Benefits Boost Financial Wellness As Well As Physical Wellness

Traditional workplace benefits such as health insurance, dental insurance and accident insurance give employees the tools they need to protect their physical health. But what about their fiscal health? Can group benefits protect an employee’s financial wellness? Researchers at two benefits carriers say financial wellness benefits are the latest offerings to help a pandemic-battered workforce obtain some security.

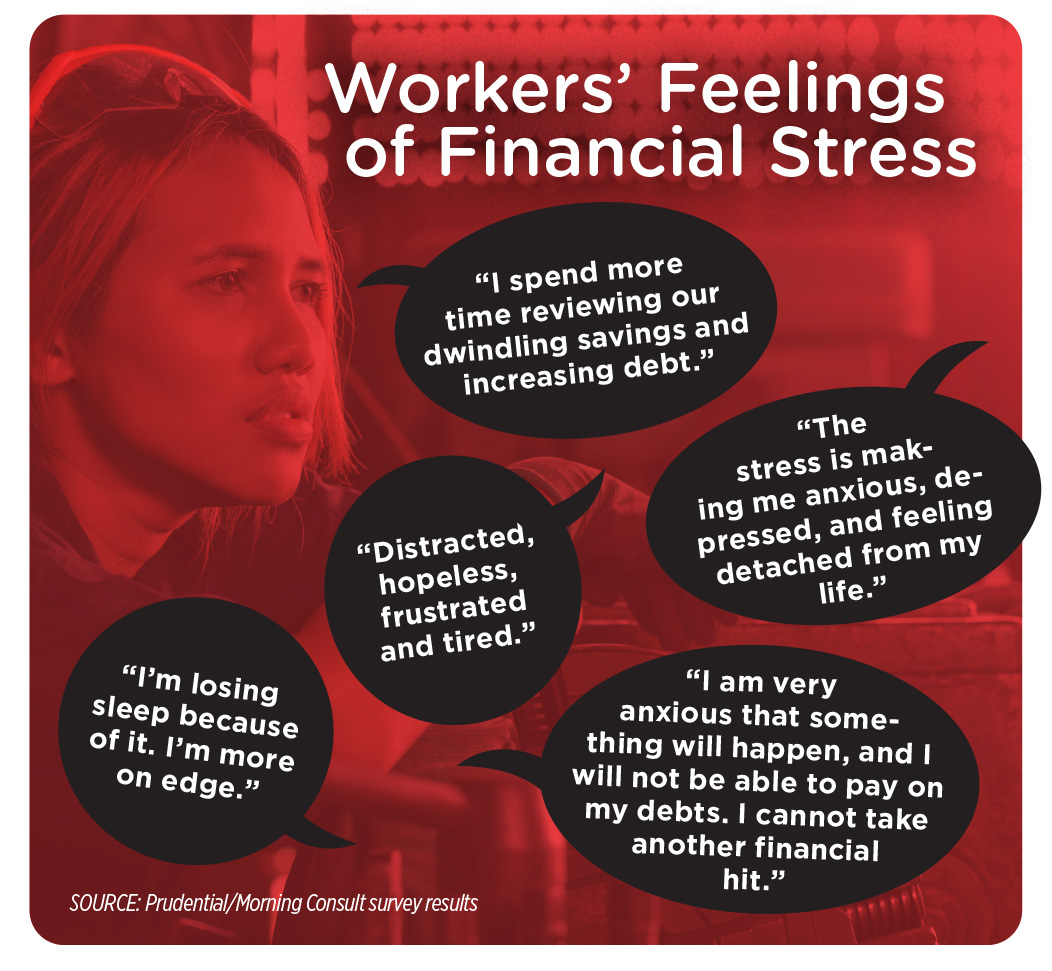

Workers who are highly stressed due to financial reasons are more likely than average to feel a range of negative emotions, Prudential reports, with the majority feeling worried (80%), frustrated (73%), exhausted (65%), low energy (58%), in fear (59%), sad (60%) and hopeless (51%). Some even report feeling depressed and suicidal.

“We found that about 29% of people who are experiencing financial problems also had some increased health risk, compared with about 11% of those who weren’t experiencing financial problems, said Suzanne Schmitt, Prudential vice president of financial wellness outcomes.

The COVID-19 pandemic has cast a bright spotlight on the interconnected challenges of managing mental and financial health, Prudential said in its report “The Tight Links Between Mental And Financial Health.”

