Health Savings Accounts: Don’t Leave FICA Savings On The Table

The Federal Insurance Contributions Act, commonly referred to as FICA, is likely not a new term for most clients. At the highest level, they know it’s a payroll tax applied to both employees and employers. Barring a few exceptions, the FICA deduction comes out of each employee paycheck, and employers share in FICA by paying a matching deduction to the amount each employee is taxed.

But when it comes to clients’ understanding of how setting up a well-structured health savings account program can save them and their employees substantial money in FICA taxes, a knowledge gap sometimes exists, causing clients to dismiss altogether the idea of setting up an employer-sponsored HSA program. They simply don’t see the value in HSA program FICA savings.

Clients frequently are either misinformed about or unaware of the ins and outs of how saving on FICA taxes through an HSA program works — not to mention the many other benefits they and their employees are missing out on without an employer-sponsored HSA program.

A Little Education Goes A Long Way

When it comes to discussing HSA program FICA savings with clients, things can get confusing quickly. It usually helps to start off with a little FICA and HSA program education.

First, clients must understand that the current FICA tax rate for both them and their employees is 7.65% each. Clients are responsible for matching each of their employees’ FICA tax liabilities based off their gross taxable wages. So in essence, the total FICA tax is 15.3% for each employee/employer combination.

Now for a little HSA program education.

An employer-sponsored HSA program provides a savvy way for employers and employees to decrease their FICA tax liability and collectively save 15.3% that would otherwise be subject to FICA tax.

How? By setting up an HSA program as part of the client’s Section 125 cafeteria plan benefit offering.

This is a critical point both brokers and clients must be crystal clear on — clients can benefit from FICA tax savings only through an HSA program set up through a cafeteria plan, which provides employees with an easy way to make pretax HSA contributions through payroll deductions.

The pretax payroll deductions reduce the amount of income that applies to FICA taxes on the employee side, and, in turn, clients directly save the 7.65% on any pretax employee contributions made through their HSA program.

Use Examples To Help Clients See The Savings Potential

Once clients receive some basic FICA and HSA program education, providing real-world examples of FICA savings potential can often help them see the true value setting up an HSA program offers.

A client with 50 employees sets up an HSA program in which each employee contributes $2,000 a year to their HSA through pretax payroll deductions. Through those contributions alone, the client will save $7,650 in FICA taxes annually. The FICA savings more than offsets any cost of offering the HSA program. If they pay $2.50 per account per month, or $1,500 annually, they still save $6,150 each year.

When FICA savings are combined with the premium savings a high-deductible health plan typically offers versus traditional health plans, clients of all sizes and scopes can come out well ahead by offering an HDHP paired with an HSA program.

More Employee HSA Contributions, More Client FICA Savings

When it comes to maximizing client FICA savings through an HSA program, the more employees contribute to their HSA pretax, the more the client stands to save. Simply put, client FICA savings potential is tied to how well their employees engage with and use their HSA program.

Educating clients on HSA program FICA savings and getting them to find value in and consider creating their own HSA program is excellent; however, it’s equally important to connect clients with the right HSA partner that can help them build the best HSA program for their business and proactively engage employees from the start to deliver maximum FICA savings.

Looking Beyond FICA Savings

Beyond FICA savings, with a solid understanding of how an HSA program works and benefits both them and their employees, clients can leverage their program as a powerful recruitment and retention tool.

By offering an HDHP option with an accompanying HSA program, clients make it easy for their employees to save money on insurance premiums and taxes while better controlling their health care costs in the short and long term.

