Female financial professionals outpace their male counterparts

During recent years, female financial professionals had a higher growth rate in client base expansion compared to their male counterparts. They also experienced a larger growth rate in life and annuity production.

According to “Reimagining Growth: The LIMRA-EY Experienced Financial Professional Study,” from 2019 to 2021, female financial professionals grew their number of life insurance policies by 13% (compared to 5% for their male counterparts). The study showed a similar pattern of growth in number of annuity contracts, with female financial professionals growing their contacts by 23% versus 13% for male financial professionals.

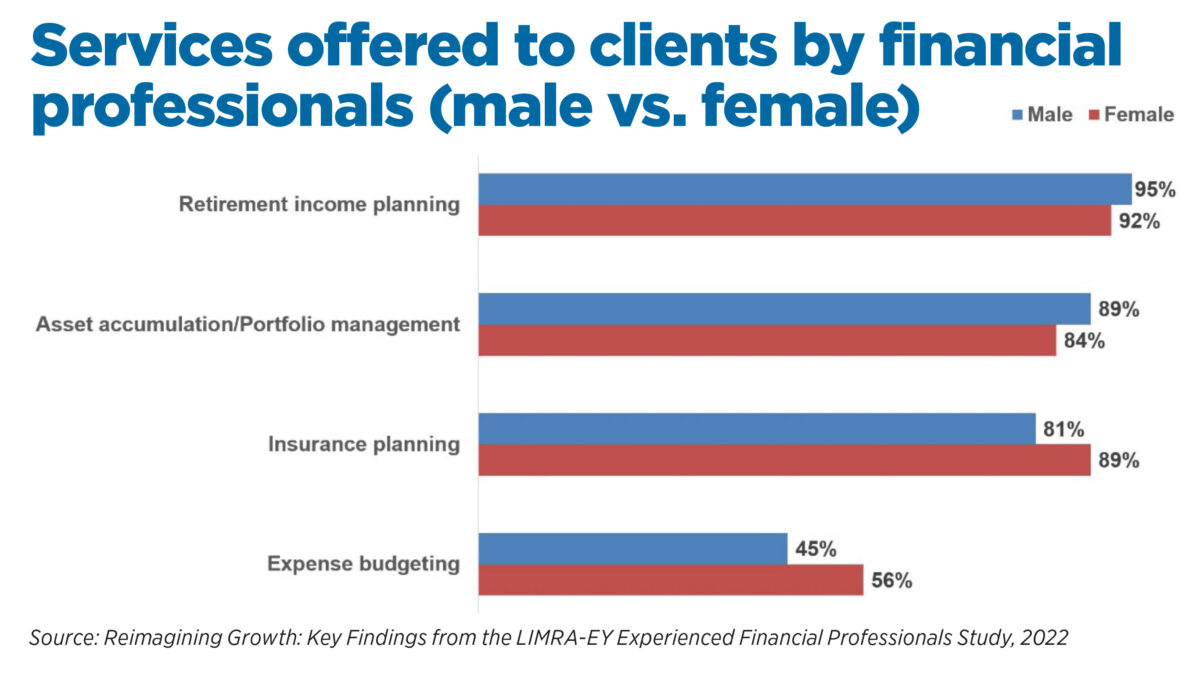

Women financial professionals tend to offer their clients a broader range of services, such as retirement planning, insurance planning and expense budgeting — taking a more holistic view of clients’ needs. They also have a higher number of licenses and designations than they did in 2018.

Female financial professionals make an investment in services that may not pay off in the near term but can ultimately result in stronger, longer-term relationships over time. Offering a wider breadth of services may explain their rising volume of life insurance policies and annuity contracts.

When we look at other measures of growth, female financial professionals (as a whole) outpaced their male counterparts in both income growth and increasing their number of clients. More than half of these women financial professionals attributed their upswing in income to client growth.

To a certain extent, the growth differences are a function of female financial professionals starting from a smaller client base. However, there are indications that they are also thinking and acting differently than their male counterparts. For example, women are two times more likely to want to diversify their client mix, and they indicate more than men do that serving the lower-to-middle market is economically feasible.

When asked if part of their strategy was to diversify their client mix, 16% of female financial professionals said it was (as opposed to only 8% of male financial professionals). Targeting these underserved markets may be paying off, as 72% of women versus 65% of men reported an increase in referrals.

Similar to the growth seen by women financial professionals, multilingual financial professionals grew their client base by 30% from 2019 to 2021 compared to 16% by financial professionals who speak only one language. Multilingual financial professionals also have notably more-diverse client bases; 59% of their clients are white versus 82% of the clients of monolingual financial professionals. They also have more clients with household incomes over $1 million (11%) than their monolingual peers (6%).

Insurers and investment firms would be well served to consider focusing on female financial professionals — as well as multilingual financial professionals — to diversify their client base while reaching currently underserved market segments and boosting overall sales revenue.

Sharing lessons learned from these leading financial professionals can also help all financial professionals identify top ways of penetrating underserved markets.

However, carriers should be aware that these diverse or underserved clients may have different needs, requiring different types of products and services, than more traditional customers do.

New methods and communication channels may also be needed to engage these new segments.

Methodology: The LIMRA-EY study surveyed more than 900 experienced financial professionals from six common insurance, investment and advisory practice models.

Respondents had a minimum of three years of sales experience in the industry and met minimum income thresholds for their practice models.

John Carroll is senior vice president, LIMRA and LOMA. He may be contacted at [email protected].

Several major insurers post disappointing numbers even while annuity sales soar

How annuities can be part of your client’s retirement formula

Advisor News

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

- Why haven’t some friends asked to become clients?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Factsheet January 2025

- Waitlists and attendant care: House lawmakers move major Medicaid bills

- California voters erased a plan to keep kids insured. It might be too late to fix it

- Military members may be eligible to pre-enroll in VA coverage, federal bill proposes

- CVS Health to cut another 22 jobs

More Health/Employee Benefits NewsLife Insurance News

- Lincoln Financial Reports 2024 Fourth Quarter and Full Year Results

- 2024 Annual Information Form

- 4th Quarter 2024 Results 2024 Management's Discussion and Analysis

- U-Haul Holding Company Reports Third Quarter Fiscal 2025 Financial Results

- U-Haul Holding Company Reports Third Quarter Fiscal 2025 Financial Results

More Life Insurance News