Whole life down as life insurance sales slump in Q1, Wink reports

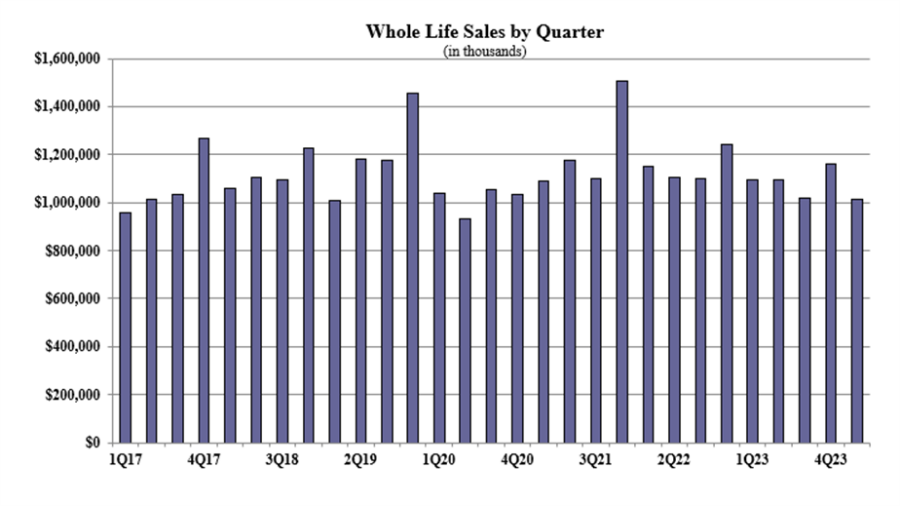

Depressed whole life sales led a disappointing first quarter for the life insurance market, Wink, Inc. reported.

Whole life sales hit $1 billion for the quarter, down 12.8% compared with the previous quarter, and down 7.4% compared to Q1 last year. Items of interest in the whole life market included the top primary pricing objective of final expense capturing 44.2% of sales.

The average premium per whole life policy for the quarter was $4,332, an increase of more than 7% from the prior quarter.

Wink released the first quarter 2024 life sales results in its 107th edition of Wink’s Sales & Market Report. The life insurance industry entered 2024 off a modest increase in new premium.

All universal life sales for the first quarter topped $1 billion, Wink said. All universal life sales include fixed UL, indexed UL, and variable UL product sales. Given that this is the first quarter that Wink has collected data on sales of all universal life insurance products, comparisons will be available in future quarters, Moore said.

Noteworthy highlights for total all universal life sales in the first quarter included National Life Group as No. 1 in overall sales ranking for all universal life sales, with a market share of 11.3%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for all universal life sales, for all channels combined for the quarter.

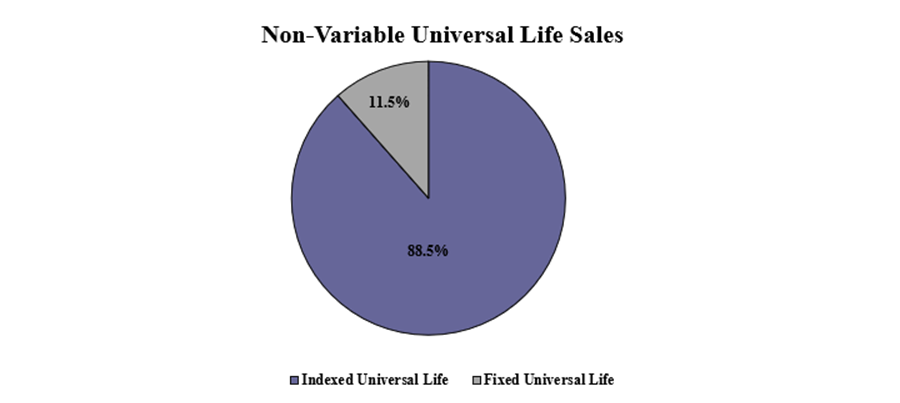

Non-variable universal life sales for the first quarter were $779.1 million, down 12.5% compared to the previous quarter and up 6.7% compared to the same period last year. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the first quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 15.1%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the twelfth consecutive quarter.

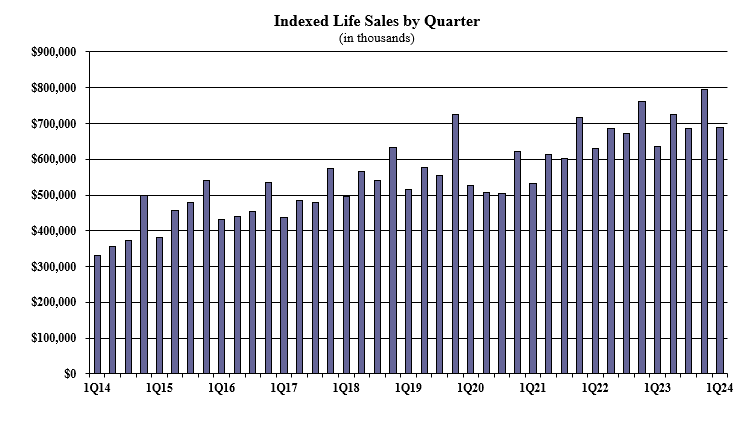

Indexed life sales for the first quarter were $689.8 million, down 13.2% compared with the previous quarter, and up 8.5% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Items of interest in the indexed life market included National Life Group keeping their No. 1 ranking in indexed life sales, with a 17% market share, Transamerica, Pacific Life Companies, Nationwide, and Symetra Financial rounded the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined, for the twelfth consecutive quarter. The top primary pricing objective for sales this quarter was cash accumulation, capturing 77.8% of sales. The average indexed life target premium for the quarter was $12,087, an increase of nearly 1% from the prior quarter.

