Brighthouse Boasts Strong Sales In Life, Annuity Segments

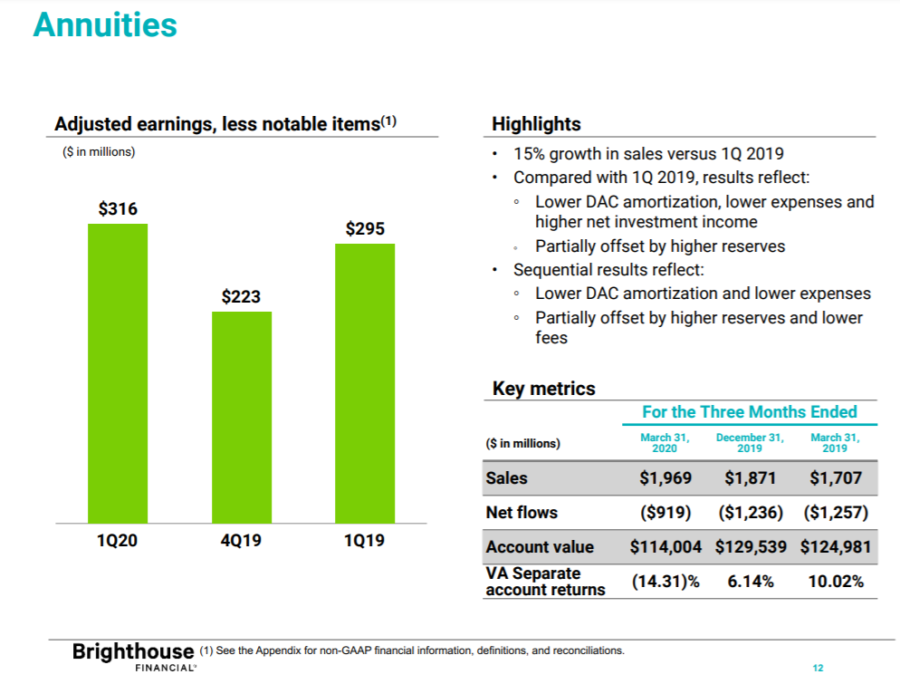

Brighthouse Financial executives hailed a successful first quarter Tuesday driven by a 15% increase in annuity sales year over year.

Annuity sales climbed to the $2 billion mark, up from $1.7 billion in the year-ago quarter.

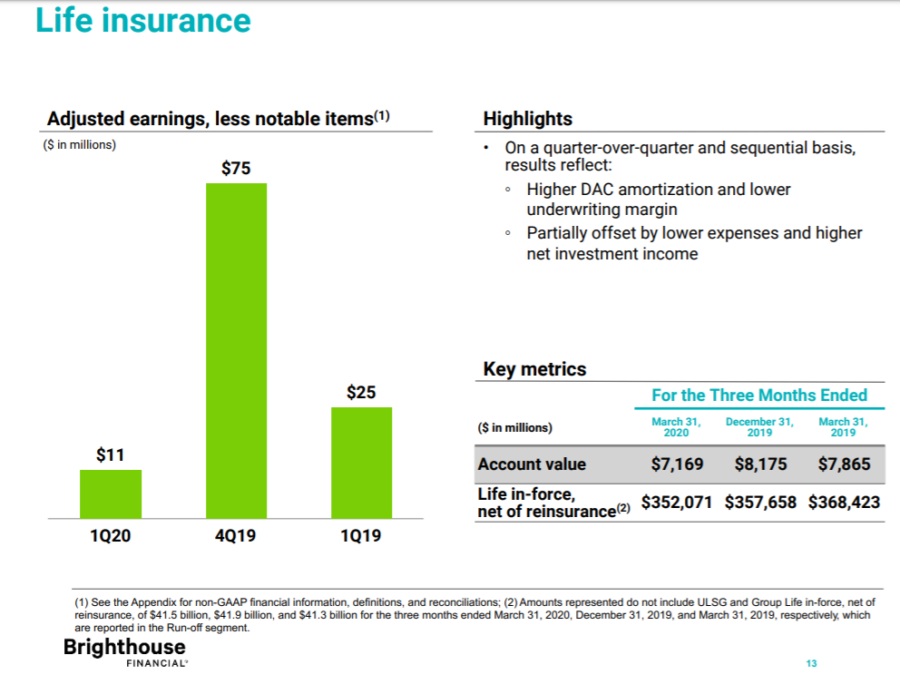

In fact, both annuity and life insurance sales were above expectations, said Eric Steigerwalt, president and chief executive officer.

"We generated approximately $16 million of life insurance sales in the first quarter of 2020, ahead of our expectations and up 33% compared with the fourth quarter of 2019, driven primarily by SmartCare," he said on a conference call. "I am very pleased with our sales results in the first quarter and the transition our teams made, moving from face-to-face model to a virtual model in order to connect with and remain in front of financial professionals."

SmartCare, a life insurance hybrid policy with a long-term care component, was introduced in February 2019, the first Brighthouse life insurance product launch since it was split off from MetLife.

"If you really think about our life franchise, it was very much in startup mode," said Myles Lambert, chief distribution and marketing officer. "We began to bring on distributors selling the product last May and that really continued on through October. So the distributer that we're working with, they’re really new to selling the product, the life insurance teams have been highly focused on establishing relationships with advisors."

Brighthouse reported $5 billion in net income for the quarter on $9 billion in revenue. That is a big improvement from a $737 million net loss on $691 million in revenue for the first quarter of 2019.

The income increase is attributable to the current value of Brighthouse's derivatives arrangements. Net results include $6.9 billion in gains in the “mark to market” value of derivatives that the company uses in support of its annuities.

Brighthouse is "laser-focused" on growing life insurance products, Steigerwalt said. Brighthouse life sales jumped from $1 million in the year-ago quarter. He acknowledged that growth will not be easy to sustain going forward.

"It probably does not surprise you that the current market environment is a headwind to near-term sales of annuity and life insurance products for the industry and for Brighthouse," Steigerwalt said. "As a result, it may be challenging to generate sales growth in annuities for this year, coming off of a very strong 2019."

Life insurance results were impacted by "unfavorable underwriting, which was driven by higher severity of claims in the first quarter," noted Ed Spehar, chief financial officer. Claims frequency was relatively flat compared with the fourth quarter of 2019 the first quarter, he added.

"While the data we've seen does not suggest a significant impact from COVID-19 to-date, cause of death reporting isn't perfect," Spehar said. "In addition, there is still uncertainty around timing of the first U.S. infection and death related to this pandemic."

Brighthouse repurchased approximately $316 million of its common stock year-to-date through May 8, representing over 12% of shares outstanding relative to year-end 2019.

"Given the unprecedented market environments in which we are operating, we are temporarily suspending repurchases of our common stock," Steigerwalt said.

Michael Fruchter, vice president at Moody’s Investors Service was impressed with Brighthouse’s first quarter results.

“Brighthouse Financial remains well-capitalized with its capital ratio remaining essentially unchanged at the end of the first quarter when excluding the dividend paid to the holding company," he said. "This demonstrates that the company’s hedging performed effectively despite volatile financial markets.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Insurers Wrestling With Distribution, Profitability Concerns: Survey

Fed Exec Sees Bounce, Economists Say Not Yet

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- 85,000 Pennie customers dropped health plans as tax credits shrank and costs spiked

- Lawsuit: About 1,000 Arizona kids have lost autism therapy

- Affordability vs. cost containment: What health plans will face in 2026

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

More Health/Employee Benefits NewsLife Insurance News