COVID, Low Rates Slam 2Q Annuity Sales: Wink

Annuity sales were down sharply in all but two product categories during the second quarter, according to the Wink’s Sales & Market Report, in a particularly tough sales period.

Overall sales for all deferred annuities in the second quarter were down 12.8% when compared to the previous quarter and 21.2% when compared to the same period last year.

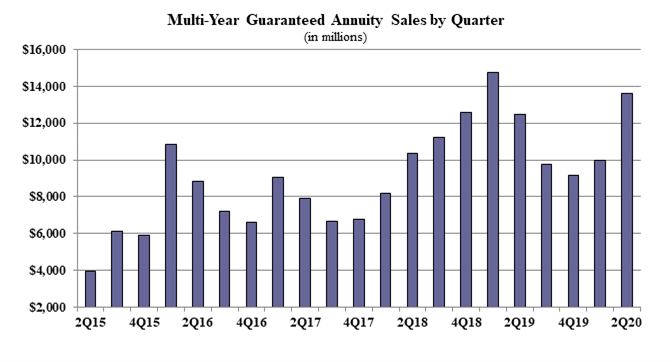

The lone bright spots came via multi-year guaranteed annuity sales of $12.5 billion, up 25.6% compared to the previous quarter, and down just 0.3% when compared to the same period last year; and structured, or registered index-linked, annuity sales of $4.5 billion were up 9.3% over the 2019 second quarter.

Other product sales numbers were down dramatically, said Sheryl J. Moore, CEO of Wink Inc. But she is not surprised.

“Everyone saw these sales declines coming from a mile away,” Moore said in a news release. “As everyone continues adjusting to COVID-friendly selling, and the 10-year Treasury remains minuscule, sales are going to continue to be challenged.”

Here are the Wink sales numbers by product:

- Total deferred annuity sales were $45.9 billion, a decline of 12.8% compared to the previous quarter and a 21.2% year-over-year decline.

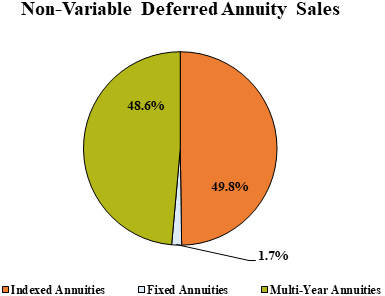

- Non-variable deferred annuity sales were $25.7 billion, down 4.8% compared to the previous quarter and a 22.2% year-over-year decline.

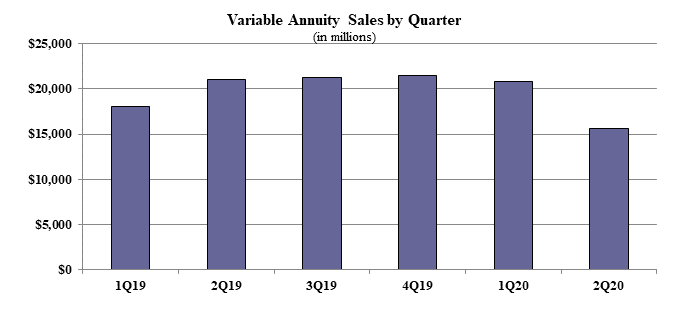

- Variable deferred annuity sales were $20.1 billion, a decline of 21.4% when compared to the previous quarter and a 19.9% year-over-year decline.

- Indexed annuity sales for the second quarter were $12.8 billion, down 21.8% when compared to the previous quarter, and a 34.8% year-over-year decline.

- Traditional fixed annuity sales in the second quarter were $425.7 million, down 38.4% when compared to the previous quarter, and a 51.2% year-over-year decline.

- Variable annuity sales in the second quarter were $15.6 billion, a decline of 24.7% as compared to the previous quarter and a 25.6% year-over-year decline.

Jackson Reigns

Noteworthy highlights for all deferred annuity sales in the second quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 7.5%.

New York Life followed in second place, while Massachusetts Mutual Life Companies, Lincoln National Life, Equitable Financial rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the sixth consecutive quarter.

Noteworthy highlights for non-variable deferred annuity sales in the second quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 10.3%.

New York Life moved into second place, while Sammons Financial Companies, Athene USA, and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year, a multi-year guaranteed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined.

Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for variable deferred annuity sales in the second quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 16.3%.

Equitable Financial retained their second-place position, as Lincoln National Life, Brighthouse Financial, and Prudential rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the sixth consecutive quarter.

Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for indexed annuities in the second quarter include Athene USA gaining the No. 1 ranking in indexed annuities, with a market share of 11%. Allianz Life moved into second-ranked position while Fidelity & Guaranty Life, AIG, and Sammons Financial Companies rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity was the No. 1 selling indexed annuity, for all channels combined, for the 20th consecutive quarter.

Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for traditional fixed annuities in the second quarter include Modern Woodmen of America ranking as the No. 1 carrier in fixed annuities, with a market share of 16.0%.

EquiTrust ranked second, while Global Atlantic Financial Group, Jackson National Life, and Brighthouse Financial rounded-out the top five carriers in the market, respectively. EquiTrust ChoiceFour with Liquidity Rider was the No. 1 selling fixed annuity, for all channels combined.

Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for MYGAs in the second quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier, with a market share of 20.3%. New York Life moved to the second-ranked position, as Sammons Financial Companies, Global Atlantic Financial Group, and Symetra Financial rounded-out the top five carriers in the market, respectively.

Massachusetts Mutual Life Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for the third consecutive quarter, for all channels combined.

“It is interesting to see that MYGA sales increased double-digits, while indexed annuity sales declined similarly," Moore said. "This is a new trend.”

MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for structured annuities in the second quarter include Lincoln National Life ranking as the No. 1 carrier in structured annuities, with a market share of 23.4%. Lincoln National Life Level Advantage B Share was the No. 1 selling structured annuity for the second consecutive quarter, for all channels combined.

Also known as registered index-linked annuities, structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Variable Annuities Fall

Noteworthy highlights for variable annuities in the second quarter include Jackson National Life holding-on to their ranking as the No. 1 carrier in variable annuities, with a market share of 21.1%.

Equitable Financial ranked second, while Lincoln National Life, Prudential, and New York Life rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the sixth consecutive quarter, for all channels combined.

Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Sixty-three indexed annuity providers, 43 fixed annuity providers, 62 multi-year guaranteed annuity (MYGA) providers, 13 structured annuity providers, and 47 variable annuity providers participated in the current report.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Powell Edges Toward Loosening The Fed’s Stance On Inflation

Fed: Buy A Home, Save The Economy

Advisor News

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

- 4 things every federal worker should do to safeguard their benefits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

- STATEHOUSE: Senate Republicans approve limiting health insurance program for Hoosiers

- State health plan users may see premium increases under SC House budget proposal

- Senate Republicans approve limits on health insurance program

- Health agents ‘optimistic’ as a new administration takes charge

More Health/Employee Benefits NewsLife Insurance News

- Whole life vs. term life: The great debate

- Prudential launches OneLeave

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

More Life Insurance News