The Family Tree Strategy That Keeps Money In The Family

Money is already in motion — are you?

The “great wealth transfer” is here, and it’s happening. Trillions of dollars in assets have begun moving from baby boomers to their Generation X and millennial offspring. And if past experience is a guide, most of those ascending generations will forgo financial professionals who once were their parents’ “go to” resource.

Heirs typically turn elsewhere when the client who initiated the relationship dies. Research shows:

» Up to 70% of widows change financial professionals within a year of the death of their spouse.

» As many as 90% of children do the same in the first year after the passing of their parents.

Connections must be created while a common element exists. Engaging the spouse and children in a significant way — while the client is alive — improves the likelihood of retaining relationships and assets.

Six Steps For Connecting Generations

Using a generational reach approach, connections created during the original client’s lifetime can be maintained and even expanded. If the relationship is retained and grown, so too may be the assets.

1. Document a family tree. Map out marriages and outline offspring. Work to gain a good understanding of all the characters in a client’s life story. Who are all the potential beneficiaries of the client’s love and legacy? Learn the family dynamics. Nurture expectations for multiple generations.

2. Expand the relationship. Is the spouse already a client? Is the client the couple? It’s very important to engage both spouses in financial discussions. Get to know each spouse individually. Know their priorities, preferences, dreams and fears.

3. Survey the landscape. Next-generation clients — albeit currently with fewer assets — represent the future. Skeptics may dismiss the strategic and economic rationale for expending time and energy pursuing prospects of lesser means. But it makes perfect sense when a direct line connects prospective clients with current ones. The opportunity combines two advantages: availability and access.

4. Connect with younger generations on their terms, using their preferred methods. Recognize their “always on” connectivity and overloaded attention spans. Take advantage of digital means and social media. Acknowledge special events and significant milestones in their lives.

5. Build credibility with both Gen X and millennial heirs by bringing value to those relationships. Initiate meaningful multigenerational discussions on financial matters of interest. Address needs and concerns by generation and age. Establish yourself as an educational resource on financial topics.

6. Introduce financial strategies that bridge generations. Life insurance not only invites a discussion the whole family is more inclined to join but may also advance a more holistic approach. Annuities offer many legacy options and also provide an opportunity to customize a legacy, create lifetime benefits for beneficiaries and extend time for potential tax-deferred compounding of annuity assets. An example of an annuity-based multigenerational strategy follows.

