Help employers provide workers with benefits they actually want

In the past few years, the labor force has been significantly bolder about stating their wants and needs at work. Plenty of changes in professional environments have proved this to be true. More options in terms of remote work, flexible hours and unique benefits have given workers more fluidity and negotiating power with employers. Employers are becoming more aware of the extra effort they must put into improving the employee experience and retaining top talent.

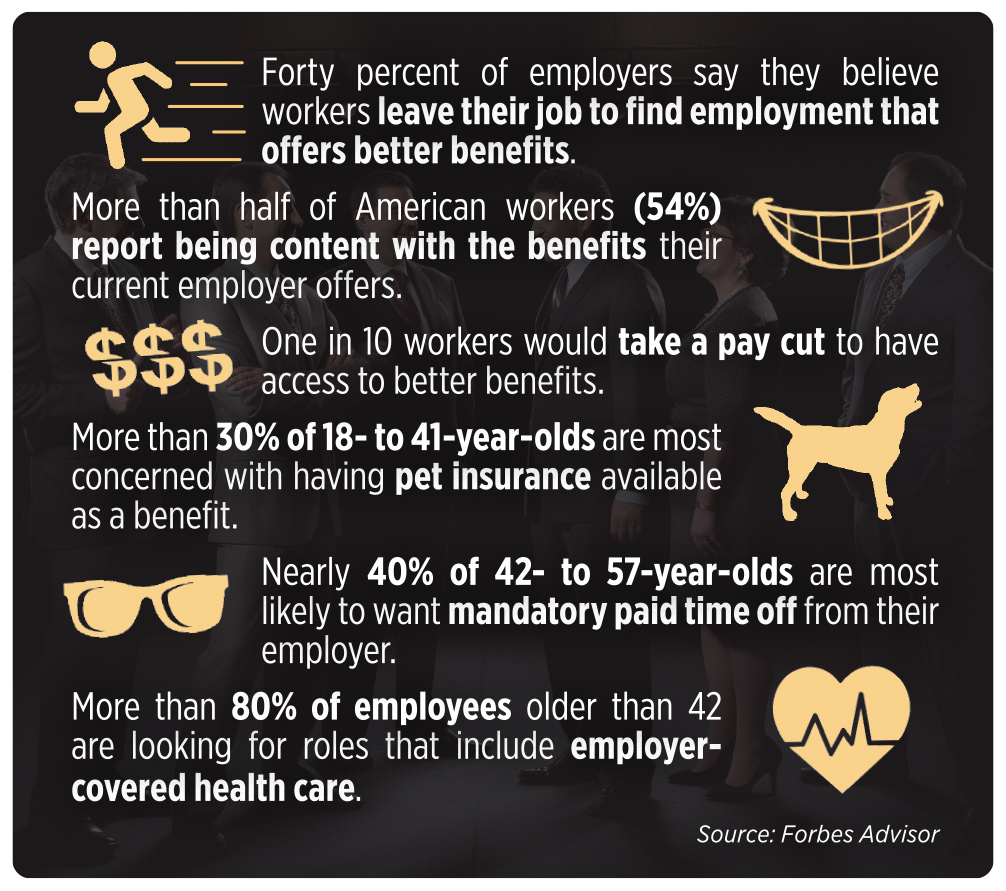

Employees have come to expect several workplace benefits as standard. These benefits include health insurance, life insurance, 401(k) plans and paid time off. However, to remain competitive in this changing work landscape, companies must start thinking outside the box and offering more unconventional and enticing benefits if they hope to attract and retain top-notch employees. If your employer clients are not making changes now, their employee retention rates will be impacted.

Nontraditional employee benefits

When we think of nontraditional or unconventional benefits, our minds may jump to pingpong tables in the break room or Fridays when people are permitted to wear jeans. However, the unconventional benefits that employees actually want likely go beyond these surface-level office perks.

You and I both know that no one stays with an organization because of a pingpong table. The new world of employee benefits taps into what employees truly care about: work/life balance, a positive work culture, and health and wellness needs.

The new benefits that companies can offer their employees are limited only by creativity. Some unusual benefits that companies have tried include pet-friendly offices, vacation stipends, nap rooms and coverage for fertility treatments. Many nontraditional benefits, such as gym memberships and subscriptions to mindfulness apps, speak to higher demand for attention to employee wellness and sound mental health.

