Brighthouse buoyed by investments, helping offset annuity sales decline

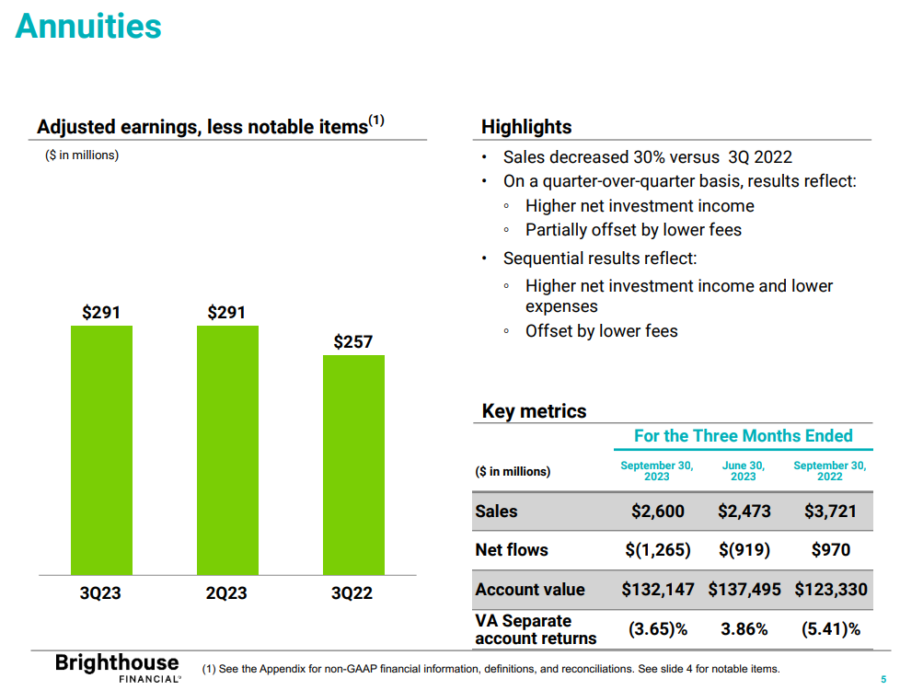

Brighthouse annuity sales were down during the third quarter, the insurer reported, but segment earnings rose substantially thanks to strong investment gains.

Adjusted earnings in the annuities segment were $319 million in Q3, compared to $202 million in the year-ago quarter and $291 million in the second quarter of 2023, Brighthouse reported in a news release.

Executives hosted a call with Wall Street analysts Wednesday morning and stressed that they are not worried about lower sales. Quarter-over-quarter annuity sales decreased 30%, driven by lower fixed deferred annuities, partially offset by a 30% increase in Shield Level annuity sales.

"Look, we have a competitive product," said Myles J. Lambert, executive vice president and chief distribution and marketing officer. "We have a very strong distribution franchise, and we continue to evolve our product portfolio. Last year, we introduced Shield Level Pay Plus, and this year, we introduced a new strategy on our Shield product called Step Rate Edge. And all those factors are helping us to drive sales."

The annuity and life insurance company posted revenue of $1.17 billion in the third quarter. Its adjusted revenue was $2.09 billion. Brighthouse is coming off a relatively strong second quarter, beating analysts' estimates.

Surrenders and opportunities

Brighthouse executives acknowledged that surrenders are up on annuity products, an industry wide reflection of higher interest rates. David Rosenbaum, head of products and underwriting for Brighthouse, talked about the opportunities in the current market.

"Just as an example of the business coming out of surrender, you may remember in 2020 we sold a meaningful amount of fixed-rate annuity business," he explained. "And that business, a three-year portion of that business, is up for surrender. We saw an impact of that in the third quarter and expect to see an impact of that also in the fourth quarter."

In other words, a percentage of those customers will be looking to exchange their annuity for another annuity with a better rate.

