Here we go again! DOL proposes new fiduciary rule

With the Nov. 3 publication of the Retirement Security Rule, the Department of Labor embarked on its latest Sisyphean quest to extend fiduciary duty to annuity sellers.

Regulators are expected to spend much of 2024 pushing the metaphorical boulder up the hill to get the rule on the books before the November presidential election.

It remains to be seen whether the rock — or rather, the rule — will ever stay in place. Industry trade associations say they have a line, and a blanket fiduciary standard crosses it.

“The proposal is out of touch with the anxieties of regular people who are worried about savings lasting through retirement, the effect of volatile markets on 401(k)s and the high cost of living,” said Jillian Froment, executive vice president and general counsel for the American Council of Life Insurers.

“Traditional pensions are no longer the norm, and guaranteed lifetime income through annuities lets people create their own pensions. That’s why annuity ownership is up.”

Much like Sisyphus, condemned by the Greek gods to suffer repeated failure, the DOL cannot seem to get its fiduciary rule to stick. In 2010, the department withdrew its initial rule after widespread criticism. Its 2016 follow-up rule was tossed out by a federal appeals court two years later. Even the 2020 replacement rule, while it avoided the word “fiduciary,” was opposed by the industry and bested in court earlier this year.

Yet, despite these setbacks, the DOL is seemingly emboldened, pairing the current rule package with an aggressive attitude. President Joe Biden held a White House press conference to denounce so-called junk fees that accompany annuity sales, words that make industry executives bristle.

“Referring to legitimate compensation many advisors receive for their work as ‘junk fees’ is insulting and unfair,” said Kevin Mayeux, CEO of the National Association of Insurance and Financial Advisors. “It disregards the fact that many consumers are best served by models that include products delivered on a commission basis.”

Continuing its aggressive stance, the DOL quickly rejected appeals to extend a 60-day comment period for the rule. With previous fiduciary proposals, the DOL held longer comment periods and granted extensions.

From where does this confident obstinance stem? The answer might be that regulators are playing the long game. After all, many distributors and producers drifted toward fiduciary delivery during the brief time the 2016 rule was in effect. Most of them did not abandon the new compliance regimes.

‘All the way to the Supreme Court’

Even if the department loses in court again, the current rule proposal might be in effect for years before it is overturned, noted Fred Reish, partner at Faegre Drinker Biddle & Reath.

“It is entirely possible that this will go all the way to the Supreme Court,” he wrote recently. “In that case, advisors and agents, insurance companies, broker-dealers and investment advisors will have been covered by and in compliance with the new rules for several years.”

Whether this version of the fiduciary rule survives or dies will likely come down to two words: “trust” and “confidence.”

In its 2018 decision, the Court of Appeals for the Fifth Circuit ruled that the 2016 fiduciary rule strayed too far from the common-law definition of the term fiduciary, which hinges on the existence of a relationship of “trust and confidence” with the client. Agents who merely sell products to their clients do not have this relationship, the court concluded.

So this became the hurdle that the fiduciary rewrite must clear. Regulators acknowledged this in the rule preamble: “The current proposal bases investment advice fiduciary status on circumstances that indicate the retirement investor may place trust and confidence in the recommendation as a professional recommendation based upon the particular needs of the investor.”

It might come down to convincing one judge to accept this argument. Opponents only needed one judge in the 2-1 Fifth Circuit decision. Brad Campbell, partner at Faegre Drinker and former assistant secretary of labor under President George W. Bush, does not accept the DOL’s explanation.

“Though paying lip service to the Fifth Circuit, declaring the new proposal to be more narrowly tailored, the reality is that the new standard would deem many recommendations to be fiduciary advice that the [court] ruled Congress did not intend to capture,” he told InsuranceNewsNet.

The big changes for everyday agents

At nearly 500 pages, the DOL’s new fiduciary rule package is more than weekend reading material. Regulators propose a host of small and big changes to plug what they say are significant gaps in the financial advice business.

“Financial advisors should put savers’ best interests first and not sell them lower-returning products in order to maximize their own fees,” said Lael Brainard, director of the National Economic Council. “When a retirement saver pays for trusted advice that is actually not in their best interest and comes at a hidden cost to their lifetime savings, that’s a junk fee.”

