American Equity Had A Mighty MYGA Year

American Equity struck gold with multi-year guaranteed annuities over the past year capped by a record-breaking first quarter, but the company’s CEO pledged that the carrier will return to its fixed indexed annuity base this year.

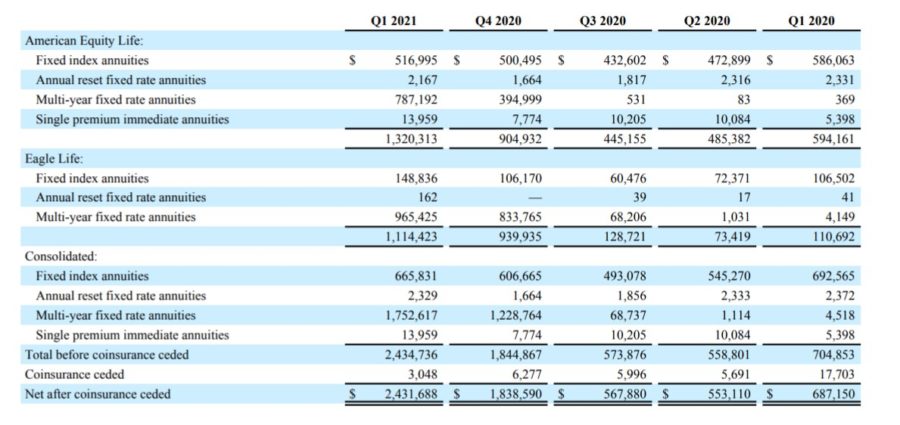

The company recorded all-time record sales of $2.4 billion, up 32% from the fourth quarter of 2020 and 245% year over year, CEO Anant Bhalla said during a first quarter results conference call for American Equity Investment Life Holding Co. Sales broke the previous record of $2.1 billion set in the fourth quarter of 2015.

The company’s MYGA sales boomed over the year since Bhalla took over as CEO last March.

Income from MYGA sales grew from $4.5 million in the first quarter of last year to $1.7 billion in this year’s first quarter. In the meantime, FIA sales dropped from $692 million last year to $665 million this year.

“Although a majority of first quarter sales were in our multi year, fixed annuity products, we expect to focus our efforts for the rest of the year on the fixed indexed annuity product line, especially given our recent product refreshes in that area,” Bhalla said.

In February, the company issued its “refreshed” AssetShield fixed index annuity, which Bhalla said was already gaining momentum in March, leading to a sequential 13% increase in accumulation deposits over that month.

The company added two new proprietary indices, the Credit Suisse tech edge index, and the Society General sentiment index. That was in addition to the existing Bank of America destinations index. Bhalla said AEL is offering these strategies for one- and two-year terms. The company also added enhanced rate riders, allowing policyholders to earn a greater cap or participation rate for an optional fee.

The product proved to be immediately popular, Bhalla said.

“We have seen a strong initial reaction to the product refresh as sales of AssetShield more than doubled in March, compared to February,” Bhalla said. “In particular, the new indices have been well received as 50% of March deposits went into the new strategies added to AssetShield in February.”

Although that was only one month’s experience, Bhalla said it portends good things for FIAs for the rest of the year.

“While one month is not a trend, the outlook for fixed index annuity sales at American Equity life is much stronger than even the pre-pandemic levels in early 2021,” Bhalla said. “In essence, momentum is on our side.”

'We Pivot To Driving Growth'

The switch to MYGAs over the past year was part of the company’s sales strategy to deal with the pandemic.

“Our plan has been to reengage with distribution with a simpler multi-yeaer fixed rate annuity products during COVID-19,” Bhalla said. “And now, we pivot to driving growth through a revamped fixed indexed annuity product portfolio.”

On April 7, the company introduced a new Eagle Select Income Focus FIA to market in the bank and broker-dealer channels.

“We plan to continue to introduce innovative new products as we move through the AEL 2.0 transformation, which will help us compete effectively and grow our share of the annuity market,” Bhalla said.

Other highlights in American Equity Life’s first-quarter report:

First quarter 2021 net income available to common stockholders of $271.8 million or $2.82 per diluted common share compared to $236.3 million, or $2.57 per diluted common share, for the first quarter of 2020.

First quarter 2021 non-GAAP operating income available to common stockholders of $41.4 million or $0.43 per diluted common share compared to $154.1 million, or $1.67 per diluted common share, for the first quarter of 2020.

Book value per common share of $54.76 at March 31, 2021; Book value per share excluding accumulated other comprehensive income and the net impact of accounting for fair value of derivatives and embedded derivatives of $39.00 and $34.81, respectively.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

US Economy On The Brink Of Dramatic Growth, CNBC Host Says

Fear Of Losing Health Insurance Keeps 1 In 6 On The Job, Gallup Poll Says

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News