Help Clients Understand And Own Their ‘Enough’ Number

One of the great gifts you can give to your clients is helping them determine the right amount of life insurance.

Most clients have a basic understanding of the purpose of life insurance. However, almost none of them could tell you what’s the right amount of life insurance.

They have never been brought through a thorough planning process. If they bought life insurance outside of their group benefits, it was most likely a roundabout number, such as a $100,000, $200,000 or $500,000 policy.

When I was a life insurance agent, I would ask clients how much coverage they had, and they often would reply “a $100,000 policy” or something close to it. I would then ask them why they had that amount, and they would say, “I don’t know” or “That’s what my agent told me to buy.” It was just a number that sounded good!

The reality is that you give your clients a tremendous gift by helping them understand exactly how much life insurance they need. There is no single universally correct amount of life insurance that works for everybody. The right amount of life insurance is whatever amount is needed to accomplish what’s important to your client — you’re there to help them figure it out.

Calculating Your Client’s Life Insurance Needs

When working with clients, I would explain that basic life insurance planning is broken down into three components:

1) Debt elimination.

2) Paying for education.

3) Income stream replacement.

There are other uses as well, such as philanthropic needs, family foundations, estate tax planning and so on. But the three components I listed are the ones that apply to most people.

Before getting started with a client, I would remind them of all the areas that the plan will not cover, such as home repairs, new cars and family vacations. The client needs to understand that even if they address these three core components, their family will still have to make tremendous sacrifices if the client doesn’t make it home tonight.

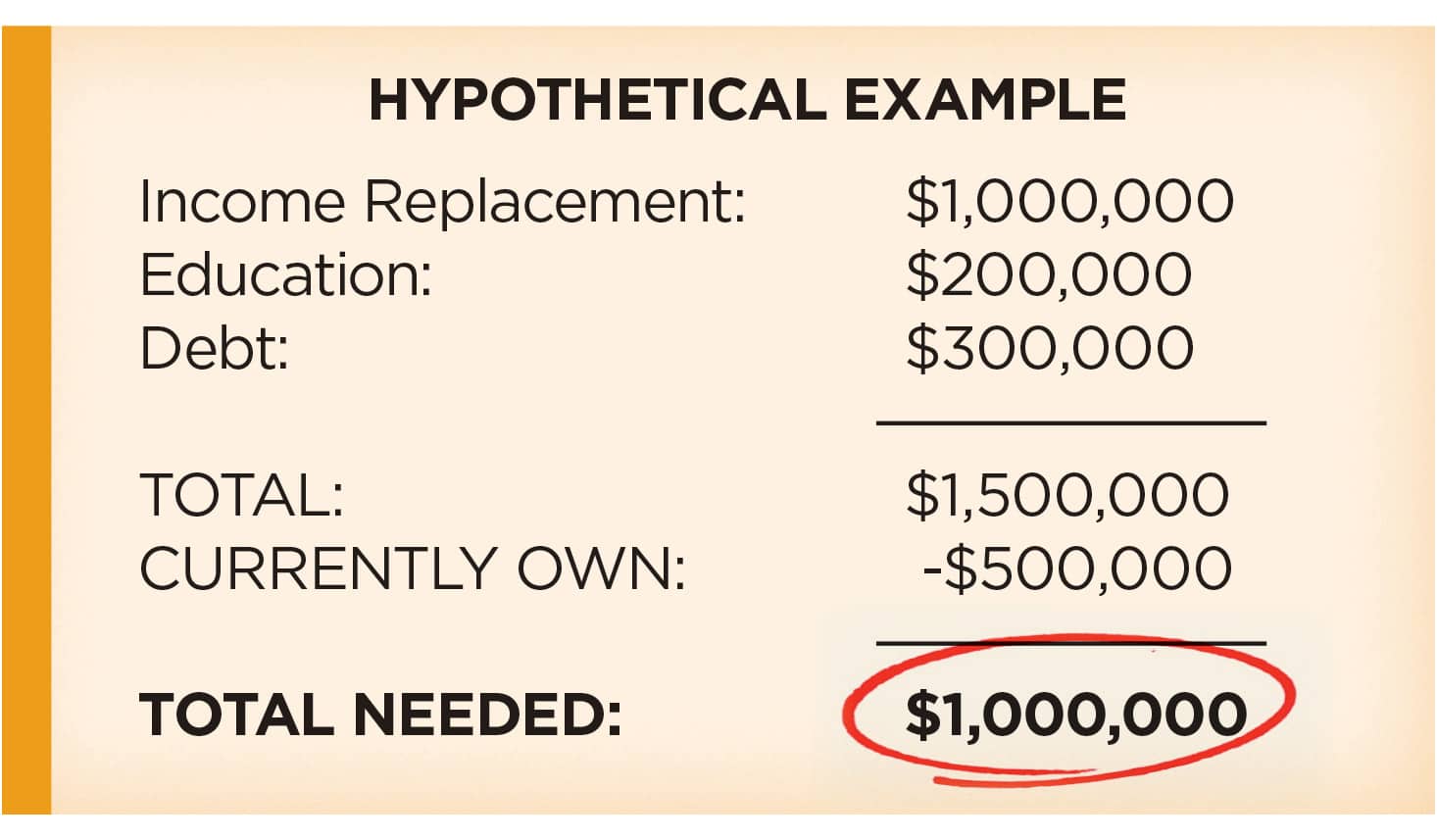

As a hypothetical example, let’s say $300,000 is what would be needed to pay off all the debt. Second, the client wants $25,000 in today’s dollars per year for four years for each one of their children. I will subtract out what they already have set aside for college savings and let them know the net present value to fund the future college costs.

