Deep Recession Seen In Deutsche Bank Report

We have a double-pronged game of “will it or won’t it” this week with the stock price slide fueling fears of a bona fide crash and inflation heating up recession anxieties.

The latest in the recession talk is from Deutsche Bank, which is not only the first major bank to predict an impending recession, but also adds that it will be worse than expected.

The bank had five reasons for its predicting that a recession will hit next year, according to its client letter this week, but they all stemmed from inflation.

- Broader trends such as demographics and a reversal in globalization will probably increase prices over the next few years.

- The drivers of inflation have broadened while the labor market is extremely tight.

- Sellers have absorbed as much inflation as they can and are more willing to pass the cost onto consumers.

- More people are expecting inflation to increase even further.

- Even though the Federal Reserve is raising interest rates more aggressively, it is moving too slow to control inflation.

“The bottom line is that while inflation may fall somewhat from its 40-year high in March,” according to the note, “multiple factors are set to keep it elevated well above target for some time. We would not be surprised to see core PCE inflation sustained in the 4-5% range well into 2023, before receding after the recession hits.”

The report writers acknowledged that they are extreme outliers with their predictions, but they claim to not be bold in their opinion and rather that the rest of the world has not been keeping up with the paradigm shift in macroeconomics.

The consensus has been wrong for the last decade in connecting the dots, the writers said, missing not only the acceleration of inflation but also misjudging its impact.

“Over the last couple of years alone they underestimated the scale of the pandemic rebound, the inflationary impact of the stimulus packages, and the fact they weren’t transitory,” according to the note. “But those same forecasters now think we can bring down inflation with a soft landing, from a starting point from which we’ve never achieved a soft landing before.”

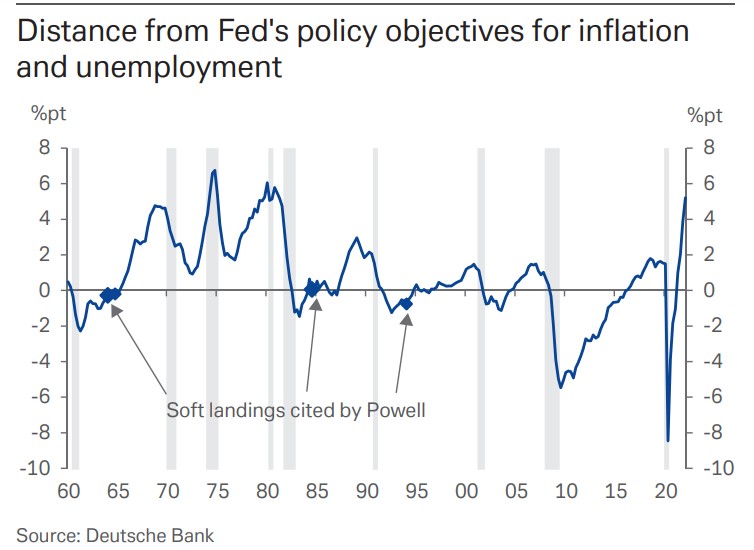

Deutsche Bank analysts created an index to show how Fed policy can fail to respond to economic shifts. In its Fed misery index, whenever the line is above zero, that means the Fed has more money tightening to do. The line has popped up to levels not seen since the early 1980s.

“What is noteworthy is that every time this index has moved noticeably above zero, the economy has gone into recession within a few years due to monetary tightening,” according to the report. “On this basis, the Fed is further behind the curve than it has been since the early 1980s. And when they did manage to achieve a soft landing (in the mid-60s, the mid-80s and mid-90s), the index was essentially at zero. So the Fed has plenty of work to do to catch up.”

Just as with the 1970s-1980s era, the Fed’s lag will just mean that it will need a stronger medicine to cure recession and its attendant rising unemployment.

“The only way to minimize the economic, financial and societal damage of prolonged inflation is to err on the side of doing too much,” according to the note. “Otherwise, inflation will only become more entrenched, inflicting further damage and requiring even tougher action to remove.”

That opinion harkens back to the 1980s when Fed Chair Paul Volcker jacked up the short-term rate (which is now under 1%) up to 20%.

Market Feeling Down

The other prong of the guessing game is predictions of The Big One, a deep October 1929-size gash in the stock market that would mark a significant economic downturn. Equity indexes have had a crazy year already, and it’s just getting nuttier, particularly with the Nasdaq.

The year started with Nasdaq logging its worst month since 2008, narrowly avoiding its worst-ever start of a year. Analysts at the time said interest rates would have to increase, which would depress the price of stocks trading at many multiples of their company’s value.

The wildly volatile first quarter was the worst-performing quarter in two years. Supply chain issues are also not unkinking very quickly, with COVID-19-inspired lockdowns in China promising more shortages. The Russian invasion of Ukraine contributed by pushing up already elevated energy prices and unsettling investors.

Even the bond market has suffered, with The Wall Street Journal noting that the Bloomberg U.S. Aggregate bond index returned a minus 6% in the first quarter, on par with the biggest quarterly loss since 1980.

Stocks are not faring much better in the second quarter, with the S&P 500 losing 8% this month. Nasdaq has had a rough several days but is down 4% this month. The leading tech stocks have been taking it on the chin but Tesla has slid significantly, about 12% so far, because Elon Musk will probably need to dump a lot of his stock to buy Twitter.

Worker shortages and wage growth have also affected tech companies, with wages growing at least 20% for the most skilled workers, according to a Wall Street Journal analysis.

In fact, the hot job market is itself an indicator that stock indexes must fall, according to The New York Times’ take on the economy.

“When recoveries peak, investor exuberance can lead to excessive risk taking by businesses, which plants the seeds of the next downturn,” according to the Times article, “just as workers are benefiting from being in high demand, with their higher wages cutting into corporate cash piles built up during good times, putting pressure on near-term profits.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

RetireOne Partners With Dr. Michael Finke On Research Exploring Portfolio Income Insurance

Insurer CEOs Receive ‘Massive’ Compensation During Pandemic, CFA Reports

Advisor News

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

- Tariffs alter Q2 economic outlook downward, Morningstar says

- Women need an advisor who’s also a coach

More Advisor NewsAnnuity News

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

More Annuity NewsHealth/Employee Benefits News

- Health care costs bill signed by Lujan Grisham

- Friday roundtable in Rochester to focus on possible Medicaid cuts

- Studies from University of Southern California (USC) Yield New Information about Military Medicine (Health Insurance Coverage and Hearing Aid Utilization In Us Older Adults: National Health Interview Survey): Military Medicine

- Pritzker's Proposed Budget Will Take Away Health Coverage From Immigrants Without Legal Status

- A fifth of Americans are on Medicaid. Some of them have no idea.

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Symetra Partners with Nayya to Introduce Digital Leaving Planning Solution

- Krispy Kreme's owner is seeking approval to buy Shenandoah Life

- Krispy Kreme owner to acquire Roanoke-based Shenandoah Life

- Directors' Report and Financial Statements 31 December 2024

More Life Insurance News