Despite high expectations, direct-to-consumer life insurance market struggles

A decade ago, direct-to-consumer platforms were the next big thing in life insurance.

With sound reasoning. Study after study continues to show that Americans like self-directed shopping experiences made easy.

Start-ups with breezy names such as Ethos and Lemonade and Ladder found seed money with ease and promised to make life insurance “affordable, accessible, and straightforward,” as an Ethos’ marketing line describes it.

Fast forward to 2024 and direct-to-consumer sales are flat, at best, and nowhere near expectations. And many of those start-up companies are either gone or struggling to survive.

Notably, Prudential Financial shuttered Assurance IQ, five years after paying $2.35 billion in a deal that was roundly criticized. While booking hundreds of millions in losses, Prudential gained little headway in the direct-to-consumer space.

Likewise, MassMutual announced in November 2023 that it would shut down Haven Life. Other direct-to-consumer life insurance startups, such as SelectQuote and Lemonade, have seen their share values drop by 90% or more since 2021.

So, what happened?

“The industry has learned a lot along the way,” said Alison Salka, senior vice president and senior research consultant at LIMRA & LOMA. “It started with some incorrect assumptions and there may be some misperceptions as well.”

It all made perfect sense

Momentum for the direct-to-consumer insurance market grew with the development of digital tools that allowed for online quote comparisons, artificial intelligence-based underwriting and telematics.

Analysts heaped praise on the potential for cost savings, streamlined underwriting, quicker approval times and personalized buying experience. Investors enthusiastically signed up for the seeming digital revolution of life insurance.

“We’re betting Lemonade will transform the insurance landscape beyond recognition,” said Haim Sadger, partner at Sequoia Capital, in a 2015 statement announcing Sequoia’s $13 million investment.

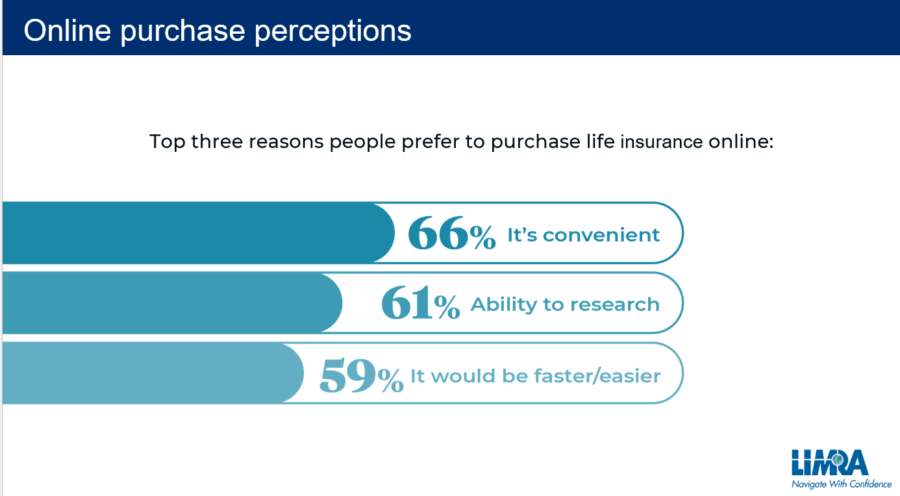

LIMRA data backed up the notion that consumers want to shop for life insurance online.

Traditional life insurers were all in on the direct-to-consumer space, either forming their own units or buying existing startups. Prudential made the biggest splash with Assurance IQ, which uses technology to match consumers with insurance plans that are purchased online or through an agent.

Founded in 2016 by Michael Rowell and Michael Paulus, the Seattle-based Assurance never raised any outside capital on its way to unicorn status as a $1 billion company.

At the time of the deal, Prudential said Assurance’s “rapid-growth model offers compelling economic advantages with low fixed costs and low capital requirements that produce high margins and high degree of scalability.”

That vision never came to fruition. Instead, Prudential took several goodwill impairment charges, which is done when an acquired asset is not worth its stated value. By 2023, Prudential had stopped reporting Assurance IQ's financial performance during its quarterly calls.

Prudential CEO Charlie Lowrey defended the Assurance IQ acquisition during the insurer's Q1 earnings call with analysts.

"Certainly, we anticipated a different outcome when we purchased Assurance and we've incorporated these lessons into our [merger-and-acquisition] approach," he said. "As we look forward will we will focus on acquisitions of more established businesses that present present opportunities to expand our capabilities and scale in our existing market-leading businesses."

