Expand your toolbox with cash value life insurance

While the market may only do three things in a given day (go up, go down, remain flat), recently it seems that the ups and downs are more extreme and occurring more frequently.

Because this is today’s investment reality, no longer should we use traditional asset classes and allocation strategies alone to reduce risk. Nor should we continue to rely solely on traditional investment products and planning strategies created during different times when constructing investment portfolios and developing planning strategies today. We must be more creative and evolve with the times.

To paraphrase David McKnight, people really do not want to save or invest more money; they want to be smarter about the money they are saving and investing. So, as we evolve, how can we be more creative when implementing savings and investment strategies that will work over time and are more efficient with planning dollars?

The answer is simple: Expand your toolbox. How, you ask? Simply consider a tool that has been available for centuries that is now being used as a “new” alternative investment in today’s new world. This tool’s general features include:

» Most favored asset class status in the IRS Tax Code.

» Tax-deferred growth and tax-free income distributions for any reason.

» Liquidity without penalty before and after age 59 ½.

» No traditional qualified plan funding limitations.

» No required minimum distributions.

» Distributions are not included in IRS provisional income calculation to determine whether Social Security income is taxable.

» Cash value and distributions are not considered in college financial aid calculations.

» Professional and institutional investment management.

» Leveraged asset transfer efficiency, unlike other assets.

» Can be a “no work and no worry” proposition with guarantees.

So, what is this “new” investment alternative that has been around for so long? Ready? Answer: cash value life insurance. Yeah, I know: letdown, right? Hold on! Keep reading.

You see, as the investment world has grown and evolved over time, so has the life insurance industry. Today’s cash value life insurance products offer all features mentioned above and more. Furthermore, every one of these features is a benefit that any and every saver or investor wants.

