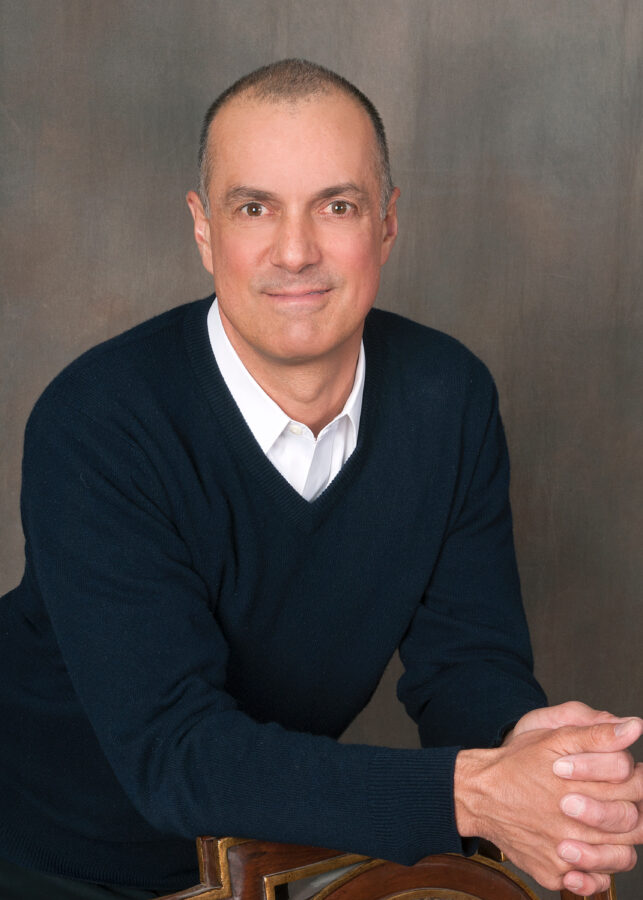

Advisor starts ‘unbiased system for learning’ to aid young investors

After a career in financial services and wealth management Stephen Martiros started thinking about how young people earn and learn about money and found an interesting dichotomy: The current young generation has access to and are interested in money like no generation before it, with all the digital currency, online buying, electronic funds, credit and debit cards. But while they are overwhelmed with information on how to manage their money, few of the social media sources touting financial literacy are credible or are simply out to sell products.

“There's content everywhere,” says Martiros, 63, from his company’s home outside of Boston. “But there’s not an unbiased system for learning.”

“We’ve incorporated tons of great feedback from hundreds of students, teachers, community leaders, family, friends, and financial experts,” Martiros said.

Kindros launched pilot programs with five colleges last year, all of which are continuing to use the platform. Martiros said the plan this year is to limit the growth to five more so they can work closely with the initial partner organizations as it refines the platform and content. Schools that have signed up with Kindros include Boston University, Boston College, Williams College, and Olin College. The program is sometimes offered within a curriculum, as a separate course, or free extension class.

“We initially envisioned it as a system of learning,” Martiros said. “But then we actually built the whole thing into an online platform. So, we just see an almost boundless opportunity because everyone needs some form of financial power regardless of age.”

The need to boost financial literacy, especially among the young investors, has been well documented. The Gen Z and younger crowd is among a completely cashless environment, with more ways to spend electronic money on Zelle, Amazon, Uber Eats, Fanduel, Crypto, Robin Hood, and more. Moreover, many students graduate burdened with tens of thousands of dollars in college debt and have little or no savings as they begin their careers.

“People don’t know what to do,” he said. “They wait many, many, many years to really get on the path sometimes. They get bad advice about expensive things, they delay, deny, defer – there's all kinds of unfortunately missed opportunities and it's a shame.”

Despite the abundance of financial information and attempts to educate potential investors, Kindros executives are still often shocked at how little young people sometimes know about basic financial fundamentals.

“It's astounding,” said Martiros. “There's a lot to be done. More than once, I’ve heard students at very good colleges, very bright persons, ask me what interest was,”

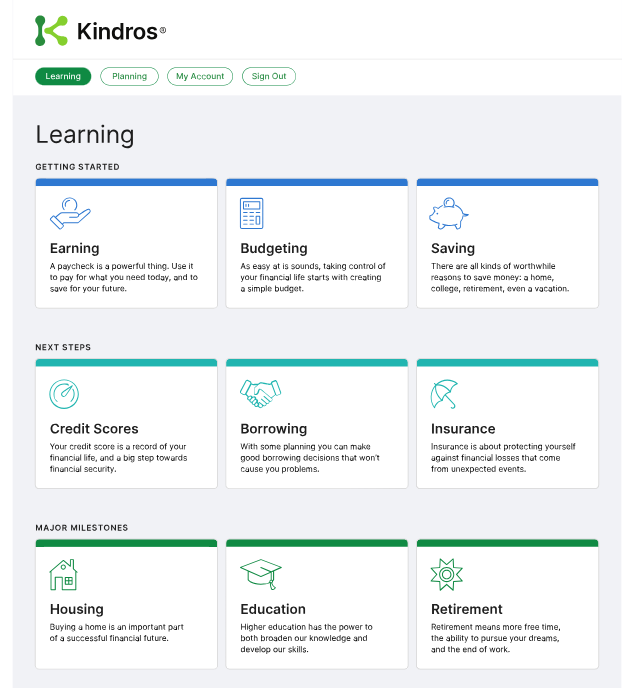

The Kindros platform using a building block approach with nine modules with Q&A components that methodically take people through basic principles of earnings, budgeting, saving, insurance, borrowing, and more.

“It's really meant to be informative, almost like a Consumer Reports,” said Jeanne Thompson, a former Fidelity senior vice president who is a strategic advisor at Kindros. “An unbiased place you can go for trusted sources of knowledge and isn’t going to try and sell you a loan or an insurance policy when you get to the end.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

How LTCi protects your client’s retirement plans

Insurers, A.M. Best reach preliminary settlement in financial ratings case

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

More Annuity NewsHealth/Employee Benefits News

- UnitedHealth Group shares fall nearly 20% as company forecasts lower sales this year

- Progress on nurses' strike as Mt. Sinai, NYP agree to keep health plans

- Nevada health insurance marketplace enrollment dips nearly 6% but 'remained fairly steady'

- AM Best Assigns Credit Ratings to CareSource Reinsurance LLC

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE INSURED

More Health/Employee Benefits NewsLife Insurance News