Brighthouse Banks On New Products, Distribution

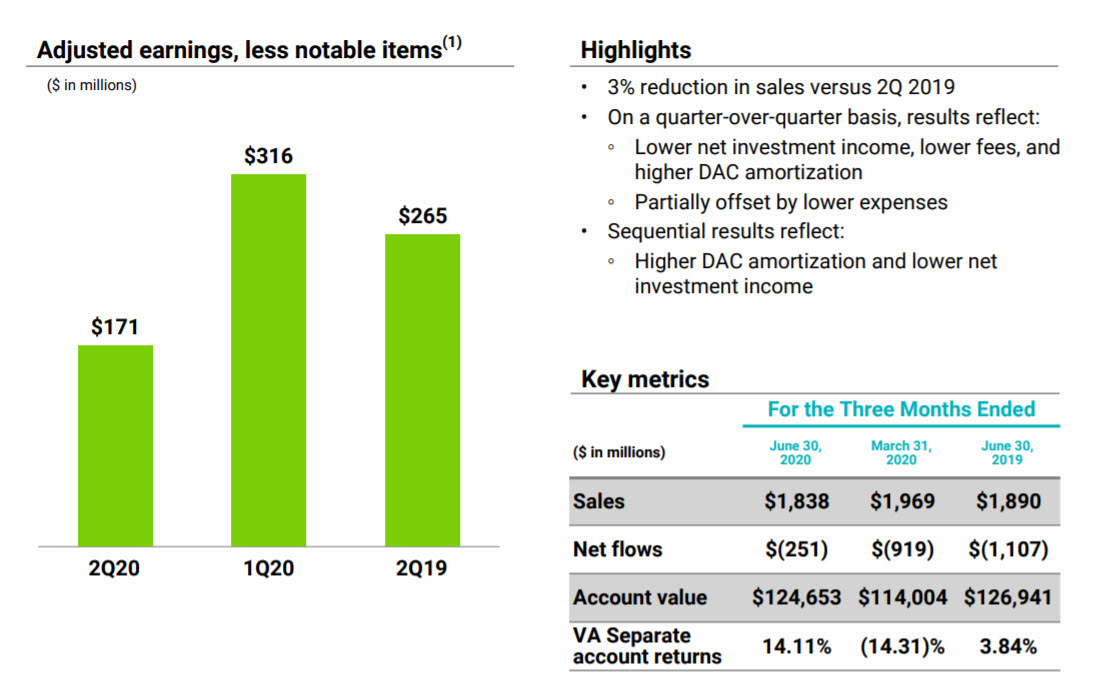

Brighthouse Financial held relatively steady in overall annuity sales with a year-over-year drop of 3% as the company pivots to growing its distribution and dialing down capital-intensive products and features, usually associated with guarantees.

“While the current market environment remains a headwind to near-term sales of annuity and life insurance products for Brighthouse and for the industry, we remain focused on broadening our product offerings and expanding our distribution footprint,” said Eric Steigerwalt, Brighthouse CEO, in the company’s second-quarter earnings call, which fell on the company's third anniversary.

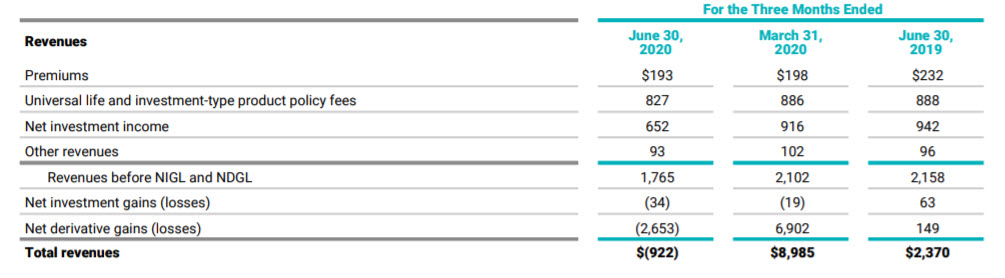

The company overall had a $922 million revenue drop from the strong first quarter.

