AI with your financial planning? Here’s what various generations say

More than half of Gen Z’ers and millennials are excited about the impact AI and generative AI (GenAI) tools could have on their financial lives, while older Americans are more skeptical.

Only 38% of Gen X’ers and 23% of boomers+ said they are excited. These are the latest findings from Northwestern Mutual’s 2024 Planning & Progress Study.

According to the survey, 63% of Gen Z and 57% of millennials said that AI will “improve the customer experience in the financial sector, including with financial planning.” Conversely, less than half of Gen X (44%) and Boomers+ (32%) shared this sentiment.

Christian Mitchell, executive vice president and chief customer officer at Northwestern Mutual, is not wholly surprised by the optimism expressed by the younger generation—especially Gen Z and millennials. “Gen Z and millennials have seen rapid advances in technology in their lifetimes and have typically embraced those innovations faster than others,” he said. “We’re excited about younger generations’ enthusiasm with AI and financial planning because we share it at Northwestern Mutual, and we’re working hard to deliver.”

Key findings of the survey

When asked to identify the potential AI benefits that Americans are the most excited about when it comes to managing their money, “advanced data analysis” emerged as the top choice. Faster response times, increased efficiencies, improved customer service and greater opportunities for customization rounded up the top five benefits.

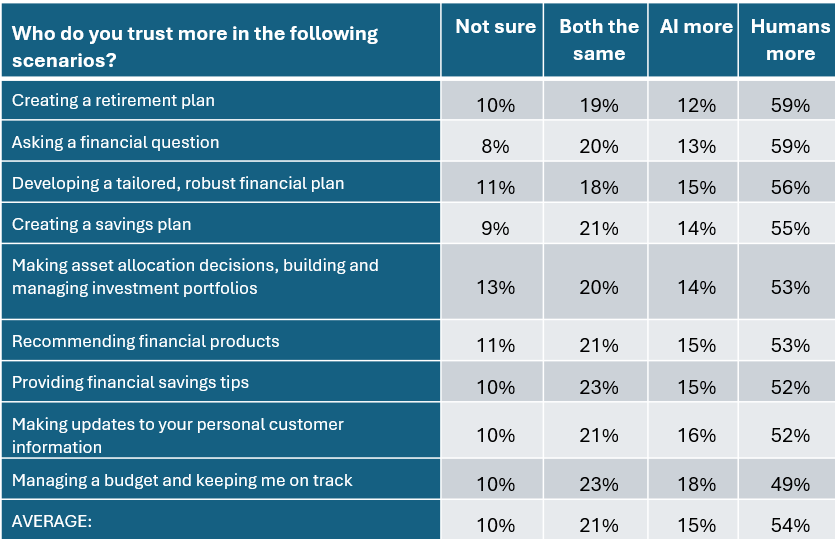

In a side-by-side comparison, the research also showed that people trust humans (54%) far more than AI alone (15%) across most core elements of financial planning--from creating a retirement plan to asking a financial question, to managing budgets:

The impact of AI tools

The rapid emergence of AI tools has the potential to greatly improve many areas of financial planning – for advisors and clients alike, said Mitchell, as he pointed out some of AI’s benefits. For advisors, he added, AI and GenAI tools will free them up to spend more time in deepening relationships with clients, said, and less time on day-to-day, manual tasks.

And as the Planning and Progress Study revealed, that human dimension to financial planning is critical. “Money management can be emotional, because it’s not just about numbers on a spreadsheet, it’s about reaching dreams and protecting people from their biggest worries,” he said. “To do it, clients rely on and trust the insights they receive from financial advisors.”

And as advisors and teams are freed from manual work, clients will benefit from increased communication, faster response times, and more efficient servicing, added Mitchell. “These additional opportunities for expert advisors to answer questions and reinforce good financial habits could meaningfully change people’s feelings of financial security. The extra time could also enable our talented advisors and teams to spend time with prospective clients, helping even more Americans live with financial confidence.”

The 2024 Planning & Progress Study was conducted by The Harris Poll on behalf of Northwestern Mutual among 4,588 U.S. adults aged 18 or older. The survey was conducted online between January 3 and January 17, 2024.

Similar findings reported by FINRA Foundation

Meanwhile, another report, this time from the FINRA Investor Education Foundation (FINRA Foundation), expresses findings similar to those in the Northwestern Mutual report. The study, The machines are coming (with personal finance information). Do we trust them?, found that in general, more consumers indicated trusting individual financial professionals than AI when it comes to financial information.

“As AI continues to be integrated into consumers’ everyday lives, it is vital to get a better understanding of how they perceive it and how they are using the technology to help make financial decisions,” said FINRA president Gerri Walsh. “This report found that while more consumers indicated trusting individual financial professionals than AI, there are instances where some consumers preferred AI-generated information related to topics like homeownership and saving,” said Walsh. “These perceptions could change with time, so it will be crucial for the financial services industry to continue to better understand how consumers interact with AI to better equip them with the resources and knowledge to make sound financial decisions.”

Major findings

Among the survey’s major findings:

- Few report currently relying on AI for financial advice: Over half of the respondents consulted with financial professionals (63 percent) and friends and family (56 percent) for information when making financial decisions, while only 5 percent indicated they used AI.

- Projected stock and bond performance information: Overall, roughly one-third of the respondents trusted the information, whether the source was AI (34 percent) or a financial professional (33 percent). However, white men were more likely to trust AI compared to a financial professional. The same was true among those with a higher level of self-assessed financial knowledge.

- Portfolio allocation information: More respondents trusted the information when coming from a financial professional (37 percent) than from AI (30 percent).

- Savings and debt information: Respondents generally trusted the information whether it came from AI or a financial professional. However, a greater proportion of Black respondents trusted the information when it came from a financial professional (69 percent) compared to AI (48 percent).

The FINRA report and its findings are based on an experimental study involving more than 1,000 adults who were asked about the trustworthiness of hypothetical AI-generated financial information versus information provided by a financial professional. The study focused on four topics: homeownership, projected stock and bond performance, portfolio allocation, and savings and debt information.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

Whole life down as life insurance sales slump in Q1, Wink reports

Globe Life reports web portal breach as troubling year continues

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

- Wellmark still worries over lowered projections of Iowa tax hike

- Trump’s Medicaid work mandate could kick thousands of homeless Californians off coverage

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

- REP. LAUREN BOEBERT INTRODUCES THE NO FEDERAL TAXPAYER DOLLARS FOR ILLEGAL ALIENS HEALTH INSURANCE ACT

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News