Here are three areas of proposed change that every producer selling annuities should know.

One-time sale will be fiduciary advice. This is the heart of the proposal, a change in what constitutes fiduciary advice from the five-part test to cover much-broader rollover recommendations. Conceived in 1975, the test is used to determine fiduciary status.

Under the five-part test, a person is a fiduciary only if (1) they render advice as to the value of securities or other property, or make recommendations to invest, purchase or sell, (2) on a regular basis (3) pursuant to a mutual agreement, arrangement, or understanding with the plan or a plan fiduciary that (4) the advice will serve as a primary basis for investment decisions with respect to plan assets, and that (5) the advice will be individualized based on the particular needs of the plan.

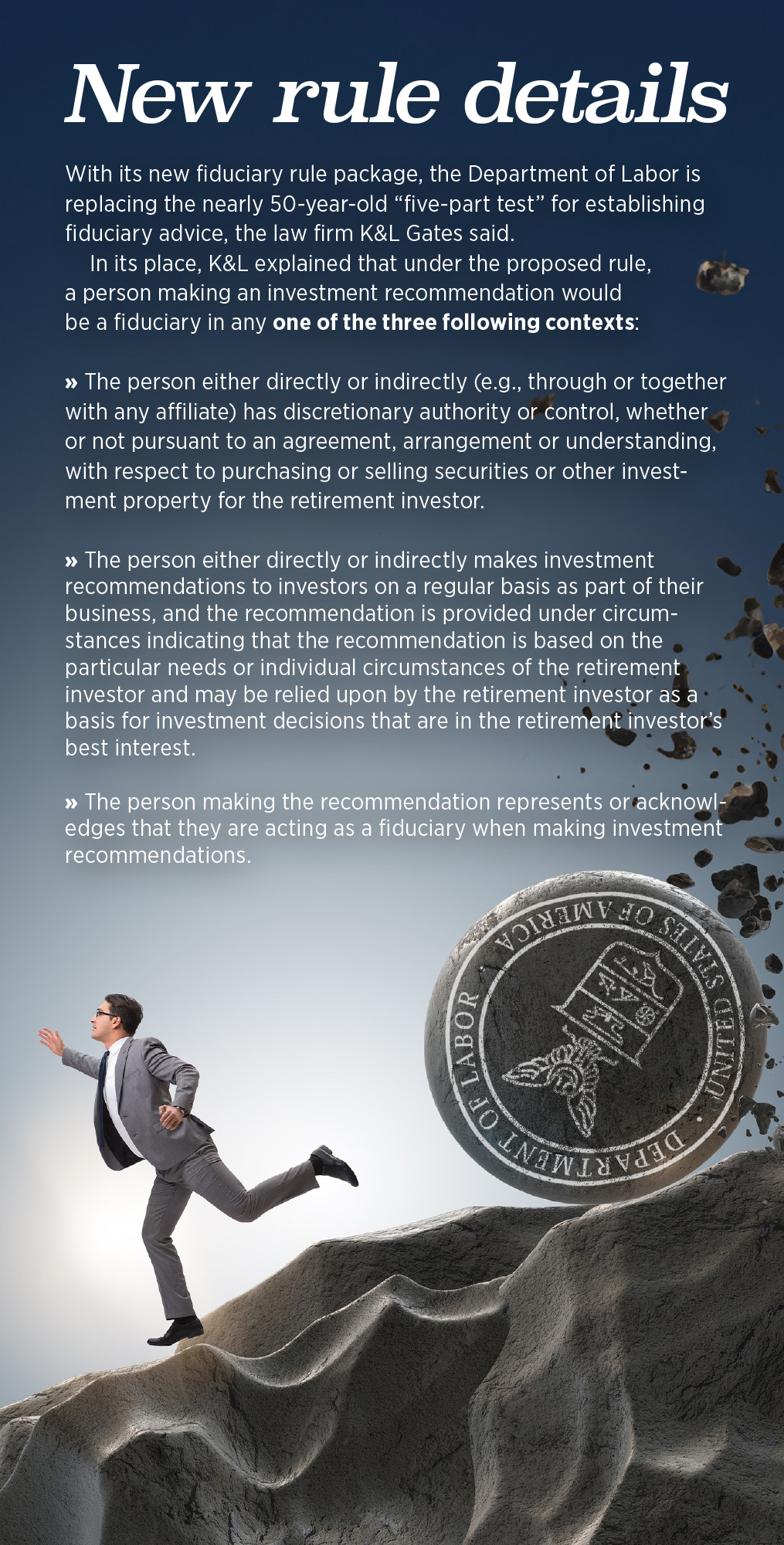

“According to DOL, the five-part test as applied to the current marketplace fails to capture many circumstances in which investors reasonably believe they are receiving advice from a fiduciary,” the law firm K&L Gates said in a client alert.

The rule proposal would eliminate the “mutual understanding” and “regular basis” concepts present in the test. In place of the five-part test, the new rule establishes three contexts in which a person would be a fiduciary by meeting any one of them.

This language opens the fiduciary gate: “The person either directly or indirectly makes investment recommendations to investors on a regular basis as part of their business.”

“The change from the five-part test’s ‘regular basis’ prong to persons providing investment recommendations ‘on a regular basis as part of their business’ would accomplish DOL’s goal of making one-time advice, such as rollover advice, covered by the fiduciary standard,” K&L Gates wrote.

Prohibited Transaction Exemption 2020-02. This exemption was part of the 2020 replacement rule developed by the Trump administration DOL and permitted to take effect by the Biden administration.

PTE 2020-02 expanded the definition of a “prohibited transaction” under retirement plan law to include any recommendation for rolling over 401(k) assets into an IRA (or from one IRA to another) when doing so would increase the compensation for the advisor.

To qualify for an exemption to this rule, advisors must comply with DOL’s Impartial Conduct Standards requiring advisors to provide prudent investment advice, charge only reasonable compensation and avoid misleading statements.

The DOL wants to push more producers into PTE 2020-02, analysts say. The exemption would be expanded to cover certain transactions involving pooled employer plans and transactions involving “pure” robo-advice providers, K&L Gates explained.

