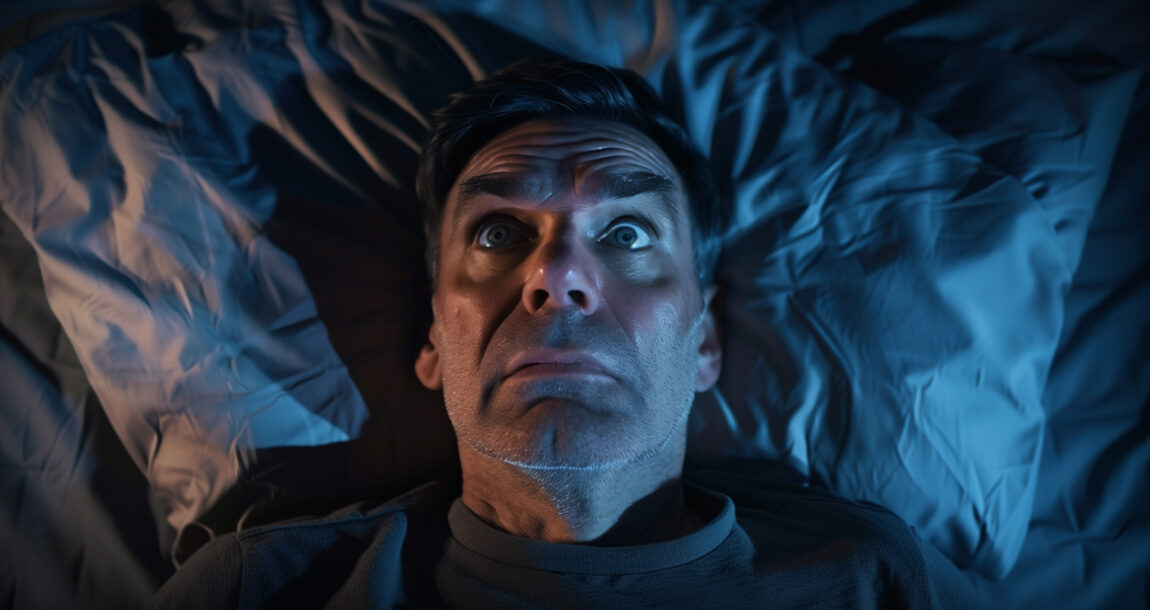

Is retaining key talent keeping you up at night?

Your top salesperson, Carol, approaches you unexpectedly and says, “Boss, I’m leaving. You’ve been great, but I have been offered a better deal!”

Carol is worth more than $300,000 in revenue to your business. She is leaving to join your competitor, who offered a better overall compensation package. You treated Carol like family, her leaving never crossed your mind, you thought she would eventually take over the business. Your advisor told you about planning for Carol, but it was not a priority, she was happy … wrong! What could you have done differently to prevent this and retain Carol?

There are several ways to provide programs to retain employees, including employee recognition, employee performance rewards, flex time and employee engagement, to name a few. However, when it comes to an exclusive benefit for your key employee or employees, you need a plan that ties them in to the organization. One such exclusive benefit for a select group of key employees is the phantom stock plan.

This plan can be for any organization — small, medium or large closely held businesses that are well established and financially sound. Most important, many owners of closely held businesses do not want to give up equity in their business; therefore, a phantom stock plan is an ideal solution.

With a phantom stock appreciation plan, key employees who are selected to participate are credited with a specific number of hypothetical shares by the business. Instead of transferring actual shares to the employee, the business creates an accounting entry in which the key employees are credited with a specified number of “shares” whose value may rise or fall over time, according to the formula selected to determine value. Upon a triggering event — such as the end of a specified time, a predetermined event, death or disability — the employee is entitled to receive the value based on the appreciation of the hypothetical shares they were credited with.

To peg the value of phantom shares, a business valuation should be performed. This does not have to be a formal valuation meeting Internal Revenue Code valuation guidelines or performed by an independent appraiser. It should be one that is accepted and understood by Carol, and easily calculated by the business’s accountant or one an advisor can perform using a software program. There are many methods that can be used, such as discounted cash flow, capitalization of earnings, or earnings before income taxes, depreciation, and amortization. The point is there must be a beginning valuation and an ending valuation. This valuation ideally should be performed each year so Carol can see the increased value of the shares.

To provide liquidity upon the triggering events for the key employees, life insurance is usually used to support the appreciation of the hypothetical stock. Businesses that wish to prefund their phantom stock plans have several investment options (e.g., mutual funds, securities, and annuities) from which to choose. However, most investments and annuities generate taxable income each year, and there are no guarantees. Permanent life insurance, however, does not have this “tax drag,” making it a common funding vehicle for these types of plans. The business can purchase corporate-owned life insurance on the life of the executive to “informally” fund the plan’s future payments (with the cash value) and to recover all the plan costs at the executive’s death (with the death benefit). A phantom stock plan informally funded with the proper amount of life insurance provides flexibility, while helping the business pay promised benefits and recover the cost of establishing the plan. This allows a business to recruit, retain, reward and retire key executives in a cost-efficient manner.

The advantages for the closely held business owner:

» Fortune 500 company benefits: Most publicly traded companies offer some sort of key executive compensation arrangement. The closely held business owner can offer the same package.

» Flexibility: The business owner can select the employees who will participate — and the company can offer different participants different benefit levels.

» Control: The business owner can tie the benefit to corporate growth —without having to sacrifice equity in the company.

» Financial benefits: The life insurance policy increases tax deferred and is an asset in the corporation’s books.

» Forfeiture: If the employee does not live up to their end of the deal, by not performing or by leaving too early, the benefit is forfeited.

» Tax advantages: The business gets a tax deduction when it pays the benefit.

» Ease of implementation: A typical phantom stock plan requires only a board resolution and a phantom stock plan agreement.

The advantages for the key employee:

» Ownership: Psychologically, the employee owns a percentage of the company.

» The ability to share in the company’s success: The employee will receive a benefit that is tied to the performance of the company and be rewarded for increased growth.

» Tax advantages: No tax is due on the incentive until it is paid out.

Ernest J. Guerriero, CLU, ChFC, CEBS, CPCU, CPC, CMS, AIF, RICP, CPFA, national president of the Society of Financial Service Professionals, is the director of qualified plans, business markets for Consolidated Planning. He may be contacted at [email protected].

Applying customer centricity to help close the life insurance gap

We don’t need Life Insurance Awareness Month

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- WELCH TO BRING VERMONTER HIT BY SKYROCKETING HEALTH INSURANCE COSTS TO STATE OF THE UNION

- Data on Managed Care Reported by Researchers at Dartmouth College Geisel School of Medicine (Impact of the Medicare carotid stenting national coverage determination on procedure utilization and long-term stroke risk after carotid …): Managed Care

- New Managed Care and Specialty Pharmacy Findings Has Been Reported by Howard Weston Schmutz et al (Challenges of the Inflation Reduction Act for long-term care pharmacy: Examining impact and policy solutions): Drugs and Therapies – Managed Care and Specialty Pharmacy

- University of Washington Reports Findings in Managed Care (Too Sick to be True? Evaluating Potentially Problematic Diagnosis Coding Practices in Medicare’s Patient-Driven Payment Model): Managed Care

- Falling off the cliff: Loss of insurance subsidies hits Durango's middle class

More Health/Employee Benefits NewsLife Insurance News