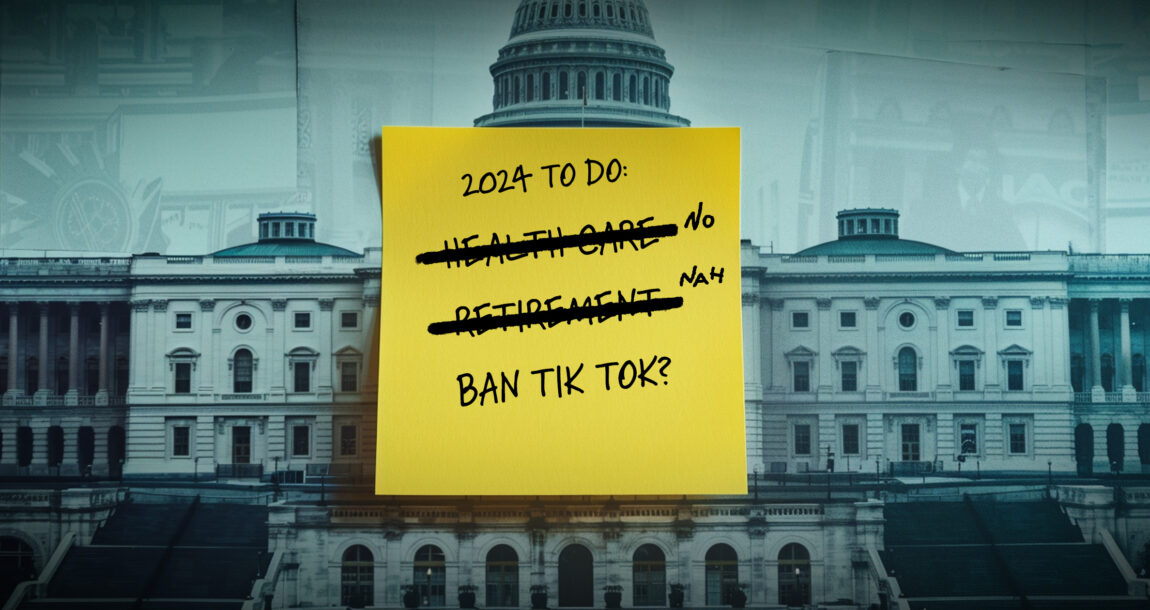

Congress unlikely to take up health care, retirement issues this year

“It’s no secret that this Congress has not been the most productive one,” said Geoff Manville, partner with Mercer’s Law and Policy Group, in a recent webinar. However, some bipartisan health care reforms could come before Congress at the end of 2024, he said.

Among the health care reforms that could come up for a vote in the year-end lame duck session are:

- Pharmacy benefit manager reforms. These include an extensive disclosure of PBM business practices to plan sponsors and the government; a ban on spread pricing, and a 100% pass-through of rebates, fees and discounts to the plan sponsor. The proposed reforms also would require PBMs and third-party administrators to disclose direct and indirect compensation to plan fiduciaries.

- Price transparency. This would codify rules requiring disclosure of out-of-pocket costs and negotiated rates to plan members and beneficiaries.

- Provider and hospital billing reforms. This would require hospital outpatient departments to provide a unique identifier on all bills, and would bar contract terms that prevent patients from being steered to higher-value, lower-cost providers.

- Telehealth flexibilities. This would treat stand-alone telehealth and remote care benefits as an excepted benefit.

- Health savings account modernization. This would allow individuals to convert their own flexible spending arrangement or health reimbursement arrangement funds into an HSA.

No action expected on retirement policy in Congress

Manville said it’s unlikely that Congress will take action on retirement policy this year. However, two issues could see action this session, he added.

The House of Representatives passed HR 2799, a package of securities law changes. Included in that package is a provision to permit 403(b) plans to invest in collective trusts. Manville said the bill is now in the Senate, where its future is uncertain.

Lawmakers continue working on a SECURE 2.0 technical corrections bill. A draft bill has been compiled and it’s possible it could become part of a legislative vehicle to come up for a vote in the lame duck session, Manville said.

“There is little chance of any ESG-related legislation passing before the new Congress takes office next year,” he said. Two bills relating to environmental, social and governance in investing have stalled out in Congress and are unlikely to see further action.

However, Manville said, some recent legislation could set the stage for a potential reform package to come before the next Congress. That legislation includes:

- HR 7293, which would require many employers to prospectively offer an automatic contribution retirement plan or an automatic individual retirement account.

- HR 6757, which would allow a Roth IRA to Roth plan account rollover.

- S 3305, the Helping Young Americans Save for Retirement Act, which would lower plan eligibility age to 18.

- HR 4924 and S 2517, the Auto-Reenroll Act, which would encourage adoption of automatic reenrollment in retirement plans.

In addition, Manville said, there is Senate interest in proposals that would strengthen defined benefit pension plans.

Health care on the presidential campaign trail

Health care affordability is a key focus for President Joe Biden and his Republican challenger Donald Trump as the two face a rematch for the presidency in 2024.

Biden outlined his health care priorities in his 2025 budget request to Congress. Those priorities include:

- Extending the Inflation Reduction Act’s prescription drug cost controls and caps to employer plans.

- Addressing industry consolidation and anti-competitive practices.

- Requiring insurers to cover three mental health care visits without cost sharing each year.

- Establishing a national paid leave program run by the Social Security Administration.

Meanwhile, Manville said, Trump wants to revisit his earlier health care priorities, which include:

- Reducing premiums and drug costs.

- Increasing price transparency.

- Expanding coverage options that are not compliant with Affordable Care Act requirements, such as association health plans, short-term limited-duration plans and fixed indemnity plans.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

State Farm, plaintiffs trade barbs in lawsuit over total loss values

JPMorgan, BOA, others reach $70M settlement for alleged municipal bond fraud

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

- Legislation for more cancer coverage for firefighters clears the Iowa Senate

- Gentry Mountain Mining Under Fire Due to Recent Allegations

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News