DOL fiduciary rule would bring ‘massive change’ to industry, analyst says

While the Department of Labor's fiduciary rule proposal might be a long way from becoming settled law, it brings the potential for "massive" change to the industry, a labor lawyer said Thursday.

May to June is the likely timeframe for publication of the final fiduciary rule, said Tom Roberts and Michael Kreps, principals with Groom Law Group in Washington, D.C.

The scope of change the rule would bring will impact everyone from the street agent to the insurance company CEO, they said.

"It would require massive changes in distribution models. It would require changes in how people are compensated, and how product sales are overseen," Kreps said. "This is not a small tweak to the industry. This is not a, 'Well, we can paper around this change.' This is a massive sea change that will have a profound impact across the board."

Groom hosted a webinar for National Association for Fixed Annuities' members.

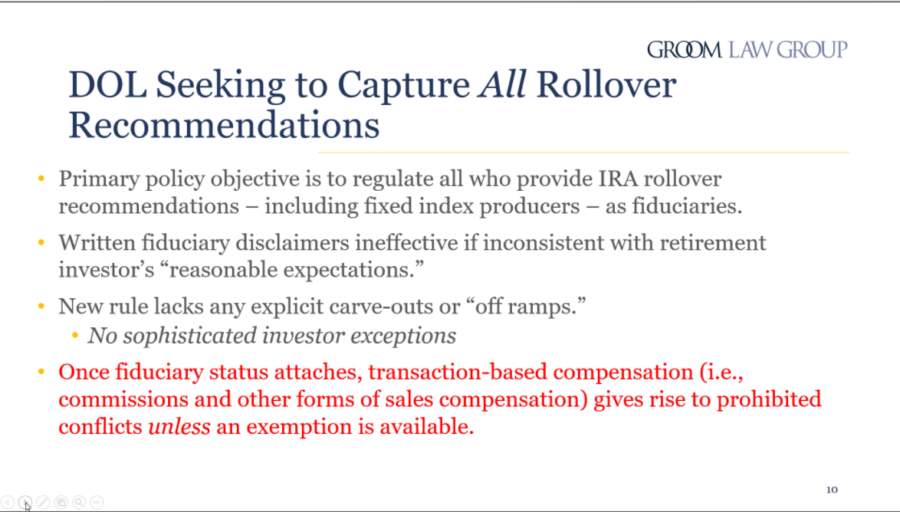

Released on Halloween, the DOL fiduciary proposal is the agency's fourth attempt at extending fiduciary duty to nearly all transactions involving retirement dollars. In 2018, a federal appeals court threw out the Obama administration's fiduciary rule. A three-judge panel ruled 2-1 that it went beyond the DOL's mandate from Congress to regulate workplace retirement plans.

The 2018 court decision examined the common law meaning of the word “fiduciary,” which requires a relationship of trust and confidence, and determined that Congress codified that common law meaning in the statutory text.

Administration officials repeatedly mention "trust and confidence" in both the rule text and their public comments since its release. Their challenge is to shoehorn an agent's one-time sale of an annuity into the established understanding of a relationship of "trust and confidence" between an advisor and client.

"What the Department of Labor is essentially trying to do is take what we would consider to be normal run-of-the-mill sales and marketing activity, and convert that into fiduciary advice," Kreps explained.

If there is a lawsuit to stop the fiduciary rule from taking effect, industry plaintiffs could cite the "major questions doctrine," he added. The idea behind the doctrine is that Congress must speak particularly clearly when it authorizes the executive branch to take on matters of political or economic significance.

The Supreme Court first cited the major questions doctrine in a 2022 decision limiting the Environmental Protection Agency’s power to address climate change.

Change to exemptions

Big changes in the DOL fiduciary rule proposal deal with two exemptions that allow annuity sellers to collect a commission: Prohibited Transaction Exemption 84-24, which dates to 1977, and PTE 2020-02, an alternative created by the Trump administration.

Amended several times over the years, PTE 84-24 allows producers to receive commissions when retirement plans and IRAs purchase insurance and annuity contracts.

Under PTE 2020-02, if an "investment professional” gives fiduciary advice to a retirement investor, the “financial institution” is also considered a fiduciary. There are strict requirements with this exemption.

Many annuity sellers want to use PTE 84-24. But the proposed changes are going to make it difficult to continue doing so.

Compensation sharply limited

Insurance agents will feel compensation pain if the fiduciary rule takes effect. The only permissible compensation would be the upfront commission, the renewal fee, and any trailing fees.

The department is not being very consistent with its treatment of compensation, Roberts said.

"The Department of Labor in its proposal repeated some statements that it made back in 2016 that 84-24 since its inception has never covered the receipt of anything other than simple commissions," Roberts said.

In its comment letter, NAFA pointed out that the DOL had a different position on compensation when PTE 84-24 was created more than 45 years ago.

If the rule survives any court challenges and takes effect, industry players are going to face difficult decisions on whether to do business under PTE 84-24 or PTE 2020-02, Kreps said. Neither is a great option.

"Regardless of what path you take, there's still going to be pretty massive changes to these comp structures, [and] those comp structures have developed over decades," he said. "They are deeply entrenched. And they're how the industry organizes itself. So, to uproot them and try to mitigate conflict partially or entirely, is going to be incredibly difficult."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Improving indicators raise expectations for economic outlook

Differing generational retirement expectations spur personalized strategies

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- Insurer ends coverage of Medicare Advantage Plan

- NM House approves fund to pay for expired federal health care tax credits

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

- Students at HPHS celebrate 'No One Eats Alone Day'

- Bloomfield-based health care giant Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News