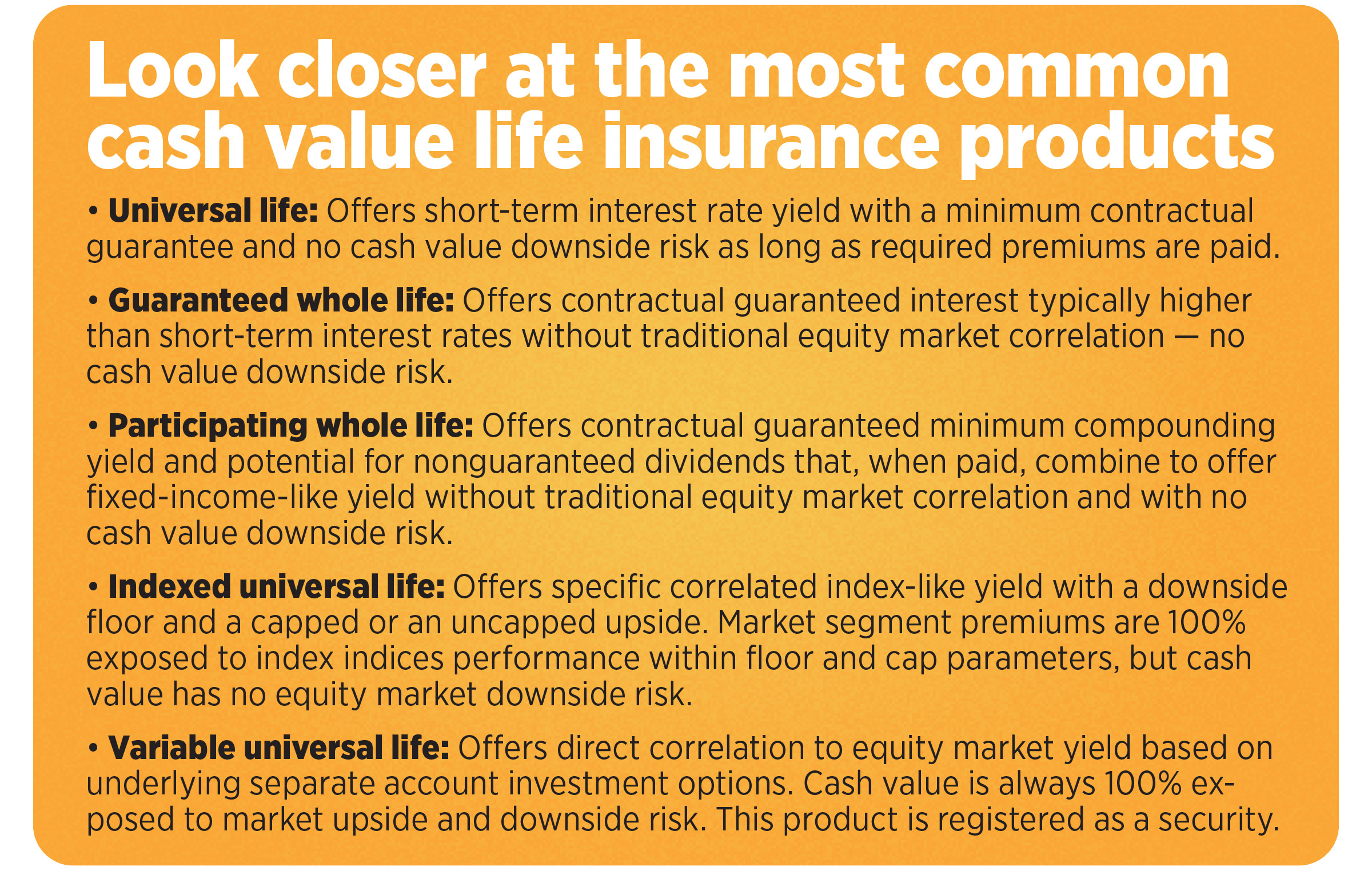

Additionally, life insurance eliminates potential investment liquidity at death, preserving investment portfolios. Cash value life insurance also can be used as an asset in a diversified investment strategy or as a hedge in an investment plan. Today’s cash value life insurance can be designed to offer guaranteed interest, fixed-income-like returns with guarantees, market index indices return with guarantees and complete equity market upside potential like other traditional investments.

Furthermore, in addition to providing attractive competitive returns, tax-free growth, tax-free income, and access to cash for purchases, expenses, emergencies, opportunities, and things like college funding and retirement, cash value life insurance may also be designed to provide living benefits for things such as terminal and chronic illness.

Today’s life insurance products can allow for death benefit acceleration under certain circumstances while the policy owner is living. General life situations where death benefit acceleration may be helpful include the following.

Critical illness: A sudden acute medical condition or event. Examples of qualifying conditions include major heart attack, coronary artery bypass, stroke, invasive and blood cancers, major organ transplant, end-stage renal failure, paralysis, coma, and severe burns. Conditions vary by carrier and state.

Chronic/cognitive illness: Doctor-verified inability to perform two out of six activities of daily living, requiring assistance or supervision for severe cognitive impairment. Those activities of daily living include walking, bathing, dressing, eating, toileting and transferring. (Note: Some carriers do not require permanent diagnoses.)

Terminal illness: A physician-diagnosed medical condition that is expected to result in the death of the insured within a specified period of time, usually 12-24 months.

The following may apply to each or all of the benefits described above and vary by carrier:

» These benefits are typically available as a part of the policy contract and or may be offered as a rider on a contract.

» These benefits usually have a minimum and may allow for a percentage up to the full death benefit amount to be accelerated as long as the insured qualifies as stipulated in the policy and/or rider. However, many carriers cap the amount available below the full death benefit.

» These benefits may be offered at no cost at policy issue but charge a fee (fixed or formula) at time of access or may charge a premium in addition to the cost of the base policy.

» Electing to accelerate any amount of death benefit will reduce the amount a beneficiary receives upon the insured’s death.

» Chronic illness riders may or may not have an elimination period and may or may not be indemnity benefits.

» Qualified accelerated benefits that are received generally will not be subject to taxation under Section 101(g) of the Internal Revenue Code. However, receiving an accelerated benefit may affect the recipient’s rights to receive certain public funds, such as Medicare, Medicaid, Social Security and Supplemental Security Income. As with all taxable matters, clients should consult with a tax advisor to determine the tax consequences prior to electing to receive benefits.

Another life situation is disability. Although this does not trigger death benefit acceleration, many carriers offer a disability rider for an additional premium that pays the policy premiums, as stipulated in the rider, if the policy owner becomes disabled. This allows the policy owner to keep their life insurance death benefit and cash value without having to pay premiums while disabled.

The world and the economy continue to evolve, forcing the financial services and insurance industries to evolve to meet the demands of our new world. Your toolbox must expand to meet your prospects’ and clients’ holistic planning needs while you help them become smarter about how they plan and save and invest their money. Now is the time to add cash value life insurance to your planning toolbox if you haven’t done so already.

Jeff Snyder is executive vice president of business development and insurance with Gateway Financial Advisors. He may be contacted at [email protected].

Using a SPIA to protect an IRA in Medicaid planning

Simplicity in it for the long haul

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

More Annuity NewsHealth/Employee Benefits News

- MISSISSIPPI SENATE PASSES "JILL'S LAW," SENDING BIOMARKER TESTING COVERAGE BILL TO GOVERNOR'S DESK

- MEDICAID FINANCING: THE BASICS

- MORRISON JOINS COLLEAGUES, ADVOCATES TO HIGHLIGHT MEASURE PROVIDING COVERAGE FOR SEIZURE DETECTION DEVICES

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- Iowa insurance firms warn bill would make health costs rise

More Health/Employee Benefits NewsLife Insurance News

- Busch, Pacific Life settle dispute over $8.5M investmentFormer NASCAR champion Kyle Busch settles $8.5M lawsuit against life insurance companyTwo-time NASCAR champion Kyle Busch and a life insurance company have settled an $8.5 million lawsuit in which the driver said he was misled into purchasing policies marketed as safe retirement plans

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

More Life Insurance News