Congress reaches deal on historic retirement saving changes

Congress reached agreement Monday on historic retirement saving changes, tucked inside a massive $1.7 trillion spending plan expected to pass in the coming days.

Industry lobbyists were still pouring through the bill's 4,155 pages this morning. In addition to SECURE 2.0 retirement provisions, the Registration for Indexed-Linked Annuities Act is also included, the Insured Retirement Institute said.

But it's the retirement changes that have industry executives buzzing today.

"We expect that the legislation will add billions to the retirement savings for small business workers, part-time workers, employees with student loan debt, military spouses, low-income workers, and others," said Paul Richman, chief government and political affairs officer for IRI.

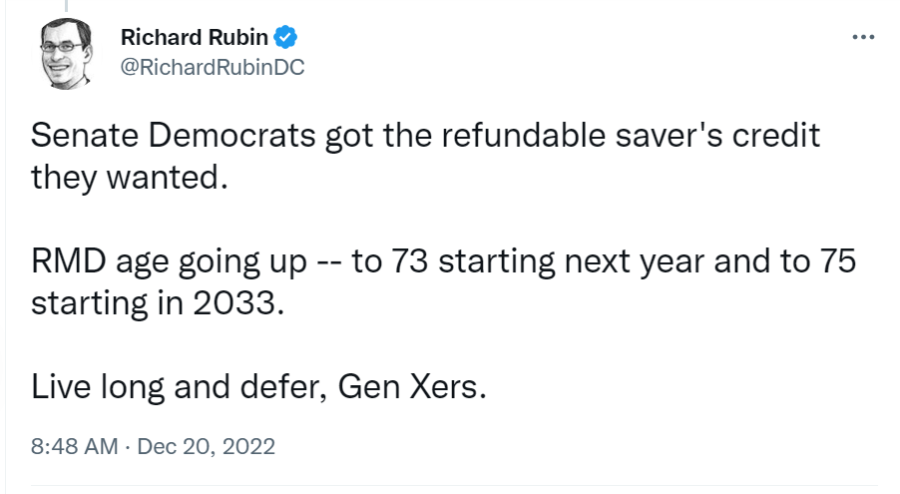

According to the Wall Street Journal, the age for required minimum distributions from plans is going up – to 73 starting next year and to 75 starting in 2033. The bill increases retirement savings contribution limits for older workers, provides an increased incentive to people with low and moderate incomes to save in retirement accounts, and allows more employers to offer emergency savings accounts inside 401(k) plans.

Democrats got a big win with an extension of the refundable saver's credit WSJ reporter Richard Rubin tweeted:

Retirement crisis

The push for retirement plan changes through legislation grew out of two trends: the switch away from defined benefit, or pensions, to defined contribution plans, most commonly 401(k) plans is one. Perhaps not coincidentally, that trend mirrored the declining retirement preparedness trend.

The median 401(k) balance is just $35,345, according to the “How America Saves 2022” report compiled by Vanguard, an investment firm that represents more than 30 million investors. Experts estimate that Americans are trillions short on retirement funds.

In response, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act.

Among its many provisions, the 2019 legislation opened the door wider to annuities inside retirement plans. Under the SECURE Act, retirement plans now have “safe harbor” from being sued if annuity providers go out of business or stop making payments.

The House passed the Securing a Strong Retirement Act of 2022, known as SECURE 2.0, on March 29 with overwhelming support. The Senate followed up with two different versions.

The final bill contains many of the priorities industry lobbyists pushed for over the past three years, including:

- Expanding automatic enrollment requirement for 401(k) and 403(b) plans.

- Multiple employer plans allowing small employers "to band together to obtain more favorable retirement plan investment results and more efficient and less expensive management services," the bill text reads.

- An increase in catch-up contribution limits for people ages 60-64. The bill "increases these limits to the greater of $10,000 or 50% more than the regular catch-up amount in 2025 for individuals who have attained ages 60, 61, 62 and 63," the bill reads.

- The ability to count student loan payments as plan contributions eligible for the employer match.

- Easing the penalties for emergency withdrawals. New rules will allow one distribution per year of up to $1,000, and a taxpayer has the option to repay the distribution within three years.

- Starter 401(k) plans for employers with no retirement plan.

- Requiring employers to allow long-term, part-time workers to participate in the employers’ 401(k) plans.

- Updates Treasury Department regulations to allow "insurance-dedicated exchange-traded funds."

In total, the bill text includes 19 pages of retirement plan changes to new provisions.

That it took just two years for SECURE 2.0 to get passed is due to organizations like Finseca lobbying Congress on retirement issues, said Josh Caron, vice president of federal affairs for Finseca. The original SECURE Act took a decade to get to final legislation.

There is more to come, Caron added.

"There will be a SECURE 3.0," he said. "I think that’s something that will definitely be on the table. There will be always new, innovative ways and solutions for Americans to save for retirement."

'More tax breaks for the well off'

Not everyone is a fan of the retirement legislation. The Institute on Taxation and Economic Policy (ITEP) is a nonprofit, nonpartisan research organization, called the bills "major disappointments" in a column by Steve Wamhoff, director of federal tax policy, earlier this month.

"They would mainly provide more tax breaks for the well off, who will most likely retire comfortably regardless of what policies Congress enacts," he wrote. "Already the top 40 percent of taxpayers receive 87 percent of the tax benefits for retirement savings."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Commentary: The global insurance industry will undergo an exciting shift in perception

Equitable research looks at financial protection as an asset class

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Minnesota couple accused of cheating Medicaid and Medicare of millions, buying mansion

- Health Insurance Shares Climb After Medicare Reimbursements are Boosted

- Medicaid expansion at risk: 'My life was saved by the citizens of Ohio'

- Obamacare rule changes could shorten enrollment, limit coverage through Pennie, ACA marketplaces

- Most older adults say Medicare and other insurance should cover obesity drugs, and many show interest in using them: Michigan Medicine – University of Michigan

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News