Applying customer centricity to help close the life insurance gap

The life insurance “need gap” — the difference between the amount of life insurance coverage people have and the amount they actually need — continues to be a challenge for our industry. The 2024 “Insurance Barometer Study,” a collaboration between LIMRA and Life Happens, shows that 42% of Americans say they need (or need more) life insurance coverage. This percentage represents an estimated 102 million adults.

The question remains: Why does the life insurance need gap persist, and what can we do about it?

This unmet need continues to hover at around 40% of Americans for several reasons.

» Underestimation of need and an overestimation of cost: Many individuals underestimate how much life insurance they need, a miscalculation that often stems from not fully appreciating the purpose and importance of life insurance. And as the cost of living increases, the amount of coverage needed also rises, yet many people do not adjust their policies to keep up with inflation and increased financial responsibilities. Similarly, many may assume that coverage they receive through their employer is sufficient, and misconceptions about the cost can deter people from getting adequate coverage.

» Impact of changing workforce dynamics on accessibility: As gig and freelance work becomes more prevalent, fewer people have access to employer-provided life insurance. Many gig workers do not purchase their own policies, perhaps due to lack of awareness of how to obtain them. This further exacerbates the gap.

» Shifting demographics: The demographic landscape is changing, with younger generations delaying life events (such as getting married and having children) that traditionally prompt life insurance purchases. Additionally, an aging population means that older adults may find it harder to qualify for affordable life insurance.

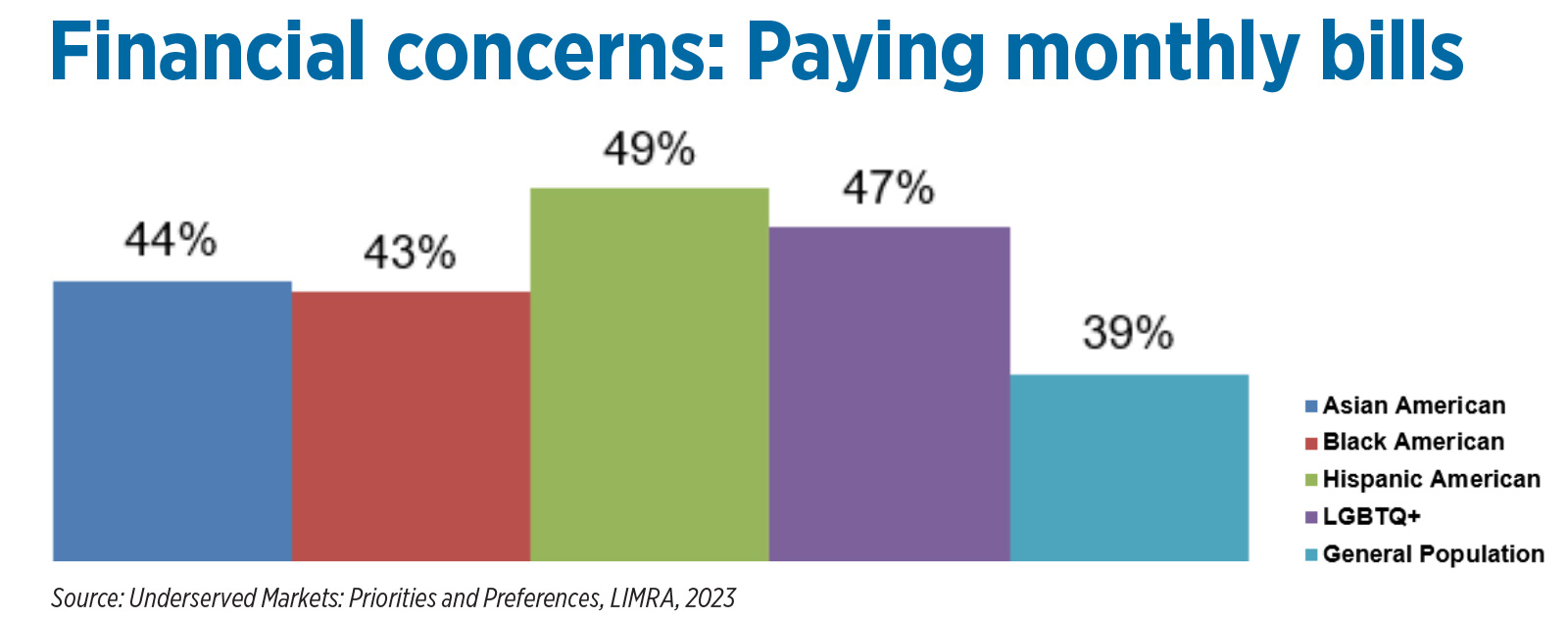

To address this unmet need, insurance companies and financial professionals can become more customer centric by gaining a deeper understanding of consumers’ diverse needs, challenges and perceptions. Consumers have competing priorities, and these priorities tend to differ based on things such as generation, life stage, and racial or ethnic makeup. According to LIMRA’s “Underserved Markets” study, while Asian Americans are more concerned about having enough money for retirement, Hispanic and LGBTQ+ Americans are so focused on their immediate financial needs (e.g., paying monthly bills) that they find it challenging to effectively plan for the future.

Reasons for owning life insurance can vary by consumer segment. Recent research conducted by LIMRA’s Applied Research Solutions team found that compared to other segments, Black Americans often own life insurance to pay for burial and final expenses, while Asian Americans are more apt to own it for investment and tax purposes.

Hispanic Americans have unique barriers to life insurance ownership. Although this segment tends to be younger and less affluent, they also often speak a language other than English and have self-reported lower levels of financial knowledge that impact their ability to confidently navigate the life insurance buying process.

Consumer expectations continue to rise and evolve. Today’s consumers demand personalization and convenience, influenced by digital transformation in other sectors. They expect the same level of service and ease of access from their insurance providers as they do from their favorite online retailers. This shift requires carriers to rethink their approach to engaging and serving customers. Our industry often focuses on our customers’ financial situation, but we would better serve consumers by also taking their physical, mental and social needs into account, and these needs typically vary by generation.

The better we know these consumers, the better we can anticipate and meet their needs.

To reduce the life insurance need gap, our industry should strive to become more customer centric and gain a deeper understanding of the diverse needs and preferences of various consumer segments. Although the life insurance need gap continues to be a challenge for our industry, it is also an opportunity.

Lai-Sahn Hackett is corporate vice president, Applied Research Solutions, LIMRA. Contact her at [email protected].

Why advisors should discuss funeral preplanning with clients

Is retaining key talent keeping you up at night?

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- In WA, thousands are forgoing health insurance this year. Here’s why

- Sidecar Health Expands Into Texas to Meet Rising Employer Demand for a Better Alternative to Legacy Health Plans

- Trump's 'Great Healthcare Plan' Is Neither Great, Healthcare, Nor A Plan. Discuss!

- Commentary: Is that the way the ball bounces?

- Far fewer people buy Obamacare coverage as insurance premiums spike

More Health/Employee Benefits NewsLife Insurance News