In that report, Prudential said many American workers are struggling to manage day-to-day activities that look nothing like they did before. In many cases, they are worried about their mental and financial well-being. The many changes resulting from the pandemic, including quarantines, social isolation, remote work, virtual exhaustion and increased loneliness, each can have a dramatic effect on a person’s well-being.

The financial and mental stress brought about by the pandemic is damaging workers’ well-being, Prudential’s report said. In fact, loneliness and social isolation can be as damaging to health as smoking 15 cigarettes a day, according to the Health Resources & Services Administration.

More than half of Americans say their financial health has been negatively affected amid the COVID-19 pandemic. Among the 51% who say they’ve experienced a financial setback, some have seen devastating consequences. About 26% of the respondents to Prudential’s 2020 Financial Wellness Census had experienced an income disruption (whether due to furlough or reduced compensation or work hours), and 17% had seen their household income fall by half or more in the months following the virus’ outbreak.

The link between financial health and mental health is obvious in the Prudential report. Individuals who struggle to pay off their debts and loans are more than twice as likely as others to experience mental health problems, including depression and anxiety. The impact on a person’s mental health can be particularly severe if they resort to cutting back on essentials (e.g., food, heating, medicine, etc.), or if creditors are aggressive or insensitive when collecting outstanding debts.

Employees experiencing financial problems may miss significantly more days of work and hours of productivity than those who are not experiencing financial problems. Prudential found that employees who experience financial problems lose a full week of productivity compared to other employees. In addition, those who experience financial problems are more likely to experience a short-term disability.

Mental and financial health problems can devolve into a vicious circle in which one compounds the other. When employees experience poor mental health, earning and managing money may become challenging. In turn, this can create financial stress, anxiety, fear and worry.

Employers are seeing how financial wellness is an important part of their workers’ overall health. Prudential’s research showed 79% of employers surveyed reported their organization will focus more on total wellness (physical, mental and financial health) in the next year or two.

What can benefits brokers and their employer clients do to help ease workers’ fiscal stress?

“People don’t always know where to start, and the process can be overwhelming,” Schmitt said. “So, first of all, there’s a tremendous focus on providing an overall assessment of financial health and then start to frame some best actions.”

The second thing they are seeing is tremendous interest in programs that help employees with their emergency savings, she said. “And the next thing is working on employee debt management — having the conversation, bringing financial education coaching support into the workplace, working with expert counselors who can help workers get on a better path toward paying off their student loan debt or their credit card debt.”

Another benefit that could help workers’ financial health, Schmitt said, is caregiving support. A recent McKinsey & Co. survey showed that about one-quarter of women are considering leaving the workforce because of caregiving responsibilities.

Schmitt said some caregiver support could be offered through a company’s employee assistance program.

“But there are some additional benefits that are available from a range of vendors that will provide education for folks who might not know where to start, or what community services are available to them,” she said. “This will allow individuals to work with a licensed professional who’s going to personally evaluate their situation and put together a plan of care that is unique to that caregiver’s needs as well as the needs of the care recipient.”

One common goal of all employee benefits, Schmitt said, “is the ability for employees to be present and productive at work.”

Advisors have an opportunity, she said, “to really help employers understand that in addition to helping employees be happier, more engaged in their work by offering financial wellness programs, they also have the ability to help those employers improve their productivity and make a positive impact on their health care claims exposure.”

Guardian Life’s ninth annual Workplace Benefits Study also showed a link between financial wellness and employee benefits.

More than half (52%) of workers surveyed said they would face financial hardship without their workplace benefits, while 67% said they would not be able to afford benefits if they did not get them through their employer. If faced with an emergency medical bill, one-third said they would pay with a credit card, and about one in five would take out a bank loan, home equity loan, or borrow from their retirement plan or children’s college savings.

Before the pandemic, 39% of workers told Guardian they felt their financial health was excellent or very good. That percentage dropped to 33% during the pandemic. In addition, 74% of those who report high financial stress also have very high medical deductibles, while 76% of those who report high financial stress have college debt. In January 2020, prior to the pandemic, four in 10 full-time employees reported they were living paycheck to paycheck and believed they were losing ground financially.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

The Family Tree Strategy That Keeps Money In The Family

Americans More Confident In Life Insurance Since COVID-19

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

- Wellmark still worries over lowered projections of Iowa tax hike

- Trump’s Medicaid work mandate could kick thousands of homeless Californians off coverage

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

- REP. LAUREN BOEBERT INTRODUCES THE NO FEDERAL TAXPAYER DOLLARS FOR ILLEGAL ALIENS HEALTH INSURANCE ACT

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News