Brighthouse balances strong annuity sales with weaker life numbers

This month marks the fifth anniversary of Brighthouse Financial as an independent company. Executives rejoiced Friday over strong annuity sales figures during a second-quarter earnings call.

Brighthouse was spun off as a separate company from MetLife as part of its long-term strategy to become a leaner, less complex insurer focused on segments with a higher potential for growth -- such as employee benefits.

Brighthouse, meanwhile, navigated a rocky road the past five years. But investors viewed its second-quarter performance favorably. Brighthouse stock rose about 6% as of midday Friday.

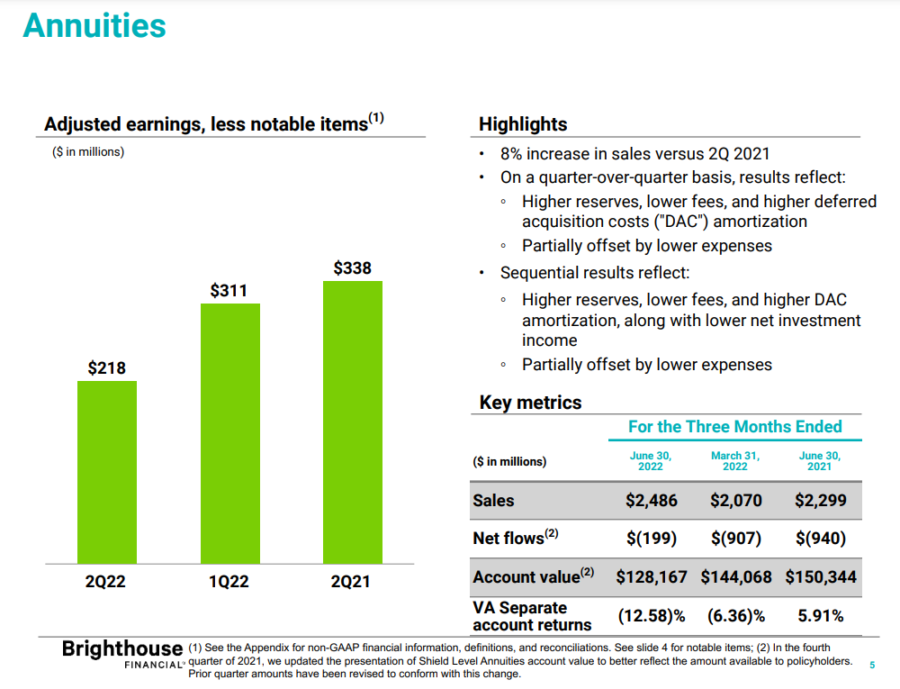

The results were driven by strong annuity sales, said Eric Steigerwalt, president and CEO.

"Total annuity sales were up 20% sequentially, and 8% quarter over quarter driven by fixed-deferred annuities, and Shield Level annuities," he told analysts. "Through the second quarter of this year, our annuity sales results were up 3% compared with the first half of 2021, which we believe demonstrates the strength and diversity of our annuity product portfolio as we continue to effectively navigate the current market environment."

The indexed-linked Shield Level products use a portion of retirement assets to participate in the market while offering downside protection. The next iteration of the product -- Shield Level Pay Plus -- will be unveiled later this month, Steigerwalt said. It will include a living benefit rider.

"This new product is designed to help strengthen clients retirement portfolios by providing a stream of guaranteed lifetime income," he explained, "while offering them opportunities to participate in market growth, combined with a level of protection against market volatility."

Life struggles

Much like Prudential Financial and Lincoln Financial earlier this week, Brighthouse is having its own unique experience with life insurance sales.

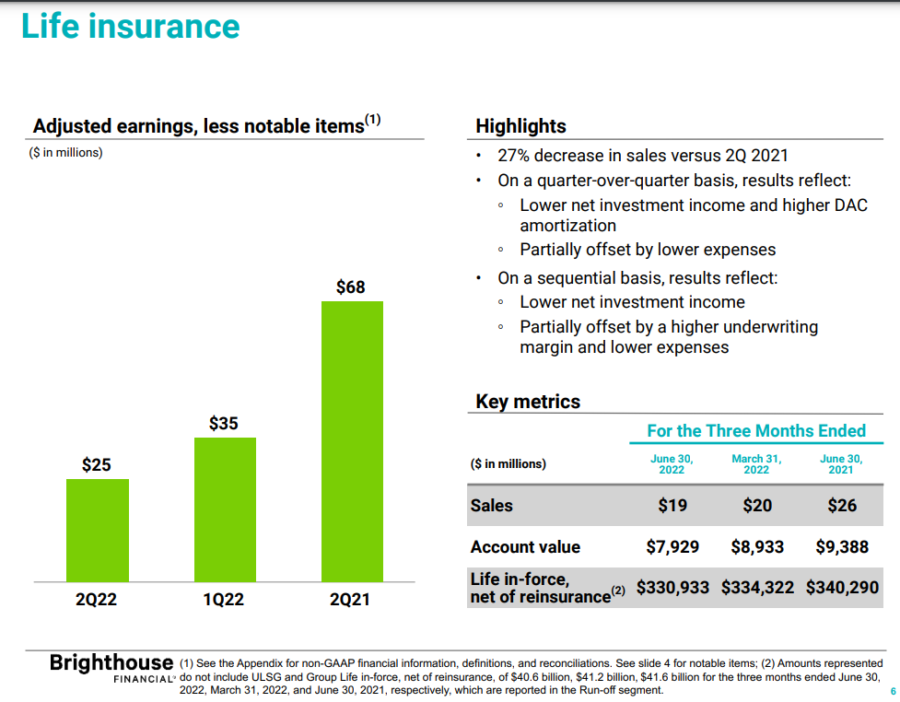

Brighthouse blamed "macroeconomic headwinds" for a 27% quarter-over-quarter decline (a 5% decline sequentially) in life insurance sales. Life sales fell to $19 million in the second quarter.

Brighthouse has struggled for several years to establish a presence in the life insurance market. In 2019, the company offered SmartCare, an indexed universal life with a long-term care benefit. This was followed by the launch of the term product, SimplySelect in 2020 in collaboration with Policygenius.

Myles Lambert, head of marketing, noted an increased distribution footprint for the SmartCare product. "We have access to approximately 8,000 new advisers that we can sell SmartCare through, and that's going to be a continued focus of ours as it relates to growing and expanding distribution for that product."

Brighthouse is undaunted in its commitment to the life insurance market, Steigerwalt told analysts.

"While we have experienced some headwinds from the economic backdrop in the past two quarters, we remain focused on and confident in our life insurance strategy and intend to continue to broaden our product offerings and expand our distribution footprint," he said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Growing number of workers enroll in high deductible health plans

How to master employee benefits

Advisor News

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

More Advisor NewsAnnuity News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

More Annuity NewsHealth/Employee Benefits News

- What Idaho Senate just did about mini-hospital firm accused of ‘excessive’ rates

- Inmates exiting Green Hill, Echo Glen now eligible for expanded health care coverage

- AM Best to Host Briefing on Negative Pressures on U.S Health Insurance Segment and Whether an Inflection Point has Arrived

- Long-Term Care Insurance: A lifeline or a financial nightmare for seniors?

- New CEO at major health insurer with 3K CT employees. ‘Excited to build on our strong foundation’

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News