As the January health insurance deadline looms

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

More Health/Employee Benefits NewsLife Insurance News