In addition, the proposed amendment includes changes and clarifications regarding the exemption’s conditions, such as clarifications regarding the fiduciary acknowledgement requirement and a new requirement to provide a written statement of the best-interest standard of care owed by the investment professional to the retirement investor.

“If the proposed amendment is adopted, financial institutions relying on PTE 2020-02 may need to amend their client disclosures and make changes to their policies and procedures,” K&L Gates wrote. “Also, because the proposed rule broadens the definition of who is an investment advice fiduciary, more parties may need to rely on PTE 2020-02.”

Prohibited Transaction Exemption 84-24. Independent agents relying on PTE 84-24 to get paid commissions are in for the biggest change, and this will be the biggest fight, Reish said.

And it all comes down to compensation. In its bid to mitigate conflicts, the DOL is very narrowly restricting how independent agents can get paid, Campbell explained.

“The whole purpose of an independent agent is to be independent; therefore, they can’t be controlled by that carrier to the same extent,” he said. “But that also means that it’s harder for us, DOL, to know that someone’s watching their conflicts and properly mitigating them. So, instead of giving broader latitude in compensation, we’re going to narrowly define what it is.”

DOL regulators have long wanted to ban questionable incentives like trips and other bonuses given to producers who hit annuity sales goals. As a result, many of those practices have gone away. The new rule would further streamline compensation.

The only permissible compensation would be the upfront commission, the renewal fee and any trailing fees, Campbell noted.

“No other form of compensation of any kind is permitted under the exemption,” he said. “That means no marketing support payment [and] a whole variety of different incentives that are typically present in insurance sales relationships.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

The IRA Whisperer — With Denise Appleby

Most Americans considering a financial resolution for 2024

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- EDITORIAL: Eliminate CON Laws, lower healthcare costs

- Thousands in CT face higher health insurance costs after federal subsidies expired at start of 2026

- Medicaid agencies stepping up outreach

- With Obamacare’s higher premiums come difficult decisions

- U.S. Federal Minimum Wage Remains Flat for 16th Straight Year as Billionaires’ Wealth Skyrockets

More Health/Employee Benefits NewsLife Insurance News