Generate Income For Generations

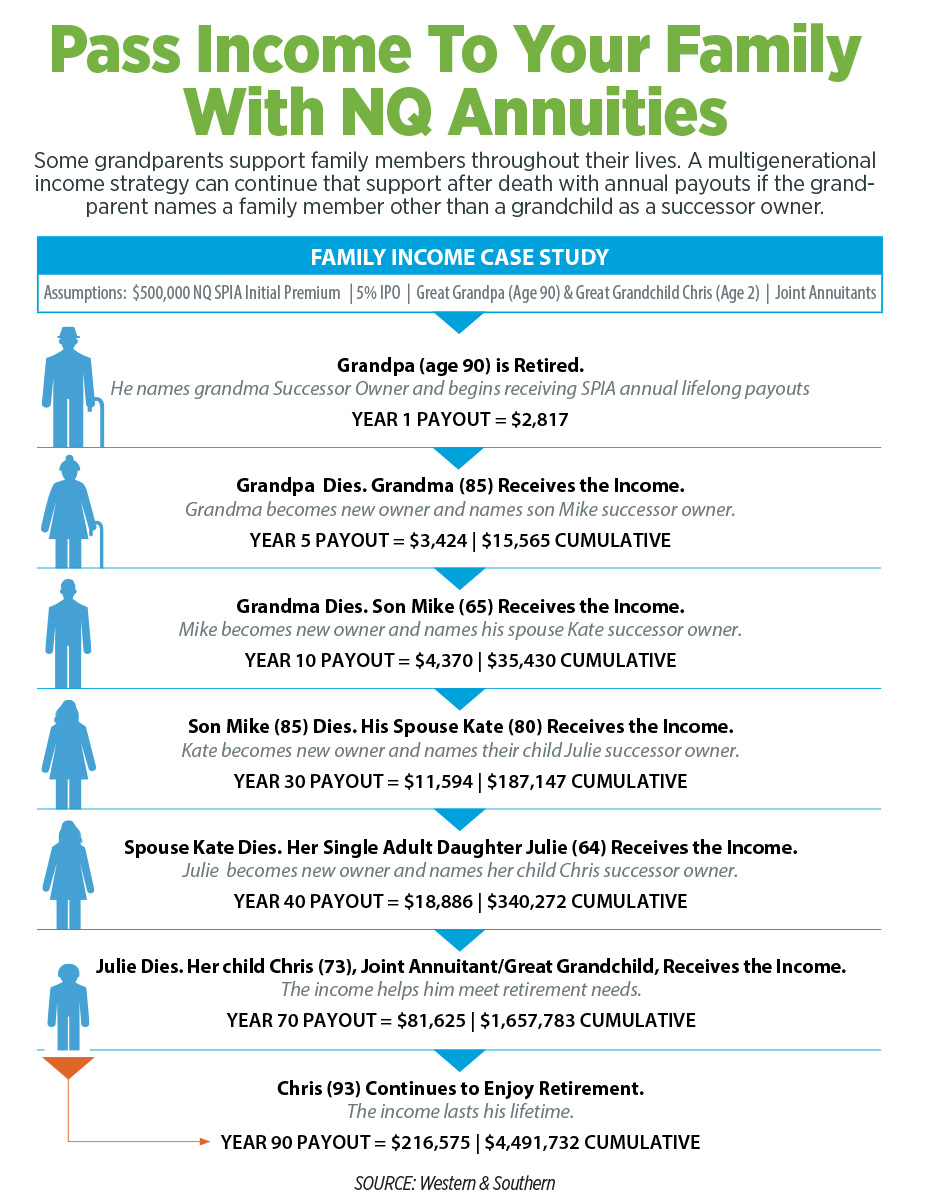

A grandparent can create a multigenerational income gift for their family or a grandchild — without life insurance. One such approach uses a single-premium immediate annuity and makes the grandparent and grandchild joint annuitants. The grandparent can create payouts for the life of the grandparent and grandchild, provide tax-deferred growth, spread out tax liability, and avoid probate.

One option is a simple grandparent-grandchild strategy, providing an annual “birthday gift” to a grandchild. Payments start with the grandparent and continue to the grandchild at the grandparent’s passing.

A second strategy — a family tree strategy — can continue payments after the death of the grandparent to a series of successor owners, rather than to only the grandchild. For example, suppose Grandpa wants to leave an income stream for his family long after he’s gone. His loved ones include his spouse, his son and daughter-in-law, and ultimately his grandson. Grandpa is 72. Grandson Chris is 10. Grandpa purchases a $150,000 SPIA with him and Chris as joint annuitants. He selects a life and 30-year certain period payout with a 3% increasing payout option. He names Grandma as the successor owner.

The family tree strategy proceeds through five steps that in theory may extend over decades:

1. Grandpa buys an immediate annuity and will receive the payouts until his death.

2. At that time, Grandma takes over and names her son, Chris’ dad, as her successor owner. Grandma will receive the payouts until her death.

3. At that time, Chris’ dad will name his wife, Chris’ mom, as successor owner. Chris’ dad will receive the payouts until his death.

4. At that time, Chris’ mom will name Chris as successor owner. Chris’ mom will receive the payouts until her death.

5. And finally — at that time — it now becomes Chris’ turn to receive the payouts until his death.

Multigenerational income strategy materials can, purely for the sake of discussion, put numbers to hypothetical scenarios. Any such illustration by necessity employs various assumptions and is always subject to change. In this particular case study, the Year 1 payout is $2,016. The Year 75 payout is $17,965. And the cumulative payout over both lifetimes comes to $549,590.

Play A Pivotal Role In Planning

The great wealth transfer isn’t coming. It’s here. And it’s here to stay for decades to come. Financial professionals can make an investment in their future by growing their relationships to encompass spouses and heirs.

Discussion of assets and taxes and estate planning and the like may be somewhat sensitive or difficult among generations, but in the long term, interaction on financial matters benefits families. And by acting as a facilitator, financial professionals are not only helping their current clients, but they’re also cultivating a pipeline of prospects potentially spanning generations.

Take It From Tom

Retirement income authority Tom Hegna likes to share a multigenerational income experience. The client was clear in his wishes: “I want a guaranteed paycheck every month for the rest of my life. Then when I die, I want it to go to my wife for the rest of her life. And when she dies, I want it to go to our son for the rest of his life. And when he dies, I’m sure he wants it to go to his wife for the rest of her life. And when she dies, we want it to go to our granddaughter for her life.”

The key, advises Hegna, is to make certain the new owners continue setting up the right successor owners and to remain aware that the paychecks continue only as long as either grandfather or the grandchild is alive. If they’re both gone, the payouts may stop.

As a final thought, cautions Hegna, “It’s important to remember that annuities are designed to be owned for a long time — especially in a multigenerational scenario — so you want to be sure the annuity company you work with will be around a long time too.”

Deborah A. Miner, JD, CLU, ChFC, RICP, is assistant vice president of advanced markets for W&S Financial Group Distributors. She may be contacted at [email protected].

Biden Transition Expected To Hit DOL Rule, Enforcement Direction

Benefits Boost Financial Wellness As Well As Physical Wellness

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- North Carolina regulators fine UnitedHealthcare $3.4 million for violations

- Tom Campbell: What if the N.C. State Health Plan goes broke?

- Bills aim to address prescription drug costs, pharmacy closures by regulating PBMs

- Sanders' maternal health plan would make it easier to get Medicaid — but not to keep it

- Anti-LGBTQ+ policies harm the health of not only LGBTQ+ people, but all Americans

More Health/Employee Benefits NewsLife Insurance News

- AM Best Revises Outlooks to Stable for Lincoln National Corporation and Most of Its Subsidiaries

- Aflac Northern Ireland: Helping Children, Caregivers and the Community

- AM Best Affirms Credit Ratings of Well Link Life Insurance Company Limited

- Top 8 trends that will impact insurance in 2025

- 59% of insurance sector breaches caused by third-party attacks.

More Life Insurance News