Empowering Americans to better understand financial products

Sometimes it can seem as though the financial services industry collectively believes that the universal solution for end-of-life planning and retirement funding is to simply “buy more policies” or “save more money.” This is simplistic and not an accurate or fair perception, but does it matter if consumers feel that way?

To set the stage, LIMRA and Life Happens partnered on the 13th annual Insurance Barometer Study in 2023 and took a closer look at consumers’ attitudes and behaviors regarding financial security and preparedness. Too many Americans are unable to prepare as well as they would like to, and many more are unaware of how to do so.

It is important for the industry to set the path for potential consumers to better understand the options attainable for them. With each passing year, we have more tools and platforms than ever before to educate, communicate and market tailored products to a diverse array of potential customers.

We know that there are millions of Americans who understand the need for protection products but believe they cannot afford them and, moreover, are unsure how to go about purchasing them. Not to mention they don’t know what products are best for them and their families.

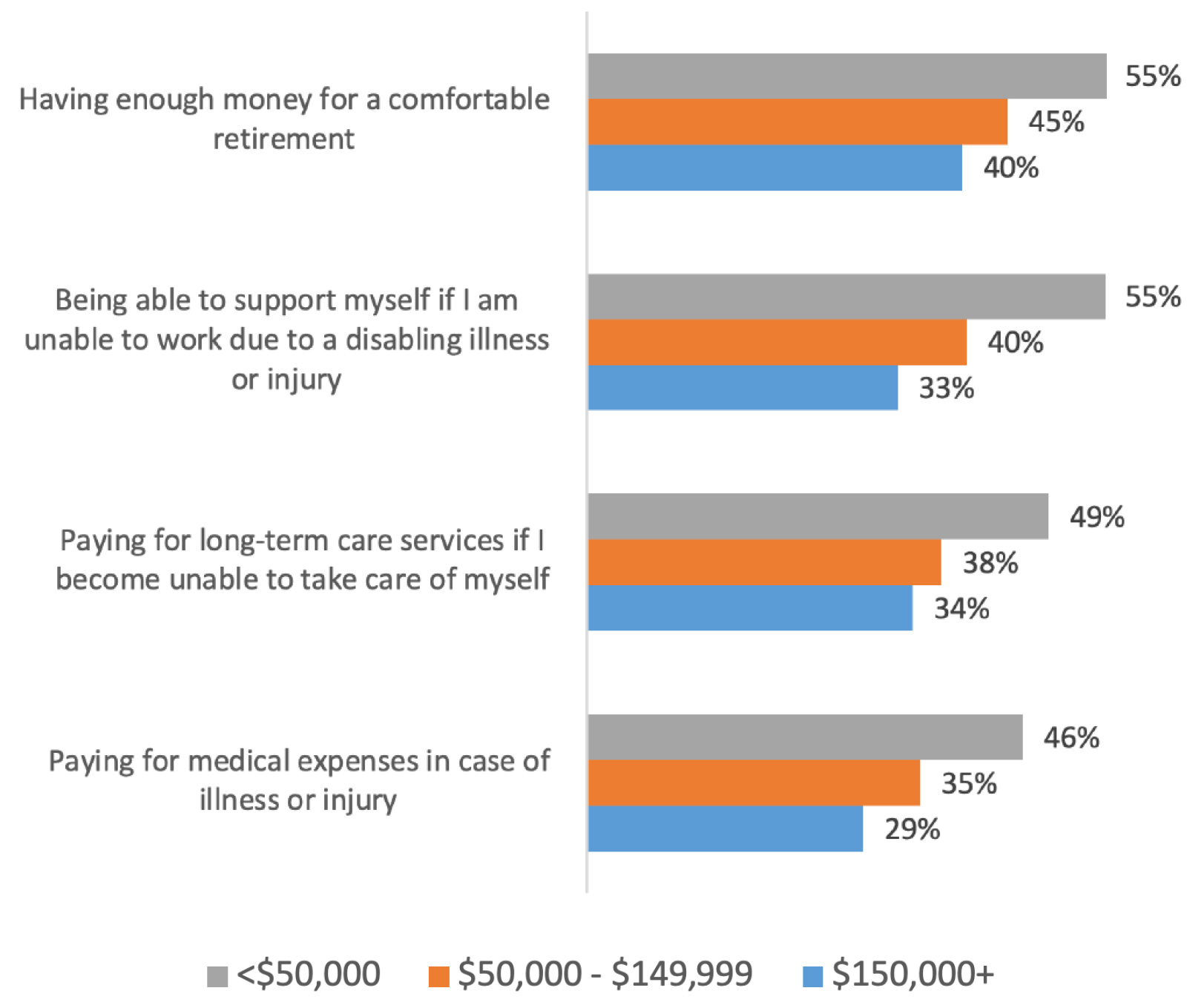

The Barometer Study has asked respondents what their top financial concerns are since its inception in 2011. “Saving money for a comfortable retirement” has been the top concern in all 13 years. This feeling is nearly universal. Retiring comfortably is the top concern for households with more than $150,000 per year of income (40%) as well as those earning under $50,000 (55%).

Strikingly, among the 14 other concerns on the survey, those landing in the top four for everyone, regardless of income, are concerns that typically become more likely later in life.

This is a snapshot of a persistent trend in America: Millions of families are not financially prepared for retirement, declining health, or serious illness or injury. A multitude of factors contribute to this general unease regarding financial security and stability.

Wealthier and more educated Americans are generally in better positions for retirement and emergency funding, but as the demographics of America change and diversify, sellers and agents must diversify their potential customer base as well.

We consistently see in our research the desire and need for consumers to better protect themselves and their families. For example, 41% of American adults self-report a life insurance need gap — that is, those who are uninsured and say they need it in addition to those who own some type of life insurance who say they need more. Although much of the life insurance and savings needs are aspirational for many Americans, we cannot overlook the millions who are willing and able to enter the market — with the right tools.

Many financial and insurance companies are developing sales strategies to better reach markets that may have been overlooked in the past — diverse markets such as middle- and lower-income households, single mothers, and different races and ethnicities.

What can the industry do now to help consumers in the future?

» Create trustworthy online content relevant to their needs — not corporate news or self-congratulations.

» Rethink marketing. Use social media to reach millennials and Generation Z.

» Invest in modern and online interfaces. Make the direct-to-consumer experience for life insurance as smooth as possible, perhaps using property/casualty sites as a template.

» Reconsider underwriting and partnerships with trusted brands. Today’s consumer wants the process to be as quick as possible and may not even want to meet with an advisor in person.

» Provide honest information to prospective clients. Retirement and estate planning can be difficult, but it is hugely important and will provide real and perceived security.

As part of LIMRA’s Markets Research team, Steve Wood is responsible for providing analyses and insights for some of the industry’s most compelling reporting. You can contact him at [email protected].

Why benefit brokers should think like human capital managers do

Addressing the gender gap in insurance and financial services

Advisor News

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- Former NFL player convicted in nearly $200M Medicare fraud scheme

- Senior Health Insurance in Florida Adapts to 2026 Care Costs

- Officials Report Record Enrollment In CT's Health Insurance Marketplace

- 'Washington is broken': Democratic U.S. Senate candidate Roy Cooper pledges to fight for affordable health insurance, Medicaid expansion

- Kontoor updates executive severance package amid talk of more potential departures

More Health/Employee Benefits NewsLife Insurance News