To remain competitive in this shifting workplace, companies must consider these nontraditional benefits or run the risk of falling short of employee expectations and losing talent to more forward-thinking companies.

What do employees care about?

The number of Generation Z workers is growing. By 2025, approximately 27% of the workforce will be Gen Z, according to the World Economic Forum. This generation has upended the workplace.

Whereas the millennial generation placed a strong emphasis on recognition and finding meaning in their work, Gen Z was raised on technological advancements. They are more demanding and more aware of the benefits that come from tech, a healthy work/life balance and remote work options. These are workers who have taken online classes in college, know how to run a business from their phones, and understand the concept of self-care.

Gen Z also strongly cares about having a positive impact, refining their skill sets and facing challenges head-on. They are a “work hard and play hard” generation that values and prioritizes mental wellness, and they are also incredibly “plugged in.” Catering to this rising generation requires that companies first understand that the workforce is changing, and then take steps toward meaningful actions that speak to those changes.

Giving these tech-savvy and self-aware Gen-Zers what they expect can solidify the company’s relationship with those workers and garner the best work from them.

Offering unique benefit packages along with the standard benefits that all employees expect is a win-win for both employee and employer. Businesses will get the most loyalty and productivity from employees who have a high level of job satisfaction — job satisfaction that comes from good pay and great benefits.

Both millennials and Gen Z highly value flexibility, a value that became apparent to employers during the pandemic. While remote work existed before the pandemic, the stay-at-home orders (and the rise of cloud computing and videoconferencing) drove home the point that most jobs could stand to be far more flexible and still remain productive. Companies offering hybrid or remote positions as a benefit are likely to be successful in attracting top talent.

The days of employees staying with a company through thick and thin their entire working lives are almost completely gone. In most jobs, the golden ticket of old — a pension — no longer exists. Companies will have to sweeten deals in order to retain a generation of workers who see no issue with being transient in search of better opportunities.

The impact of better benefits

Companies that place a strong emphasis on employee engagement and a wide array of benefits hold the best retention rates. Companies that believe the bare minimum in benefits should be acceptable and thereby foster a culture of low morale and a toxic environment are likely to see their bottom line plummet as their employees hit the road.

Companies that have pivoted heavily into employee retention programs through beefing up their benefits packages have reaped significant rewards. One example, Charles Schwab, offers incredible financial-based benefit packages to their employees, including a robust bonus plan and complimentary financial advisors.

Buffer, a social media management company, holds an impressive 94% employee retention rate. They have laser-focused on creating a “fulfilling” work environment that includes sabbaticals, free books and remote work options.

These companies and others that rode the wave of changing employee expectations have found that staff productivity and, in turn, profits have continued to climb. This illustrates the positive impact of a robust benefits system, especially one that includes some nontraditional options.

Selling the idea of the nontraditional benefit

When approaching companies with benefits packages, you will want to show them the numbers on how these packages — along with nontraditional choices — positively affect their bottom line. Decision-makers want numbers and statistics that show how offering employees what they ultimately want helps the company.

As more attention is paid to how the workplace is changing and how employee wants and needs are shifting, companies will seek out benefits experts with something different to offer. They will want benefits specialists who are aware of the nontraditional offerings that elevate benefits packages beyond health insurance or a 401(k). Benefits specialists must make themselves aware of and study the countless options out there so they can educate and guide employers on how to best entice and retain talent.

There is no denying that the landscape of work looks radically different than it did even five years ago. Employees and job seekers have a lot of bargaining power with employers, more than they ever had before. Employers who are looking to keep their retention numbers high and thrill their employees will need to consider “outside the box” benefits to meet the needs of this new world of work.

Logan Mallory is the vice president of marketing at Motivosity. He may be contacted at [email protected].

Explaining the nuances of annuities to clients

Will AG 49-B be a May Day or meh day for IUL illustrations?

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- CATHOLIC UNIVERSITY IN ILLINOIS STILL COVERS 'ABORTION CARE' WITH CAMPUS INSURANCE

- Major health insurer overspent health insurance funds

- OPINION: Lawmakers should extend state assistance for health care costs

- House Dems roll out affordability plan, take aim at Reynolds' priorities

- Municipal healthcare costs loom as officials look to fiscal 2027 budget

More Health/Employee Benefits NewsLife Insurance News