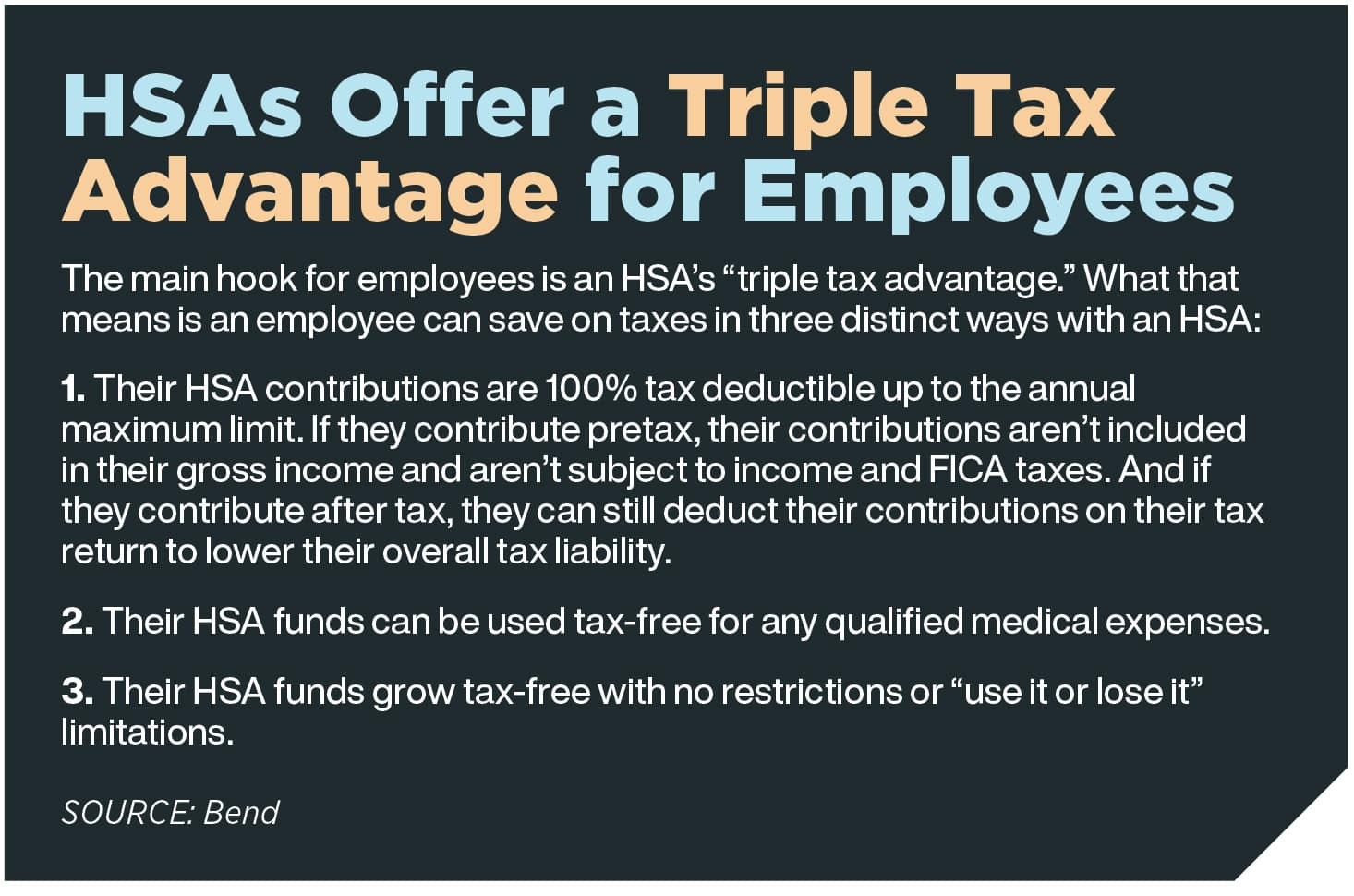

HSAs are also one of the only tax-advantaged accounts that both lower an employee’s overall taxable income while simultaneously offering the added financial benefit of lowering their FICA tax liability. Even pretax 401(k) contributions and “before-tax” IRA contributions are still subject to FICA taxes. Helping clients understand that concept alone — so they can help their employees understand it — can lead to win-win benefits, including a happier, less financially stressed workforce.

The Right HSA Partner Can Help Maximize FICA Savings And More

Connecting clients to the right HSA partner is a must, because not all HSA vendors are created equal.

Clients (and brokers) stand to benefit most from working with a provider that specializes in HSAs and has thoughtfully designed their experience — everything from program implementation and enrollment to ongoing administration, resources and tools — to make HSAs easy for everyone while maximizing HSA benefits, including FICA savings.

When clients get quick integrations, administrative automations, a proactive platform that delivers proven results, resolution-focused support and the other features the right HSA partner can provide, they save themselves and their employees time, money and headaches.

As HDHPs and HSAs continue to rise in popularity and use, building relationships with the best HSA providers and creating the right client-vendor connections will become more critical to saving clients money and keeping them on the leading edge of benefit offerings.

Tom Torre is CEO of Bend Financial. He may be contacted at [email protected].

Help Clients Understand And Own Their ‘Enough’ Number

Women’s Increasing Wealth Means More Need For Planning

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Millions of Texans could face higher costs for worse health insurance

- OUR VIEW: Health care is missing its foundational mark

- My Spin: What if the state health plan goes broke?

- Plainfield Mayor Addresses "Misinformation" Regarding Retired Firefighers' Health Benefits

- Senator files bill to "Empower Texans with Health Care Transparency and Shopping Incentives"

More Health/Employee Benefits NewsLife Insurance News

- 10 reasons we must embrace the Northwestern Life Insurance building in Minneapolis

- AM Best Revises Outlooks to Stable for Lincoln National Corporation and Most of Its Subsidiaries

- Aflac Northern Ireland: Helping Children, Caregivers and the Community

- AM Best Affirms Credit Ratings of Well Link Life Insurance Company Limited

- Top 8 trends that will impact insurance in 2025

More Life Insurance News