Annuities

Annuity sales dropped a bit quarter over quarter, but still looks good over the year’s first half because of the first quarter’s performance, said Myles Lambert, chief distribution and marketing officer.

“We're very pleased with our sales results,” Lambert said. “Annuity sales, quarter-over-quarter were down slightly, but as Eric mentioned, still up 6% year-to-date.”

Lambert said two of the carrier’s distributors were struggling with pivoting to remote sales. And although COVID-19 will still affect distribution over the rest of the year, Lambert said the company is working on getting more sellers.

“We're adding wholesalers. We're expanding into new firms as well as new channels,” Lambert said. “We're introducing products that really are complementary to all different types of market conditions.”

The company has been increasing fixed annuities, which is counter to what many other carriers are doing because of the pressure of low interest rates and capital intensity.

The company’s Shield index-linked annuities represented half of Brighthouse’s sales as opposed to about 60% a year ago, said Conor Murphy, chief operating officer.

“We've been intentional about adding a pair of fixed indexed annuities and a pair of fixed deferred annuities,” Murphy said. “We're very comfortable, very pleased with our returns, specifically with the fixed defers. Our expense base has continued to improve, which helps us. But we also have a reinsurance agreement in place on that, which also helps with our product as well.”

Lambert added that the company sees fixed products as a key part of its strategy.

“The products that we're offering right now do have competitive rates,” Lambert said. “But I think that market volatility in this environment is also making an attractive solution to many clients out there. We've had a number of marketing efforts, which have been part of our strategy direct to advisors, to make sure that they understand the competitive nature of the product that we have right now.”

Life Insurance

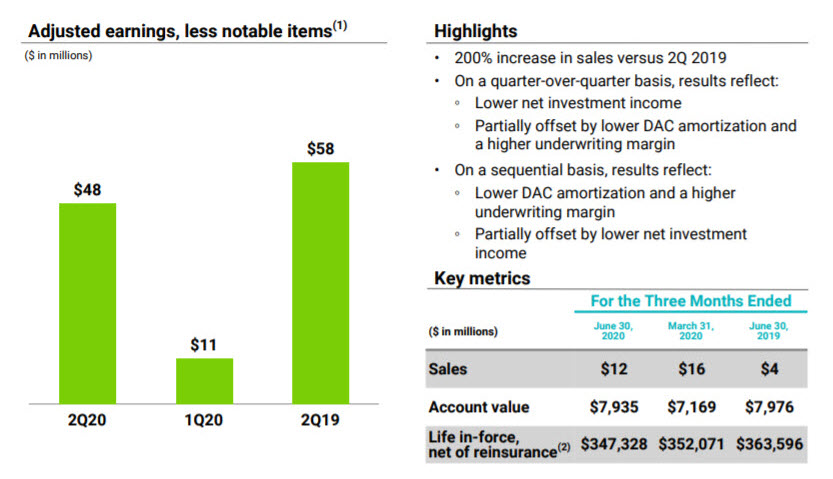

Brighthouse has said it is reentering the life insurance market with new products and broadening distribution.

Last year, the company offered SmartCare, an indexed universal life with a long-term care benefit.

“We're selling the product now at over a dozen firms and we have access to approximately 60,000 advisors,” Lambert said, adding the company has ambitious plans to grow distribution. “We have a number of plans underway as it relates to bringing on new additional major firms starting next year. We also have a channel expansion strategy that's well underway. And we feel really good about the progress that we've made.”

Lambert said SmartCare fits a unique niche.

“It's got a competitive indemnity benefit,” Lambert said. “And it's the only linked benefit product in the market right now that has a cash value that potentially could grow with market conditions.”

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Tips For Spotting Financial Abuse With Your Clients

White House, Democrats Spar Over Trump Coronavirus Aid Orders

Advisor News

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

More Advisor NewsAnnuity News

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Mayer: Universal primary care

- Trump administration announces health plan concept

- Fewer people buy Obamacare coverage as insurance premiums spike

- Funding crisis stalks state Medicaid program

- Hawai'i's Economic Outlook 2026

More Health/Employee Benefits NewsLife Insurance News