"I am still projecting that 2024 will be a record year for indexed life," said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. "That said, everyone seems to have their attention on structured life products; while only three carriers are offering it, more are doing R&D."

Indexed life sales broke records during the fourth quarter 2023, Wink reported.

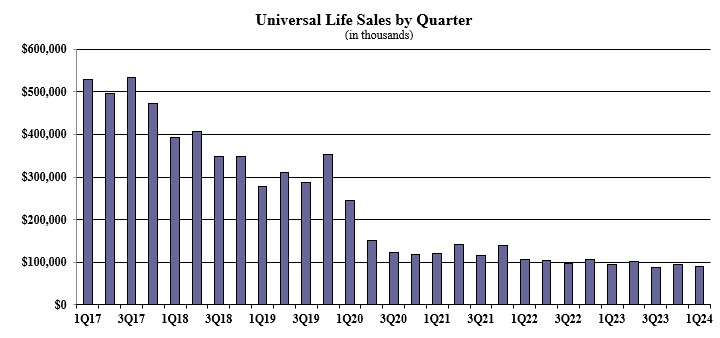

Fixed UL sales for the first quarter were $89.6 million, down 6.3% compared to the previous quarter and down 5.6% compared to the same period last year.

Noteworthy highlights for fixed universal life included the top primary pricing objective of no-lapse guarantee capturing 45.4% of sales. The average UL target premium for the quarter was $5,449, a decline of more than 5% from the prior quarter.

“Watching the downward-trending sales of UL is painful," Moore said. "Unfortunately, I don’t think things will improve any time soon.”

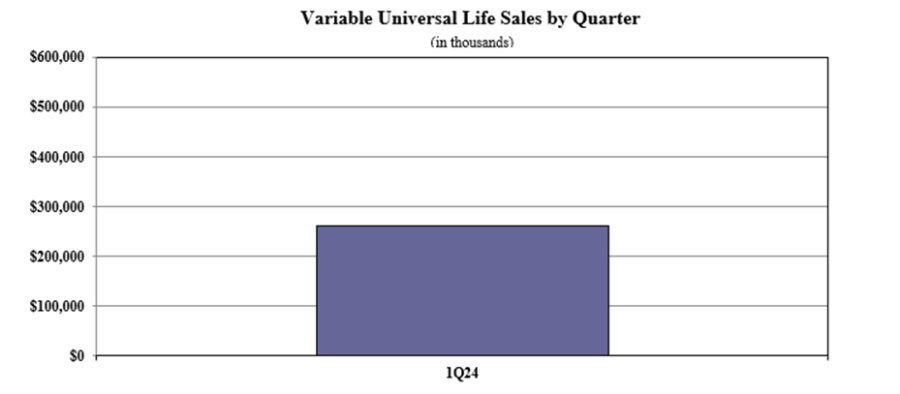

Variable Universal Life sales for the first quarter were $261.6 million. Given that this is the first quarter that Wink has collected data on variable universal life sales, comparisons will be available in future quarters, Moore said.

Items of interest in the variable universal life market included Prudential as the No. 1 ranking in variable universal life sales, with a 30.3% market share, Lincoln National Life, Pacific Life Companies, RiverSource Life, and Nationwide completed the top five, respectively.

Pruco Life’s VUL Protector was the No. 1 selling variable universal life insurance product, for all channels combined for the quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 48% of sales. The average variable universal life target premium for the quarter was $20,602.

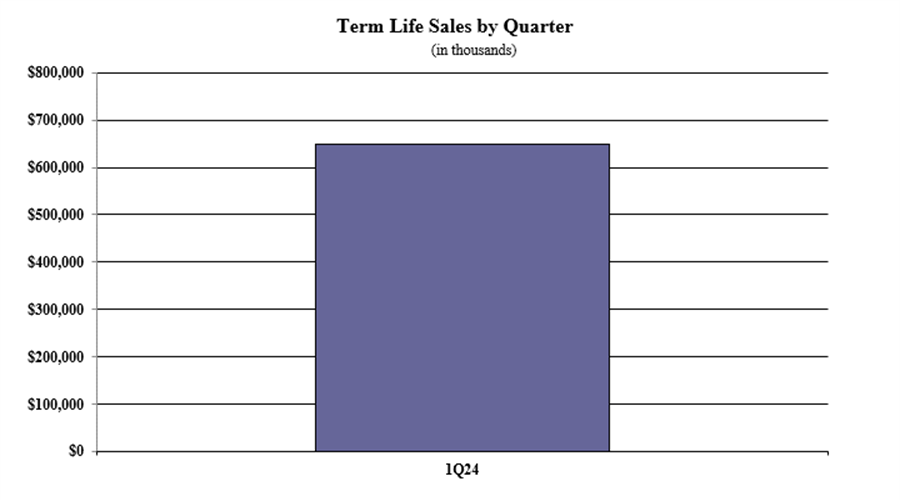

Term life first quarter sales were $648.7 million. Items of interest in the term life market include the average annual term life premium per policy reported for the quarter was $3,332. Given that this is the first quarter that Wink has collected data on term life sales, comparisons will be available in future quarters, Moore said.

Wink now reports sales on all life insurance product lines, as well as all annuity lines of business, Moore noted.

South Carolina couple sue advisor, Symetra over IUL-funded plan

AI with your financial planning? Here’s what various generations say

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News