Equitable hones in on annuity delivery across channels after strong Q3

Equitable Holdings knows what it does well and plans to keep hitting the retirement market with its popular annuity products, executives said today.

Credited with introducing the first registered indexed-lined annuity in 2010, Equitable is far and away the market leader for the now-trendy RILA products. According to LIMRA, the insurer sold $6.8 billion worth of RILAs in Q2, about 50% more than second-place Allianz.

Equitable will lose market share, CEO Mark Pearson told Wall Street analysts Tuesday. During the second quarter, LIMRA lists 19 insurers selling RILAs, and that does not include industry giant Corebridge Financial, which recently introduced its first RILA.

“Look, it's a very, very big market. It's not going to be a market where there's only one player wins,” Pearson said. “Growth will not slow for us. We had 100% of this market, because we were the only player. We were the ones who innovated. So, [market share is] going to come down as more competitors come in.”

Sales are up about 28% for the year and Equitable is meeting its 15% internal rate of return target, Pearson noted.

“So, the competition hasn't been hurting us,” he added.

Equitable’s business model is a main driver of its annuity sales success, Pearson explained.

“We participate in all parts of the value chain,” he said. “We source yield from [AllianceBernstein]. We get distribution margin through Equitable Advisors. And we're a manufacturer as well. So, we participate more on the economics than many of our competitors can.”

Over the past three years Equitable has more than doubled its sales volume, added Nick Lane, president of Equitable.

“We are mindful of competitive trends on pricing,” he said. “As new entrants come in, there does tend to be a period of teaser rate pricing as they attempt to gain a foothold. We've seen this before, and it tends to be temporary, because it's not sustainable.”

Additional takeaways

During the third quarter, Equitable inked another deal to provide products to J.P. Morgan Asset Management for its SmartRetirement Lifetime Income, a target date offering with a lifetime retirement income component.

The lifetime income feature allows electing participants to draw down their balance over an expected time horizon correlated with average life expectancies and then, upon meeting certain requirements, the participants will begin to receive annuity income directly from the supporting insurers.

Equitable has similar partnerships with AllianceBernstein and BlackRock for retirement income options inside retirement plans.

Earlier this year, Equitable announced LifePath Paycheck with BlackRock, offering a “guaranteed income” via a target date fund.

When a participant enters retirement, they will receive a guaranteed amount of funds in a paycheck-like manner that is meant to provide a stable source of income. By providing access to guaranteed income through a target date fund, LifePath Paycheck is meant to be more stable than a standard 401(k).

“We see this as creating a significant new market by enabling insurers to access the $7 trillion of assets currently sitting in 401(k) plans,” Pearson explained. “We're encouraged by the initial interest shown in guaranteed lifetime income options by both plan sponsors and asset managers with sizable target date fund complexes.”

Management Commentary

“The combination of strong new business activity and favorable market conditions drove assets under management and administration to a record $1 trillion, which will support future growth in both fee- and spread-based earnings.”

–Mark Pearson, president and CEO

Financial Overview

Total Revenue: $3.1 billion ($3.6 billion in Q3 2023)

Net Income: -$134 million ($1.1 billion in Q3 2023)

Earnings Per Share: $1.53 ($1.15 in Q3 2023)

Share repurchases: $254 million

Dividend declared: $76 million

Stock price movement: Down nearly 3% Tuesday to $43.79

Segment Performance

Individual Retirement:

Account values: $108.9 billion ($83.5 billion in Q3 2023)

Operating earnings: $225 million ($220 million in Q3 2023)

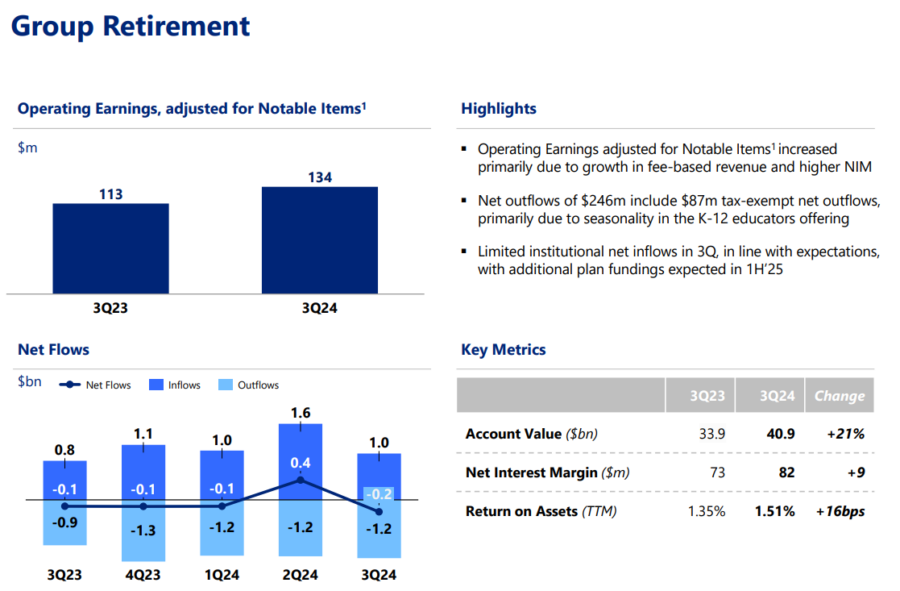

Group Retirement:

Account values: $40.9 billion ($33.9 billion in Q3 2023)

Operating earnings: $141 million ($105 million in Q3 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Maintaining annuity sales momentum with Gen X

Corebridge Financial tallies strong annuity, life sales numbers in Q3

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

- 2024 Letter to Shareholders

- Fortitude Re Announces $4 Billion Annuity Reinsurance Agreement with Taiyo Life Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Lawsuit: Casey’s exploits employees with tobacco-use surcharge

- Pat Geraghty retiring as president and CEO of GuideWell/Florida Blue

- Preserve Medicaid and de-privatize Medicare for cost savings

- A guide to health insurance for startups

- He had short-term health insurance. His colonoscopy bill? $7,000

More Health/Employee Benefits NewsLife Insurance News

- Regulators tackle troubling illustration practices

- Global Atlantic 2025 Retirement Outlook Survey: Majority of Investors Worried about Outliving Assets

- Aegon announces changes to its Board of Directors

- Proxy Statement (Form DEF 14A)

- A-CAP Counters Desperate Attempt by Utah Insurance Department to Distance Itself from its Faulty Allegations

More Life Insurance News