Charlotte-based Brighthouse, which was spun out of MetLife in 2017, completed its annual actuarial review where it reviews its long-term assumptions, the company said. This resulted in a net unfavorable impact to net income of $164 million. As part of the review, Brighthouse "increased its long-term mean reversion interest rate assumption for the 10-year U.S. Treasury from 3.50% to 3.75% and updated its policyholder behavior assumptions," the release said.

Excess mortality experience continues to be a major issue for life insurers. Brighthouse reported both positive and negative mortality in Q3, which was addressed by Ed Spehar, chief financial officer.

"We have a reinsurance offset ... that may be more beneficial in one segment than it is in another," he said. "I think the most important point would be that mortality overall for us in the quarter was slightly favorable."

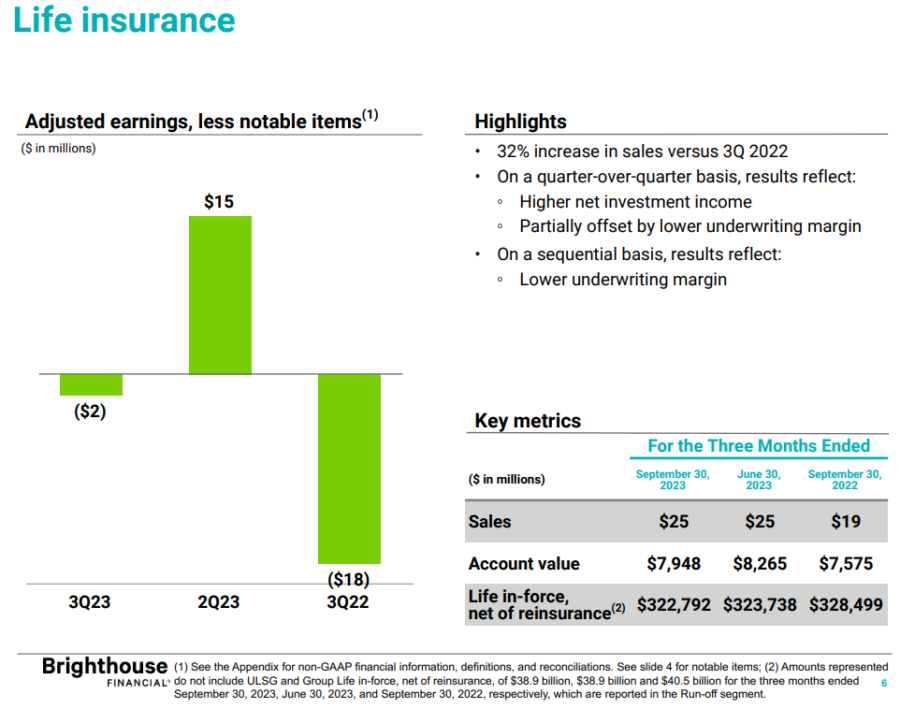

Life insurance loss

Brighthouse continues to experience ups and downs trying to boost its life insurance segment. The life segment posted an adjusted loss of $73 million in Q3, compared with an adjusted loss of $34 million in the year-ago quarter, and adjusted earnings of $15 million in the second quarter of 2023.

"The current quarter included a $71 million unfavorable notable item and the third quarter of 2022 included a $16 million unfavorable notable item, both related to the annual actuarial review completed in the respective quarters," the release said. "There were no notable items in the second quarter of 2023."

Year to date, total life sales increased 26% compared with the same period in 2022, 32% quarter-over-quarter and were flat sequentially, Brighthouse reported.

Correction: A previous version of this article incorrectly attributed Ed Spehar's comments to CEO Eric Steigerwalt.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

AI to “change everything” for financial services, says banking panel

Trade groups ask DOL for an extension of fiduciary rule comment period

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

- Legislation for more cancer coverage for firefighters clears the Iowa Senate

- Gentry Mountain Mining Under Fire Due to Recent Allegations

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News