Then I will repeat to them the income replacement need that they stated to me. For example, “Mr. Prospect, out of the $10,000 a month that you’re currently living on today, you mentioned that if your mortgage were paid off, you want $7,500 a month for your wife until she’s 65 years old. Then, you would want $5,000 a month in today’s dollars until her life expectancy.”

Next, I will show the client a single number, the net present value, of how much money needs to be set aside for income replacement. Then I’d add the net present value for education, and I add in their debt.

The three numbers added together make up the total capital required to meet the client’s income, debt and education goals if the client were to die today.

Finally, I would subtract from that number the amount of coverage the client currently has through work and has bought on their own. The difference is what they need. Below is an example of how we reached those numbers.

Responding To Your Client’s Feelings And Concerns

Here is one of the most important steps that many advisors miss: checking in with their client to see how they feel about their number.

Using the example above, I would say to my client, “Based on what you’ve told me and what we covered, $1 million is the number required to satisfy the objectives we discussed. Before I go any further, how do you feel about that number?”

How your client answers that question is going to determine the next steps. For instance, they may say, “That makes a lot of sense. Although I’m not excited about the additional expense, I believe that you’ve done a good job and that’s the number I need.”

That happens only about 5%-10% of the time.

The other extreme is someone who says, “I’m not going to buy more life insurance. I have ‘X’ amount at work and ‘X’ amount on my own. I’m fine.”

This is where you need a good enough relationship with your client to say:

“My job today is not to tell you what amount you need to buy. My job is simply to ask good questions, listen and then use my systems and planning materials to tell you what you need. So having said that, the numbers are what the numbers are.

“You can calculate these numbers six ways to Sunday, but based on what you currently have and what you told me your objectives were, $1 million is the amount you need. We don’t have to do that amount, but my job is to help you home in on what the right amount is first.

“Before we go any further, let’s go back to the debt, education and income replacement numbers and figure out where you feel comfortable lowering them.”

Then you must be quiet.

Clients typically do not want to reduce the education amount or give their spouse less income. I also would say, “I can understand and appreciate your hesitancy to own this number. A million dollars is a lot of money for most people, but let me share what I think is really important in my practice as it relates to life insurance proceeds.

“My job is to help you create a bucket for a fund that dictates your family’s future for the rest of their lives. The opposite bucket that most people think about is called a windfall profit. In other words, if you are healthy and working and you were to win the lottery, $1 million would be a huge win. You would throw a big party, and that would be a great feeling.

“However, if I were to walk in today and give you a check for $1 million, but in order to cash it, you had to sign in blood that you would never work another day the rest of your life, how would you feel about that?”

Most people say they never would cash that check. That’s when I’d say, “Exactly. But if, God forbid, you don’t make it home tonight, and your spouse gets a check from the insurance company, your spouse will be in the first bucket. It’s a much different bucket than the one of windfall profit.”

Finally, I let my clients know that if they don’t smoke and they’re in good health, term life insurance is relatively cheap. If we go the least expensive route, term life insurance probably costs less than what they pay for car insurance. They shouldn’t get too hung up on the total number. At last, we can take a deep breath, and the client will feel much better about what they’re doing.

By the time you conclude your discussion, both you and your prospective client should be in sync knowing the exact amount they need to buy to accomplish what’s important to them. Simply by taking them through this process, you already will have delivered tremendous value to your client and demonstrated your professionalism to them.

Although the client might not be doing cartwheels over their life insurance purchase, they understand it and they own it. This then paves the way for the next conversation on the different types of life insurance available and what would be the best fit for the client.

Jim Effner is a financial services speaker and trainer with more than 30 years of experience who is dedicated to helping advisors master their sales skills and grow their practices. He is the author of Bridge Your Gap and the creator of P2P Academy. He may be contacted at [email protected].

Annuity Sellers Face Rolling Economic Headwinds

Health Savings Accounts: Don’t Leave FICA Savings On The Table

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- SENATOR ALVORD PUSHES BACK ON CONSTANT COST INCREASES OF HEALTH INSURANCE WITH FULL BIPARTISAN SUPPORT

- Queensbury details exemptions to lower property tax

- Expanded Affordable Care Act subsidies – now expired – drove major increases in marketplace health insurance enrollment across key groups: Johns Hopkins Bloomberg School of Public Health

- New Insurance Study Findings Have Been Reported from University of South Carolina (Brokering a new path: navigating administrative burdens in the health insurance Marketplaces): Insurance

- Medicaid disenrollment spikes at age 19, study finds: University of Chicago

More Health/Employee Benefits NewsLife Insurance News