'That didn't happen'

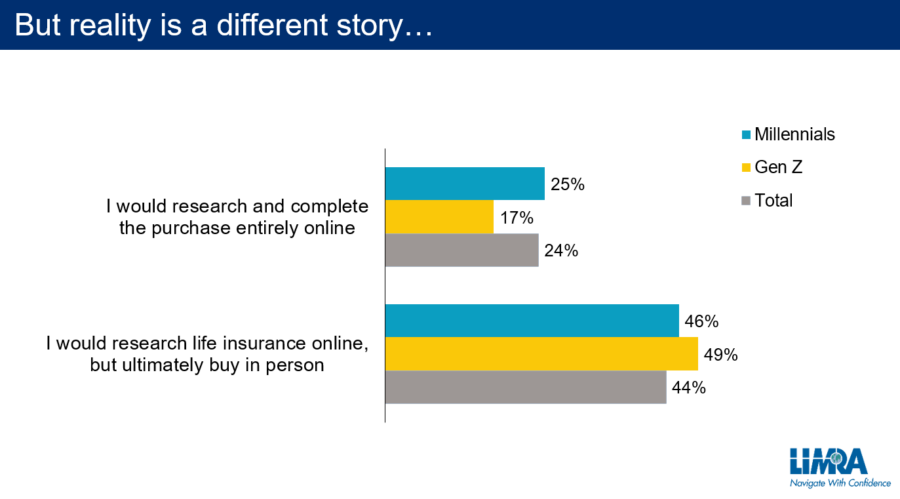

The deeper LIMRA researched the online buying issue, the worse the data looked.

“Our research found that the people who told us they want to buy online were likely more affluent, already owned life insurance and were likely male," Salka said. "We thought that this type of person would flock online to buy life insurance and that didn’t happen."

Life insurance shoppers are not motivated shoppers, Salka noted, and that is a significant problem for online platforms. People are driven to log on and buy shoes, or golf clubs. But few people are eager to purchase life insurance.

And general misconceptions about life insurance don't go away simply because it is purchased online. If anything, they are exacerbated, LIMRA found.

Just a quarter of consumers feel confident in their knowledge of life insurance, and say they haven’t purchased because they don’t know what to buy or how much they need, LIMRA researchers found. Another quarter (23%) say that procrastination is the cause for not buying coverage. Half say life insurance is too expensive but more than 7 in 10 overestimate the actual cost of life insurance.

Daniel J. Adams founded CEG Life Insurance Services, an online agency that offers direct-to-consumer life insurance, in 2009. Many direct-to-consumer life insurance start-ups have failed, or are struggling, he said, because they focused too heavily on distribution technology, and technology leadership, over professional expertise.

"Life insurance has historically always been sold by professional agents," Adams said. "While the methods of prospecting, communication, selling, and distribution may change, the reliance on an educated, customer-focused, trained, professional agents continues to play a vital role in the process."

Trust issues

There is a demographic problem that direct-to-consumer life insurance faces: Those consumers old enough to want and need the products are not always the most interested in shopping online, while those younger online shoppers are not terribly interested in life insurance.

"Life insurance is inherently complex, and most people simply don’t know enough about how to acquire it digitally or seek it digitally," explained Samantha Chow, global leader for the life insurance, annuities and benefits sector at Capgemini. "Targeting a younger demographic through digital sales is challenging. Quite unfortunately, the younger generations today do not see the value in life insurance or income replacement products. They view life insurance as death insurance with no value to their current lives or financial plans."

Despite the failures, struggles and missed expectations, Chow sees a future for direct-to-consumer life insurers, claiming the "genuine need" is there.

"To remain relevant, they must adapt their product offerings," she said. "This includes creating relevant products for the intended audience. The products must incorporate financial support, health, and wellness benefits that can be used throughout one’s life, without compromising on simply being easy to understand."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

What’s behind the optimism surrounding the Medicare trust fund?

Telehealth: Making health care more accessible and affordable

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- New Findings in Managed Care Described from University of Pennsylvania Perelman School of Medicine (Understanding Postpartum Hospital Use Among Birthing People With Medicaid Insurance): Managed Care

- Community Forum: Try something new, back publicly financed universal primary care

- Primary care a key issue this legislative session

- Studies from National Health Insurance Service Ilsan Hospital Provide New Data on Cytomegalovirus (Occult cytomegalovirus infection presents anastomotic leakage after gastrectomy: Two case reports): Herpesvirus Diseases and Conditions – Cytomegalovirus

- WATCH: BALDWIN TAKES TO SENATE FLOOR TO STOP GOP ATTACKS ON AFFORDABLE CARE ACT AND ATTEMPT TO KICK PEOPLE OFF COVERAGE

More Health/Employee Benefits NewsLife Insurance News